Mercury is a modern bank built with the requirements and expectations of digital companies in mind. Accounts can be opened completely online, and registration is possible even for non-US residents. The main strengths of Mercury are in its elegant and user-friendly design and interface, a low and straightforward fee structure, the option for multiple physical as well as up to 50 virtual debit cards, sub- and savings accounts, and solid user management.

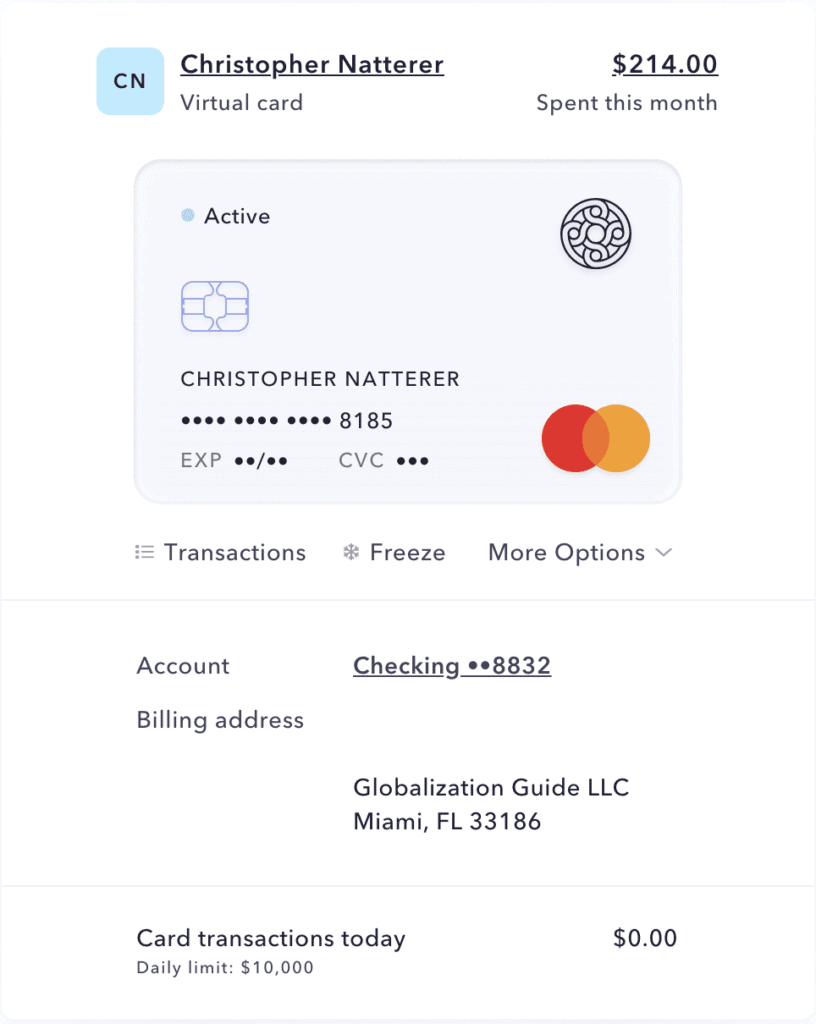

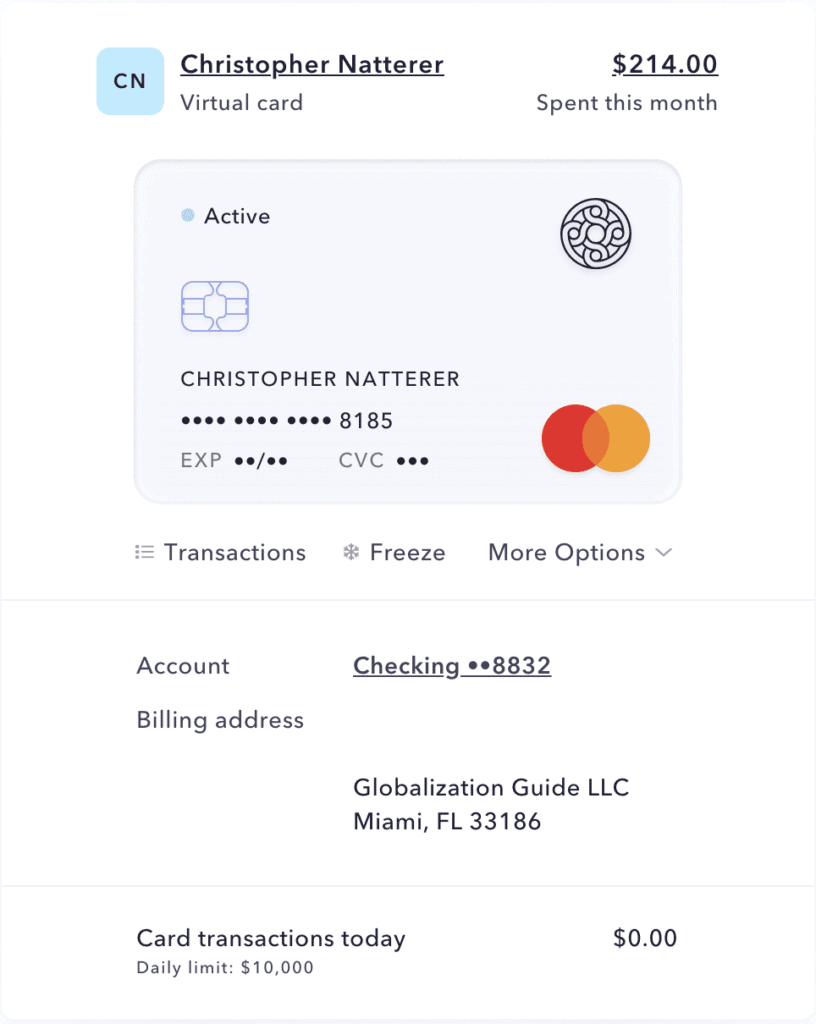

I have been using Mercury at Globalization Guide from the beginning, and while we also have accounts at a number of other banks, so far this is the primary account we use.

We have also partnered up with Mercury Bank to make sure our clients receive the best incentives for their businesses, so if you sign up for their services using this link, you will receive a $250 cash bonus when you spend $10K on your debit card within 90 days of approval.

For quick support conversations and resolutions, you can always reach out to their support team: [email protected]

Review of Mercury Bank

-

Sign-Up Process – 7/107/10

-

Design & Usability – 10/1010/10

-

Costs & Fees – 10/1010/10

-

Features – 9/109/10

Summary

Modern FDIC-insured bank that supports US LLCs owned by Non-Residents.

Pros

- No SSN required, non-resident friendly

- Modern interface with a multitude of features

- Multiple physical Mastercards + virtual debit cards possible

Cons

- Officially only supports businesses with US operations or clients

What is Mercury?

Mercury was founded in April 2019 by Immad Akhund, Max Tagher, and Jason Zhang. In Roman mythology, Mercury was the god of financial gain & commerce (among other things).

“As an entrepreneur, I felt the pain of dealing with incumbent banks. I was very frustrated with the lack of basics like transparency in customer service, and also felt like they didn’t launch any new tools to progress. Those are the main inspirations. I wanted to fix something for myself. I like entrepreneurs a lot, and I was excited about making something that would be helpful to others like myself”.

Immad Akhund for hackernoon.com

Mercury has attracted an impressive portfolio of venture capital backing, among them Andreessen Horowitz and Naval Ravikant.

It is built on the banking platform of SynapseFi, which is why you will find a lot of similarities in terms of features with RelayFi, which uses the same platform.

What Makes Mercury a Great Banking Solution

In the following section, I am going to list and explain all of the areas where I think Mercury really is ahead of most traditional banks in America.

FDIC-insured business checking account with up to 14 sub accounts

You will receive an FDIC-insured business checking account (provided by Evolve Bank & Trust) when you sign-up for Mercury.

Per default, you will also receive a standardized savings accounts, that allows six outgoing transactions per month.

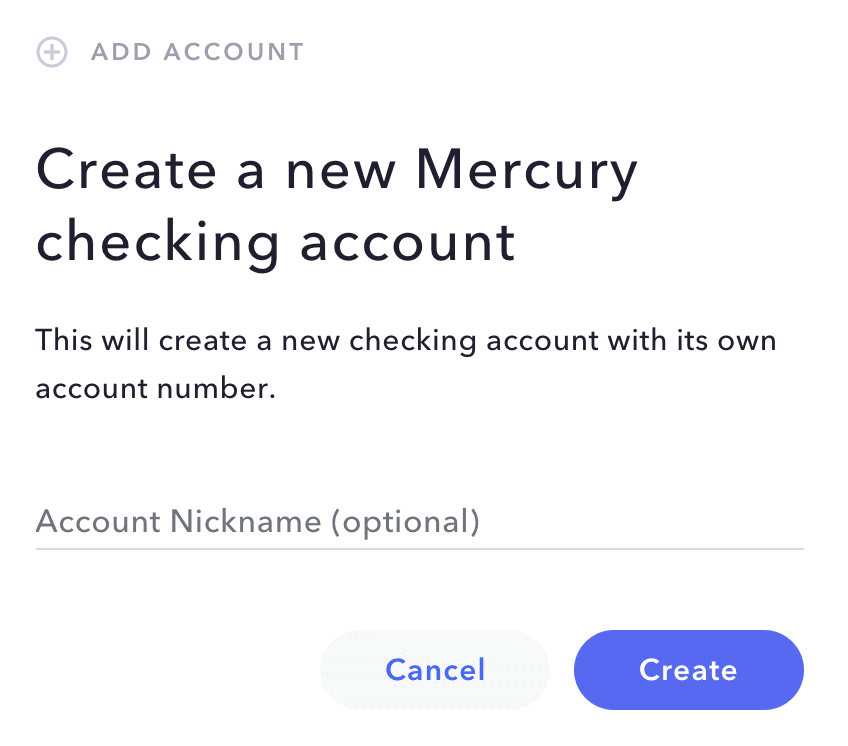

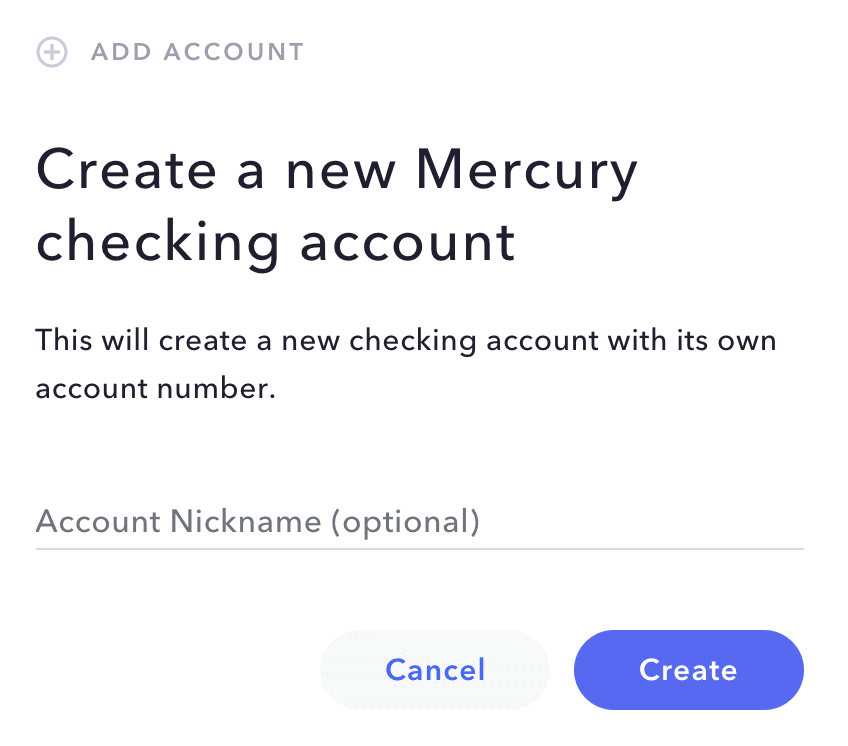

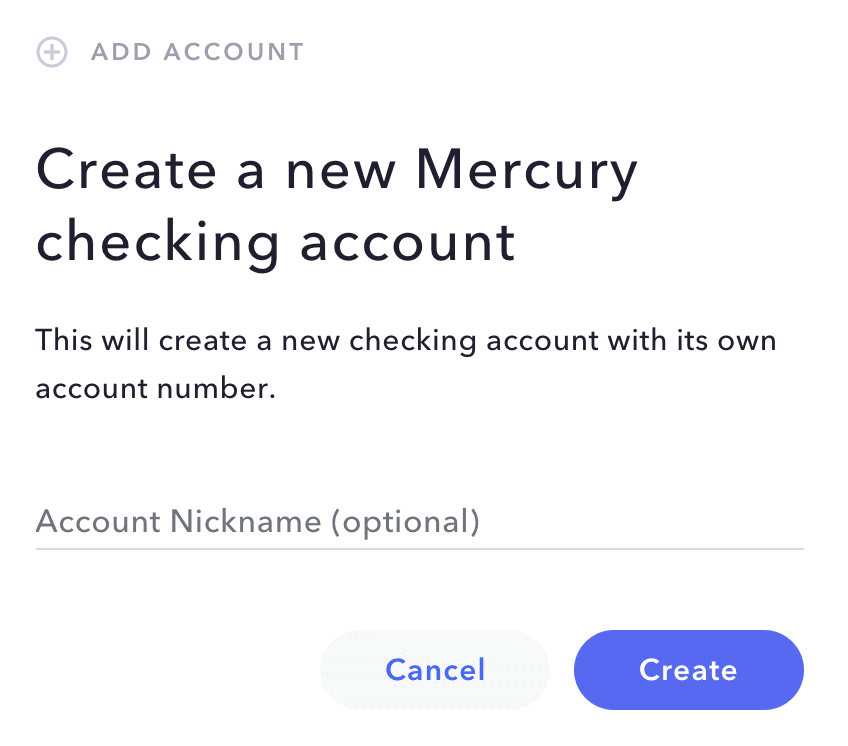

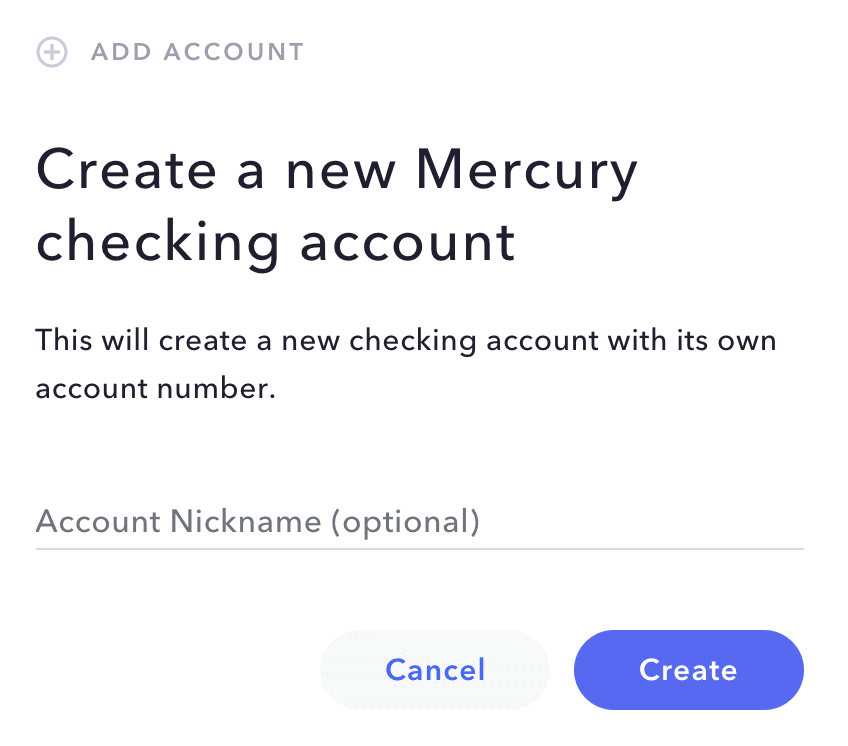

You can also have up to 14 sub-accounts, each with its own individual account information. The platform makes it very easy to create new accounts.

Modern & User-Friendly Interface

I personally find the usability of any service, software or product that I use very important, if I want to keep enjoying using it.

Traditional banks are not known for having a great user experience. And from what I have seen so far, American banks are in this regard even worse than the European banks.

So I was quite happy to see, that banking solutions like this exist in the US as well.

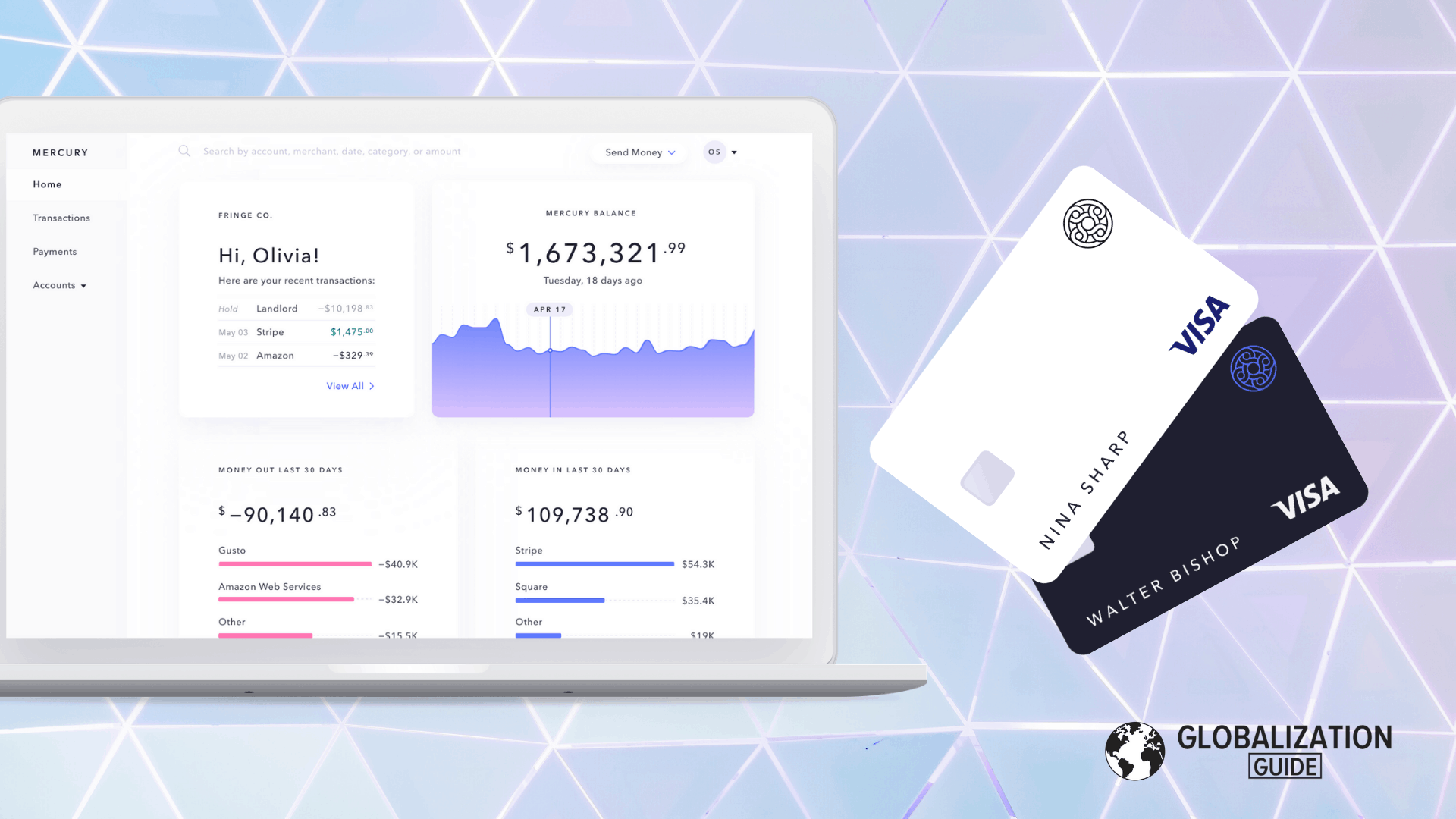

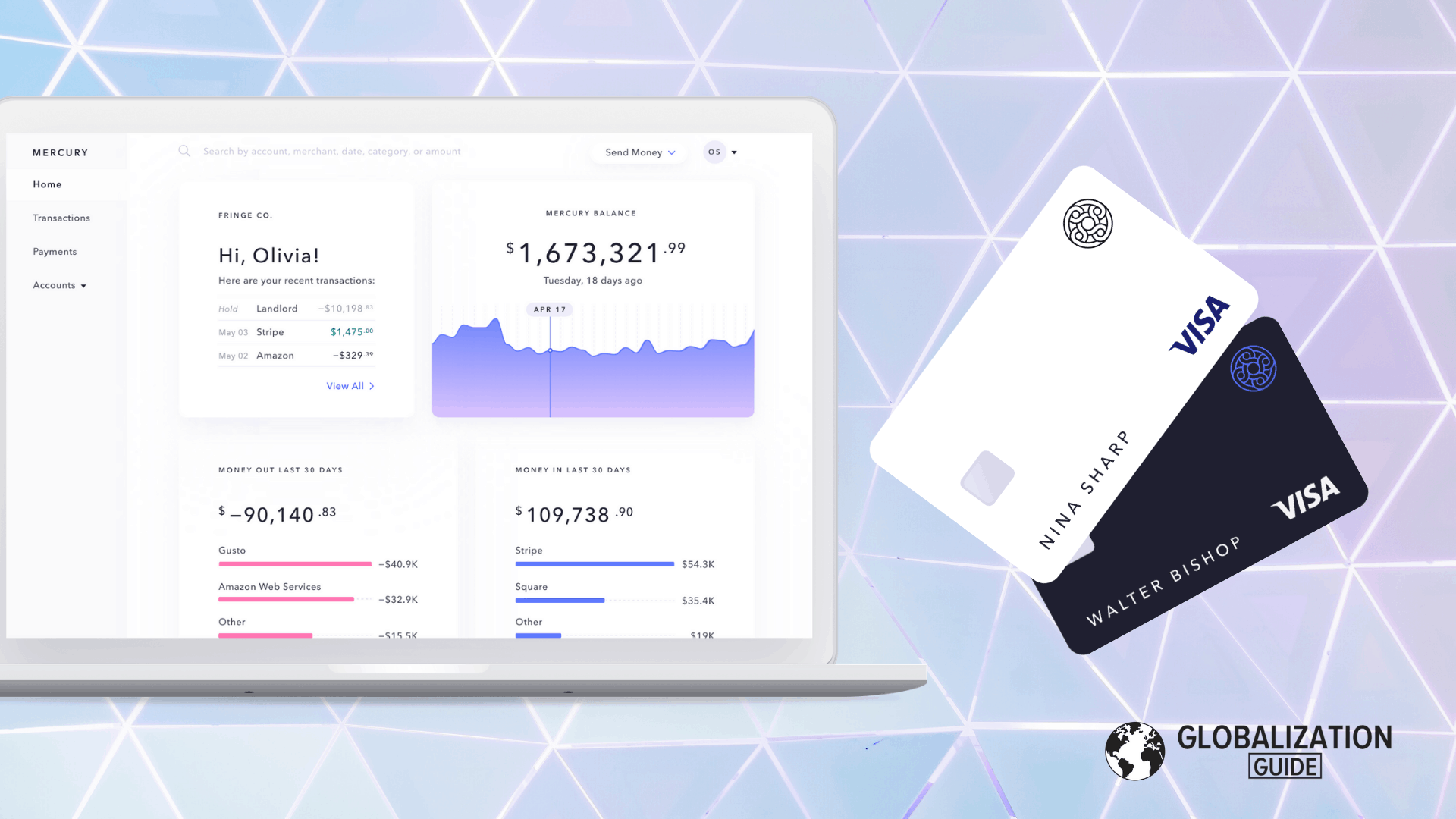

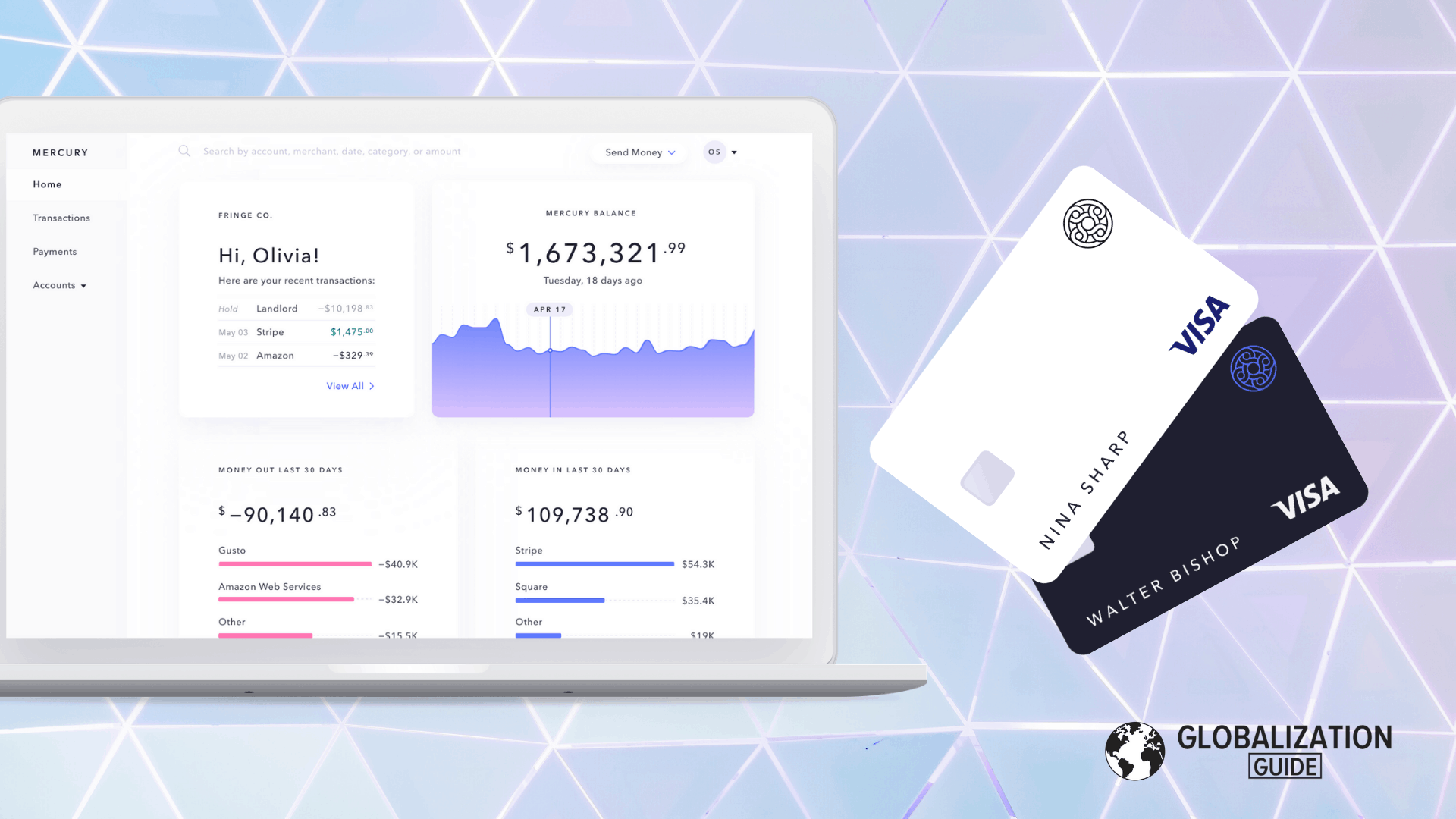

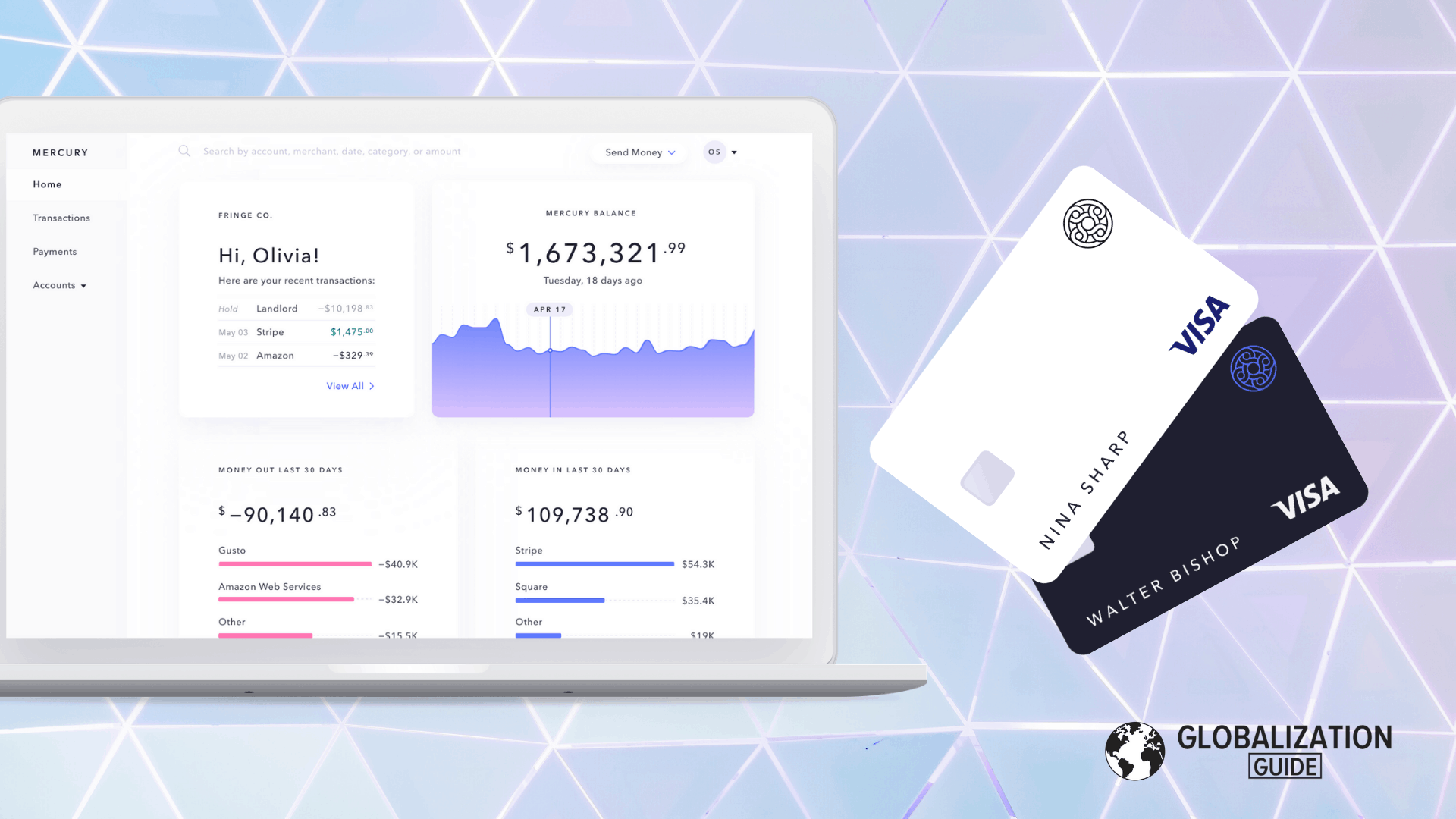

Mercury has an overall excellent user interface. It looks and feels modern, and the user experience is lightyears better than for example at Bank of America. If you like the way Stripe looks and feels, you will feel right at home when using Mercury.

There is also a native iOS app, which allows you to quickly access your financial information on your phone. Not all of the management features can be accessed this way however.

There is full support for two-factor authentification via standardized authenticator apps.

Excellent Payment Card Features

When it comes to its payment cards feature, Mercury supports really every important category a flexible business needs.

- A physical Mastercard for each user

- Up to 50 virtual debit cards

- Solid individual card control features

Physical Mastercard

You can request a physical Mastercard for each enrolled user on the account, right after signup.

The card supports Apple Pay and wireless payments.

There are no international transaction fees.

The debit card can be used at ATMs (also internationally). Mercury doesn’t charge any fees on top of the ATM operator charges. In the US it is part of the Allpoint network.

Virtual Debit Cards

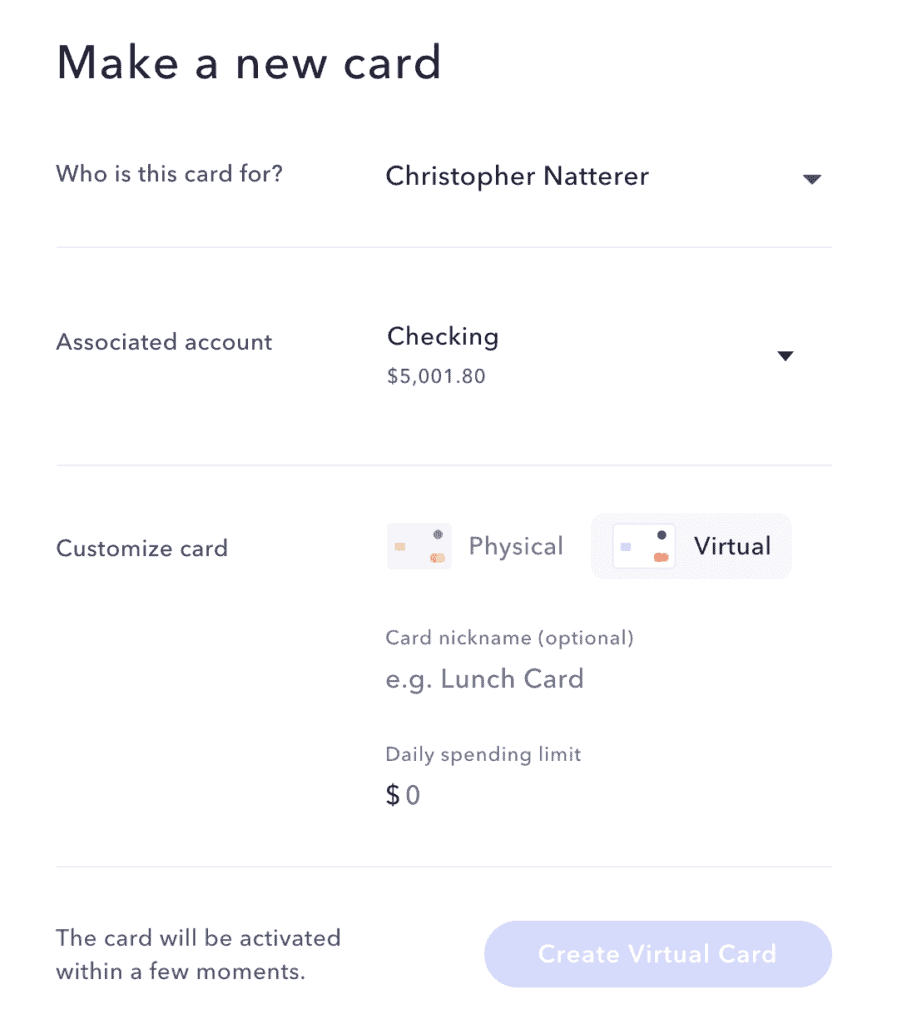

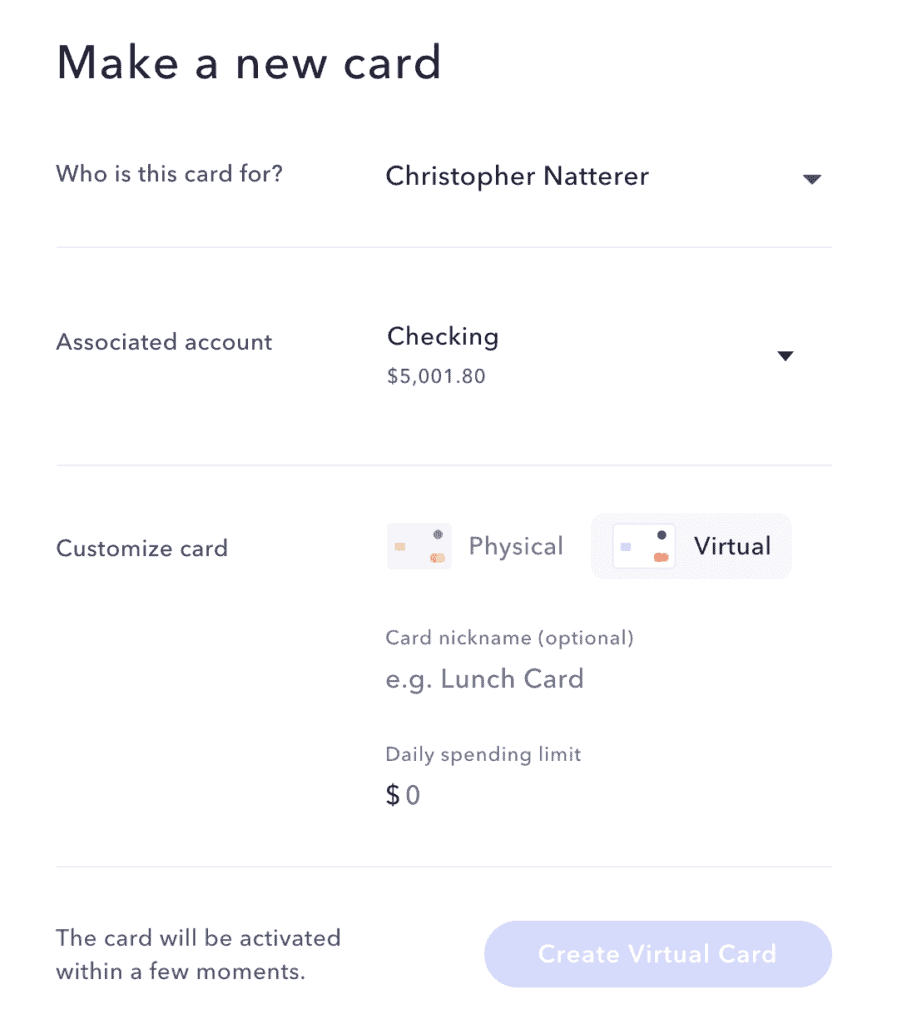

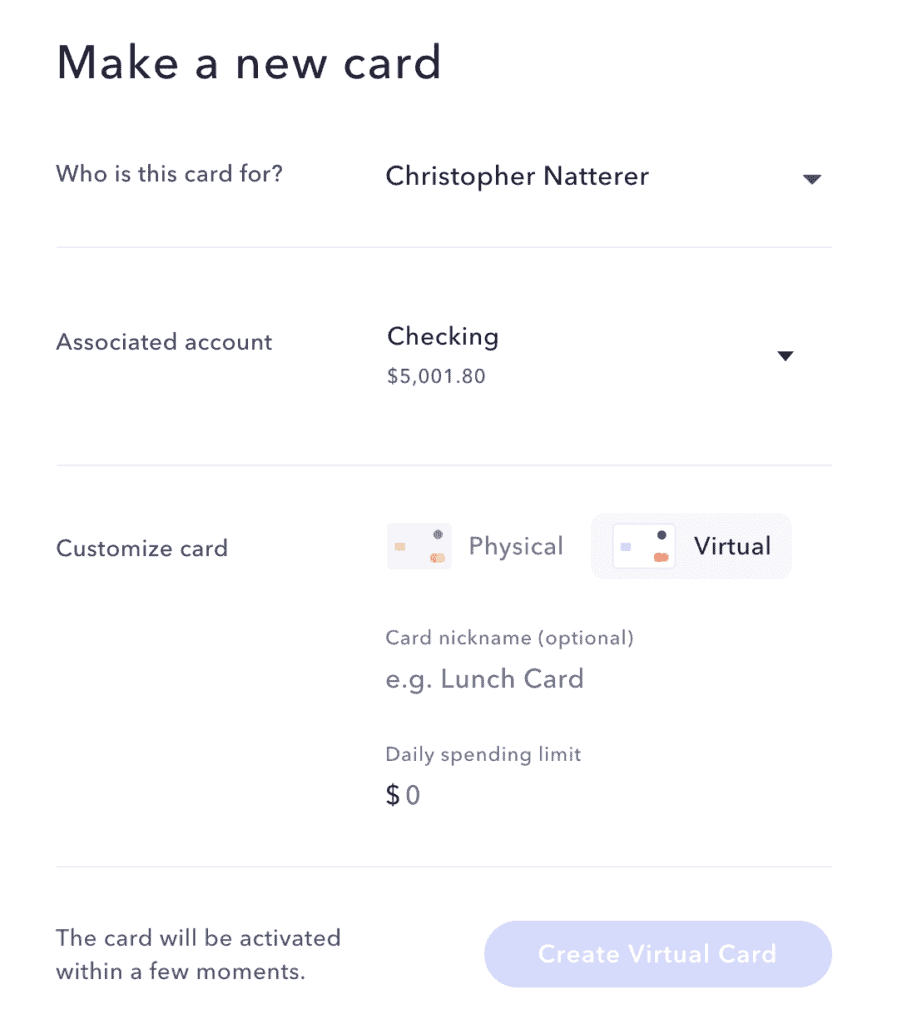

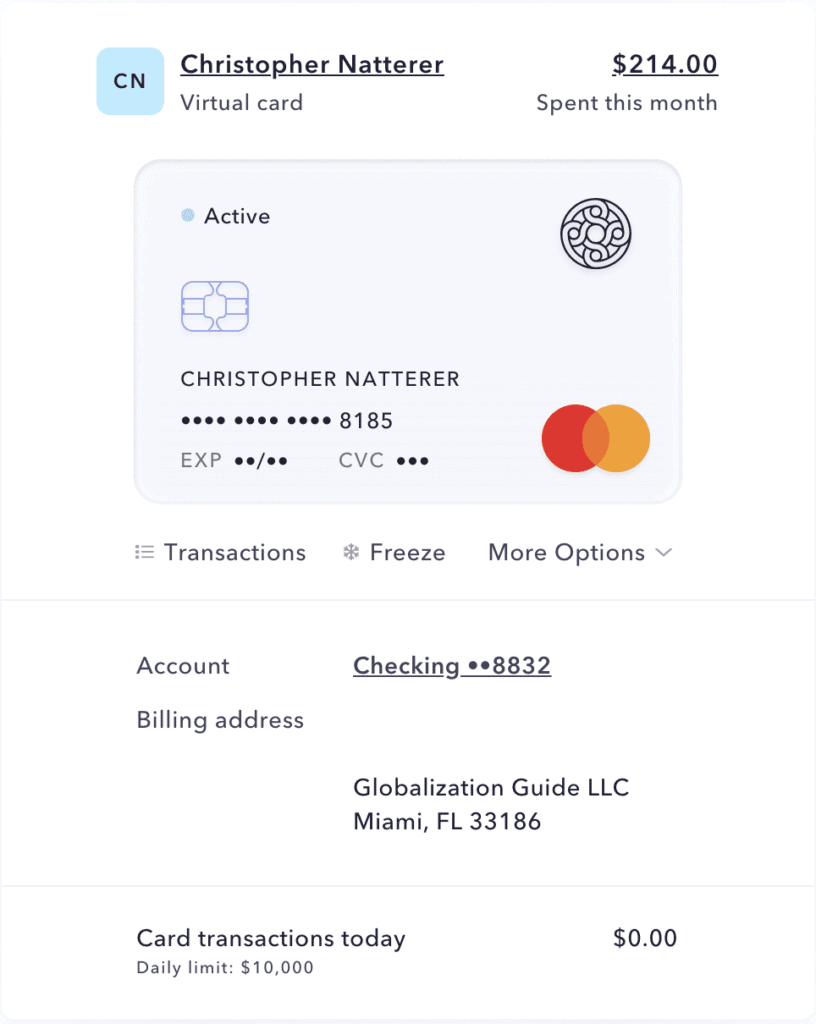

It takes just a few clicks to issue a new virtual debit card from within the web app. Each card is assigned to a specific user and a specific sub-account. Cards are usually ready to go within a minute.

Up to 50 of such cards are currently supported. A really useful feature, if you want to use certain cards for certain services, and track individual spending for each card.

Card Controls

Account administrators can individually control each card.

Each card is assigned to a specific user, as well as to a specific sub account.

You can turn on or turn off (freeze/unfreeze) each card with a simple switch.

All cards can be canceled by the user, and all carts support a daily transaction limit.

You can also set a new PIN for your physical debit cards through the web interface.

Online Check Deposits

Mercury supports both sending and depositing checks, without having to ever physically visit a bank.

You can send checks for free through your dashboard, by going through the Send Money flow.

You can deposit checks by using the Mercury iOS app. Just endorse the check, then take a picture of the front and the back and upload it through the app. Most checks get verified and credited to your account within 1-3 days.

Security and Teams

The platform makes it very easy to manage users. Your account can have multiple team members with two different permission levels: Administrator or bookkeeper. You can also define custom roles.

Excellent, if you want to give regulated access to employees, business partners, and contractors.

There is required 2-factor-authentification, which supports standard authenticator apps like Google Authenticator, Authy or 1Password. The databases are encrypted, the passwords hashed and HTTPS/HST required on all pages.

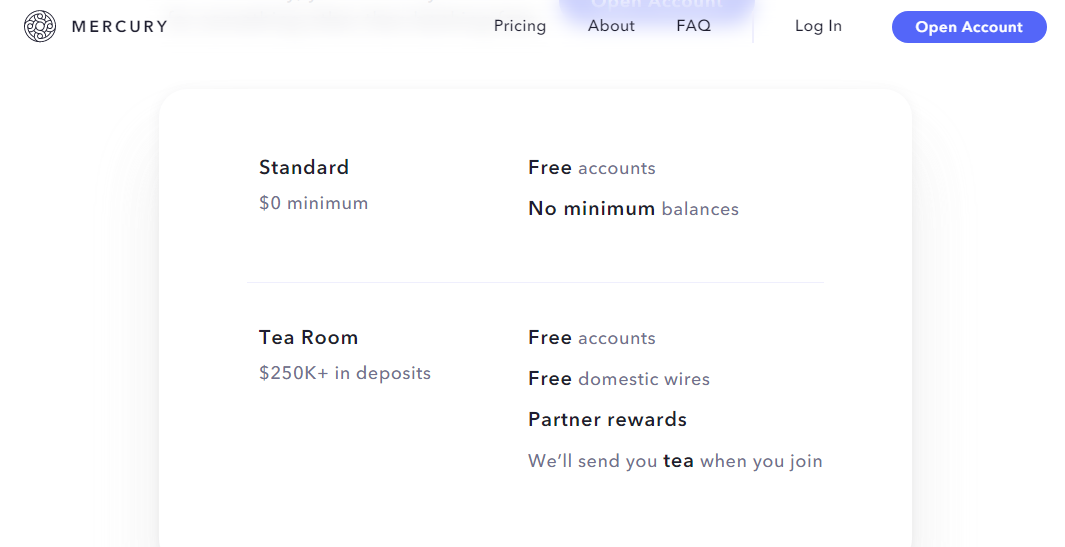

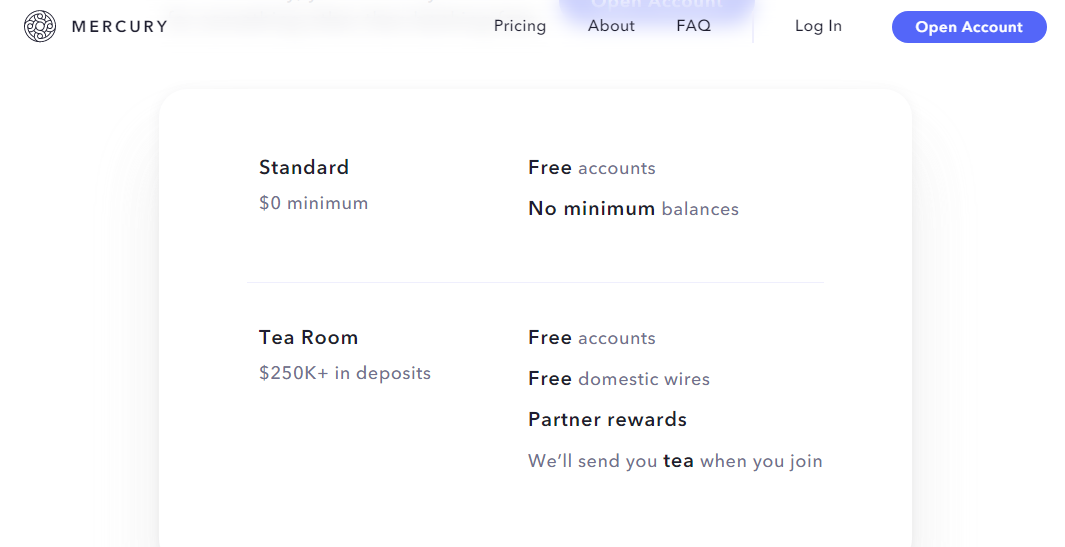

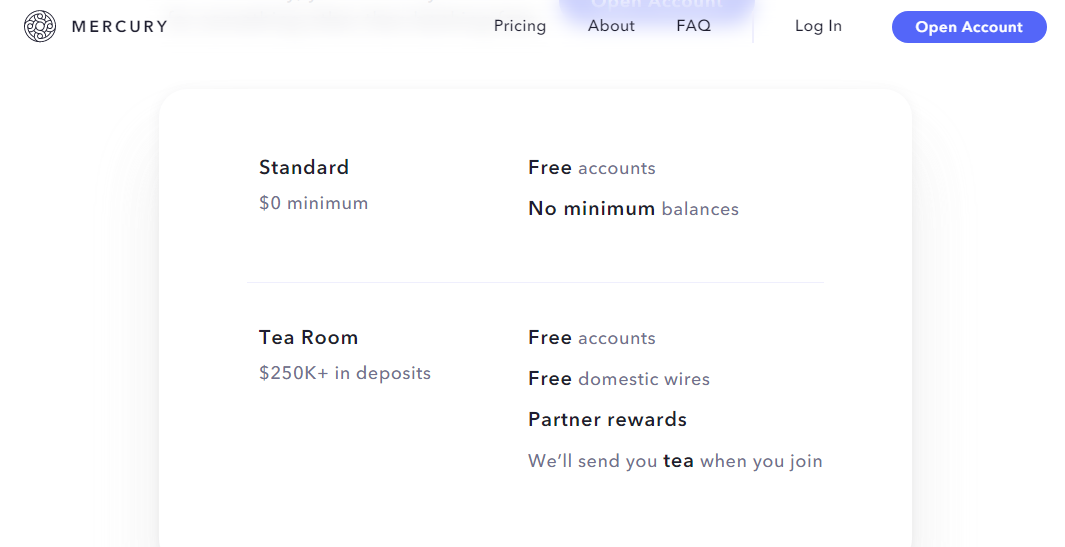

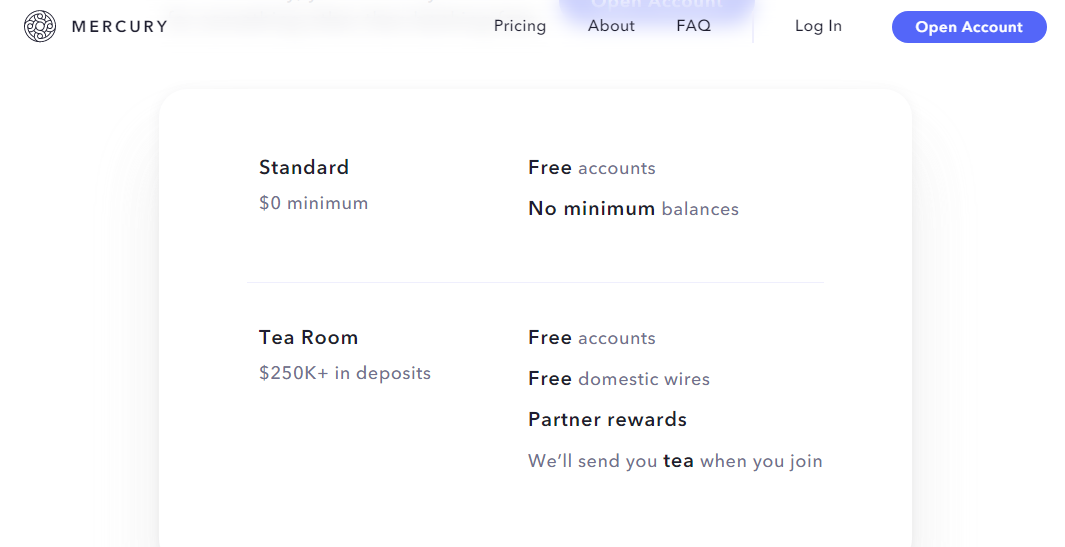

Simple and Straightforward Pricing Structure

Mercury has a simple and straightforward pricing structure.

Even without any minimum balance, the account is free to sign-up and there are no monthly fees. There are also no overdraft fees or other hidden fees.

All incoming transactions are free, that includes international wires.

Outgoing ACH transfers are also free.

Domestic wires are charged at $5, and international wires cost $20 per wire.

Accounts with over 250k$ in deposits become members of the Tea Room, and will receive free domestic wires as well as other partner rewards.

Software Integrations

Mercury comes with native integrations for the two biggest bookkeeping software solutions out there: Xero and Quickbooks.

Through the use of Plaid, it will also integrate with a large number of other services, for example, Wave Accounting (which is what we currently use and recommend often).

How You Can Open Your Mercury Account

I have applied for and received accounts at Mercury for many of my clients. In the following section I am going to share what I have seen so far.

Eligibility

The service works exclusively with U.S. businesses. If you do not already have your US business registered, you can read my guide on how to open your US LLC.

Mercury proudly has this quote on their website:

[…], we’re proud to support U.S. companies founded by people all across the globe. You can open your account right from your laptop without needing to visit the U.S.

While this is the case, I have seen companies getting denied, in cases where:

- The owner is not a US resident

- The business is not serving US clients

If your business does not currently serve US clients, I would make sure that you at least create that appearance during the sign-up process. If you need help creating a compliant website, send an email to [email protected], and we can help you.

Money service businesses or companies involved with adult entertainment, marijuana or internet gambling are not supported.

LLCs with owners that live in countries on the US embargo list are also prevented from opening accounts. Currently, those countries are Belarus, Burundi, Central African Republic, Cuba, the Democratic Republic of the Congo, Iran, Iraq, Lebanon, Libya, Nicaragua, North Korea, Somalia, South Sudan, Sudan, Syria, Ukraine, Venezuela, Yemen, and Zimbabwe.

Verification Process

You will need to following information and documents.

- EIN verification letter.

- Company formation documents

- Company contract and contact details.

- Social Security Number (Not needed for foreigners)

- Government ID.

- Filling the company profile on Mercury bank website.

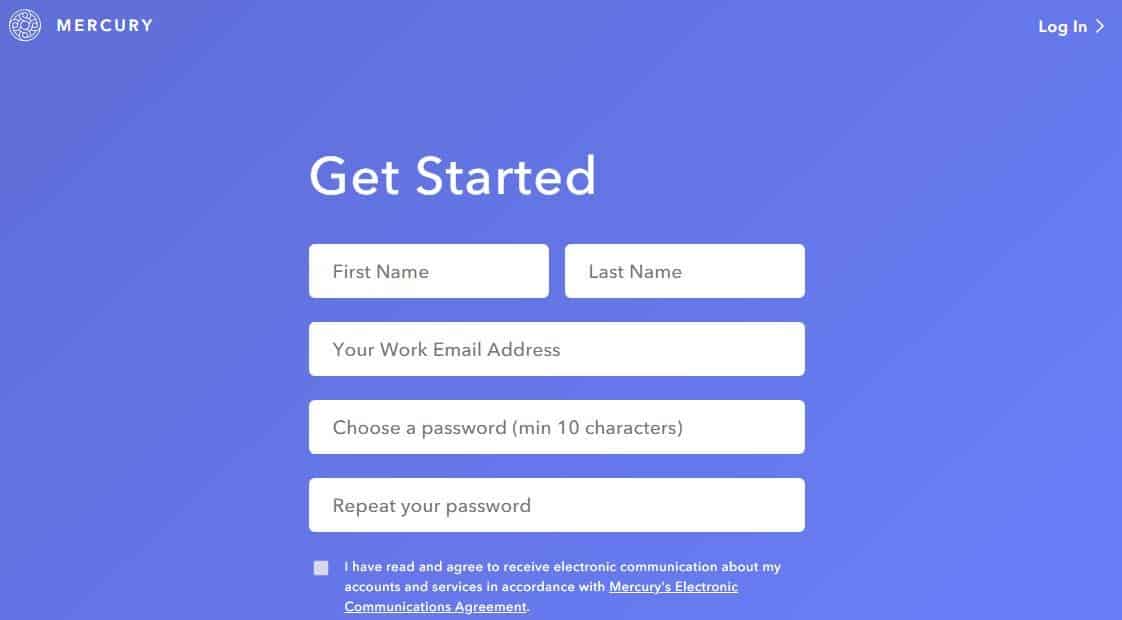

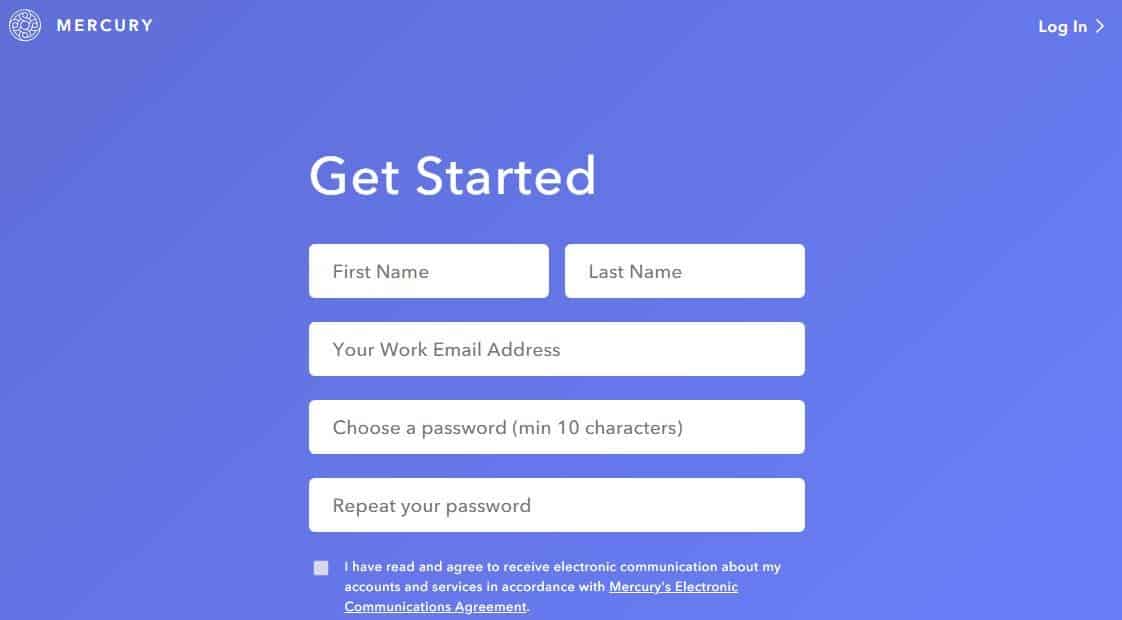

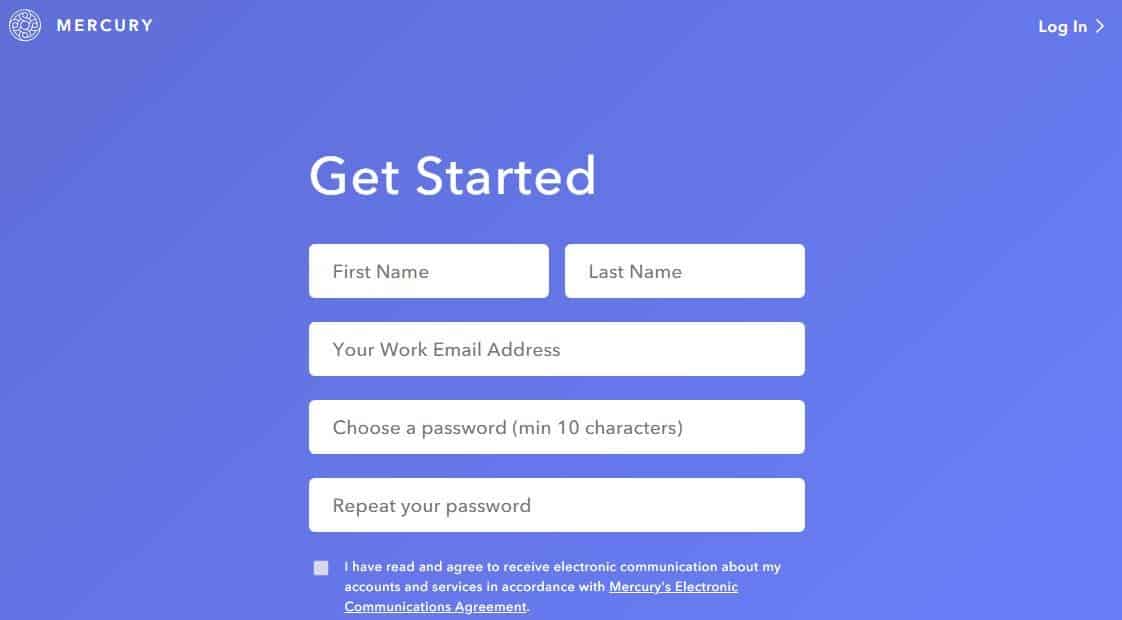

First, you click on “Open account” at Mercury’s website. Then you fill the form with simple requirements. You’ll receive an email verification request.

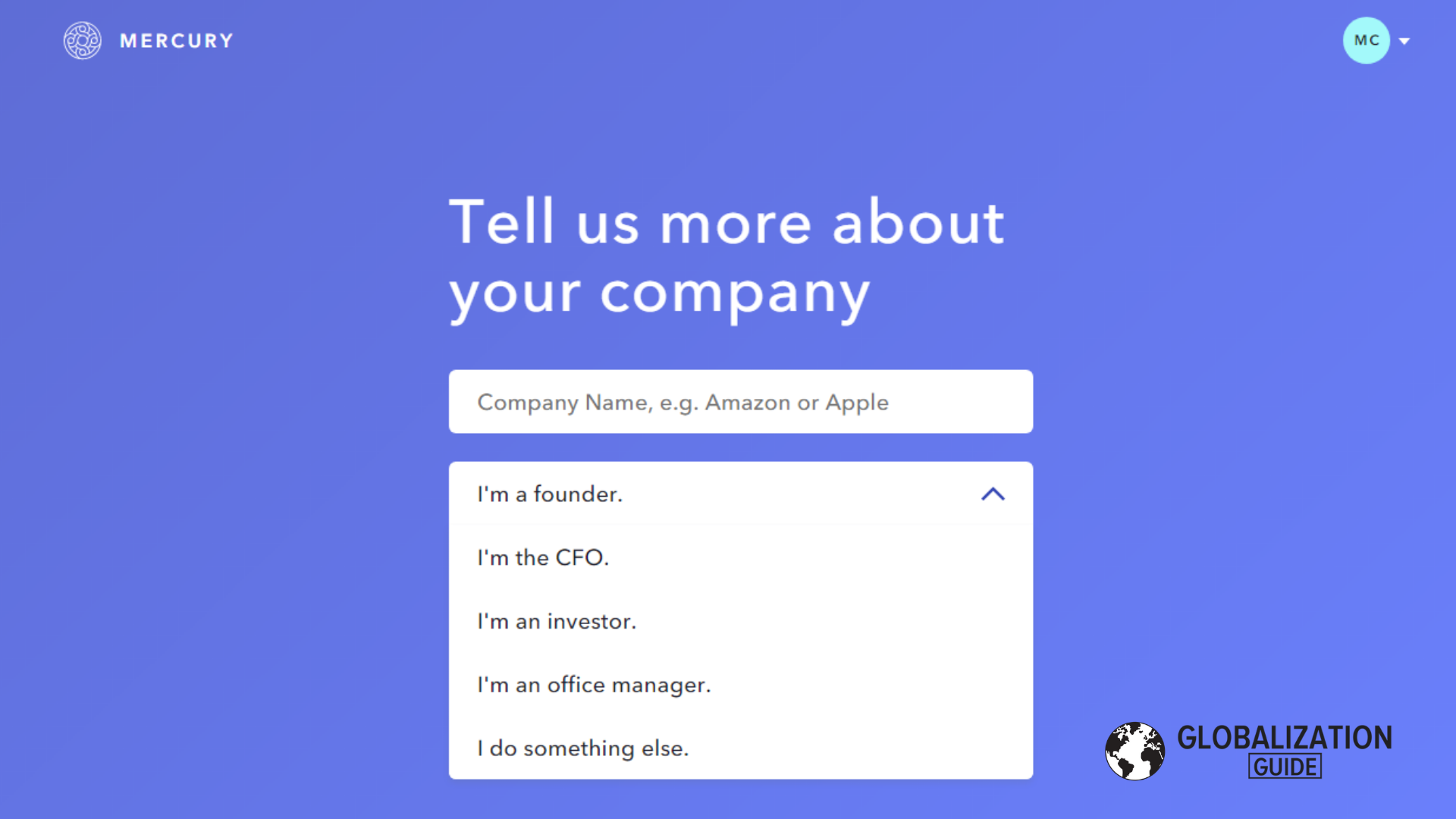

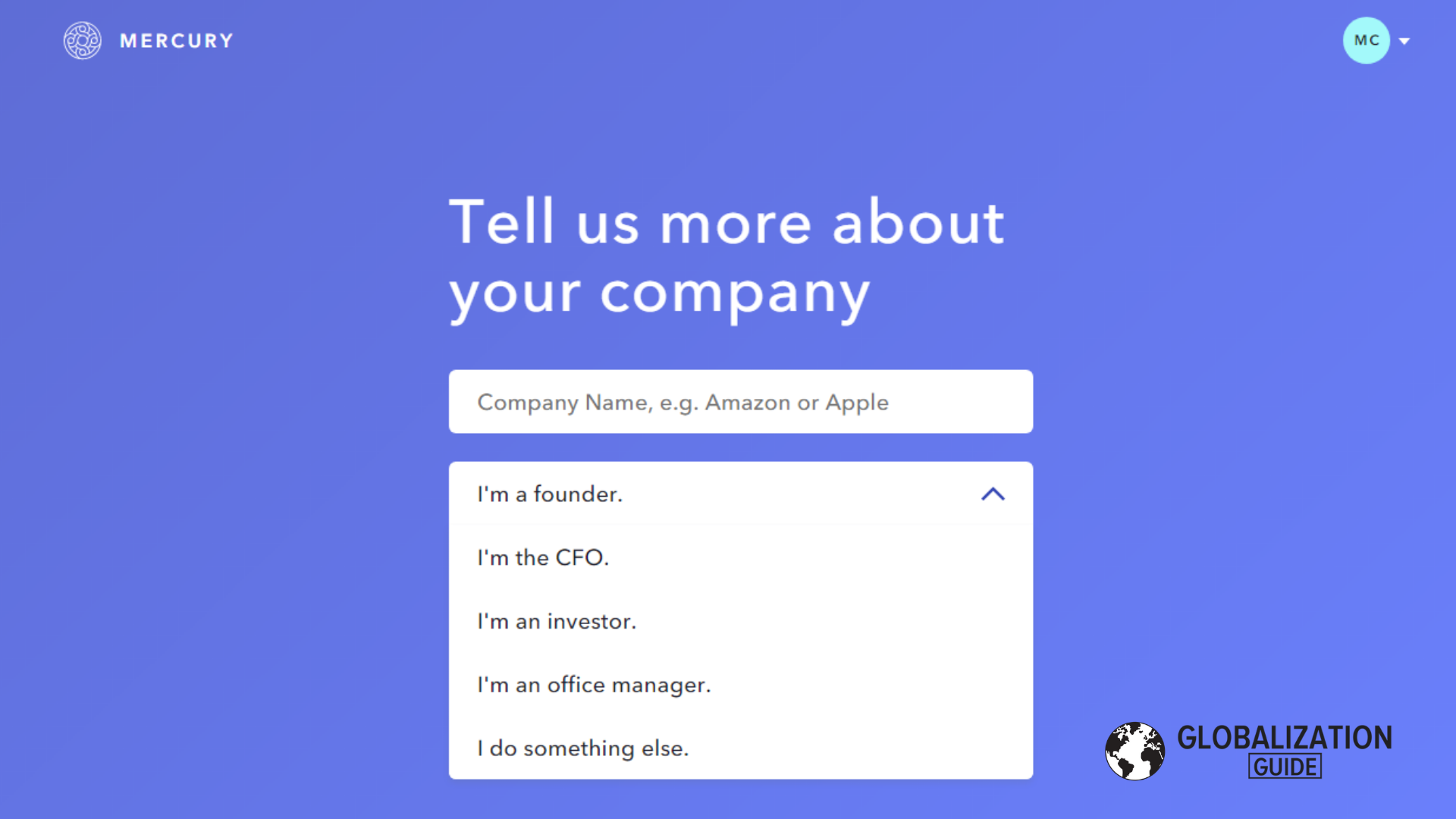

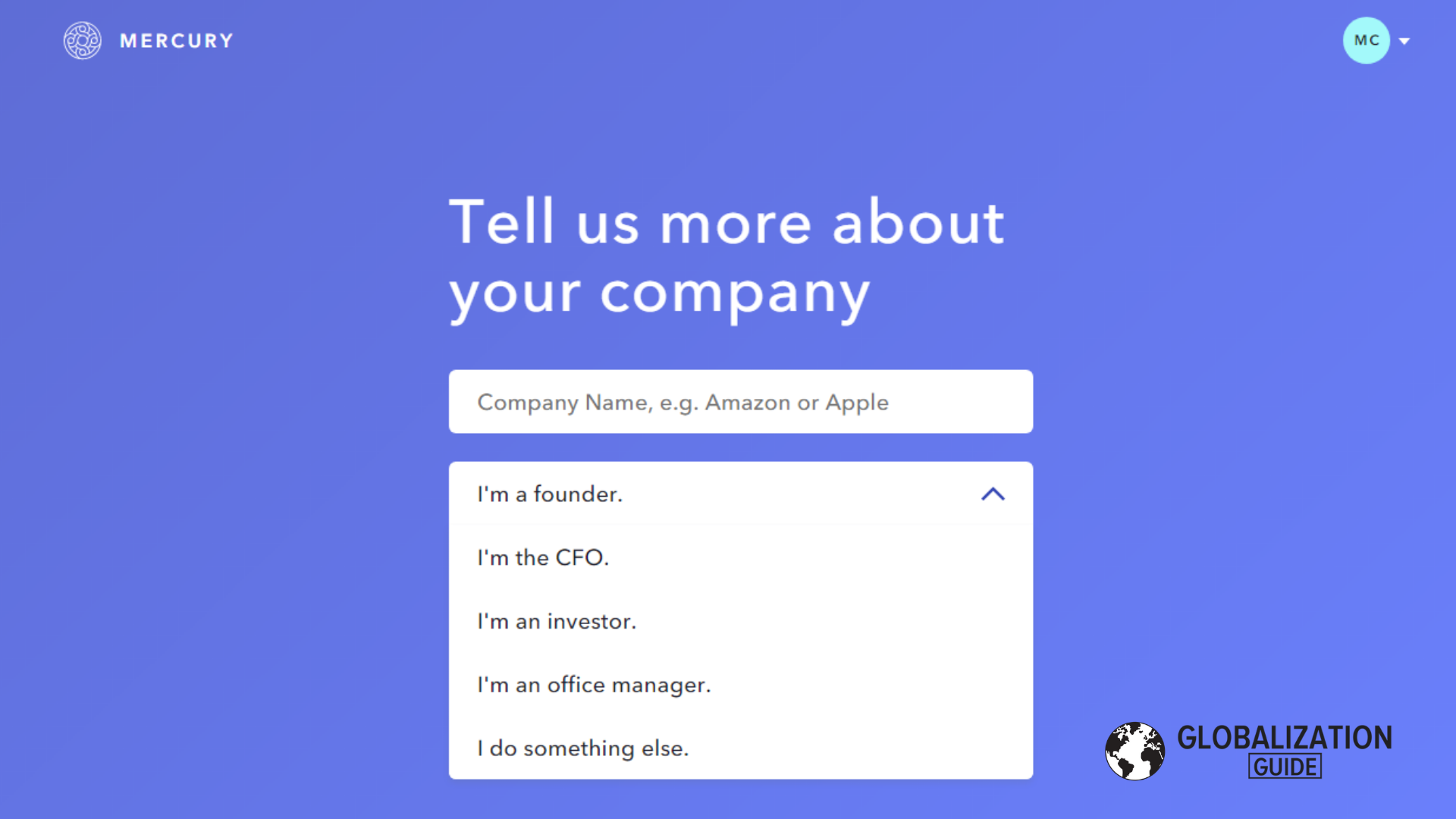

Once the email address is verified, you can proceed to add your LLC’s information and indicate your role.

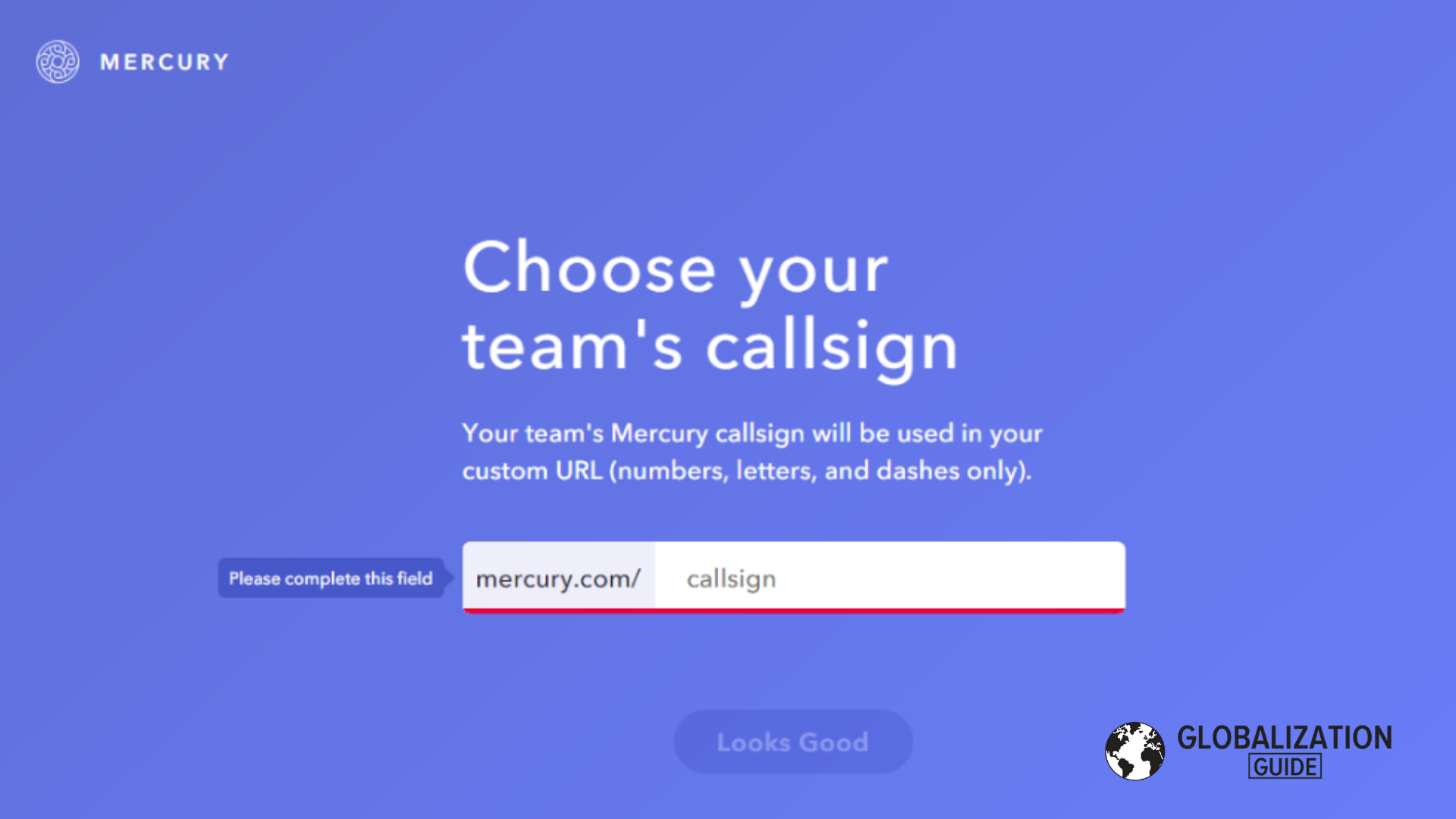

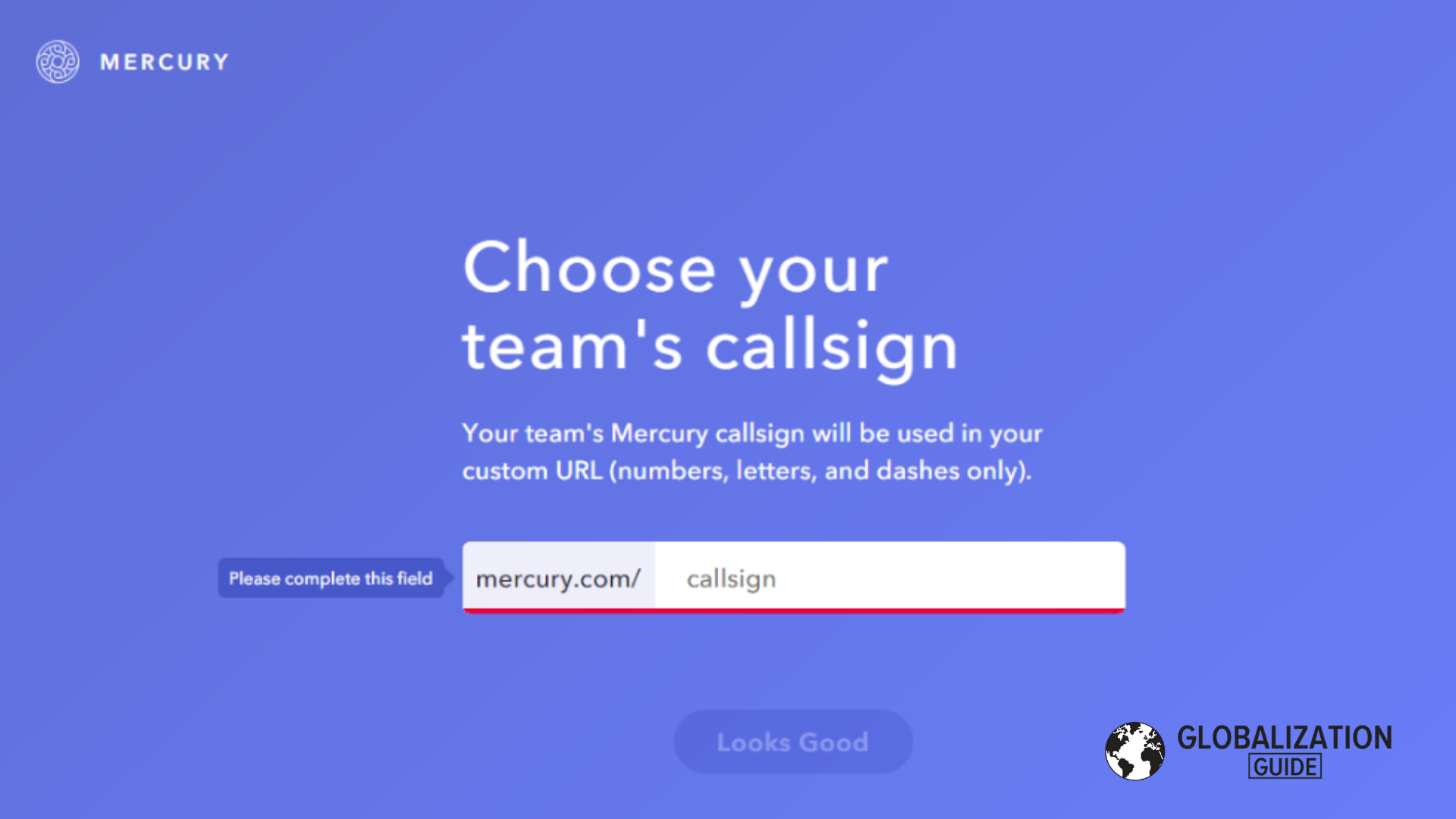

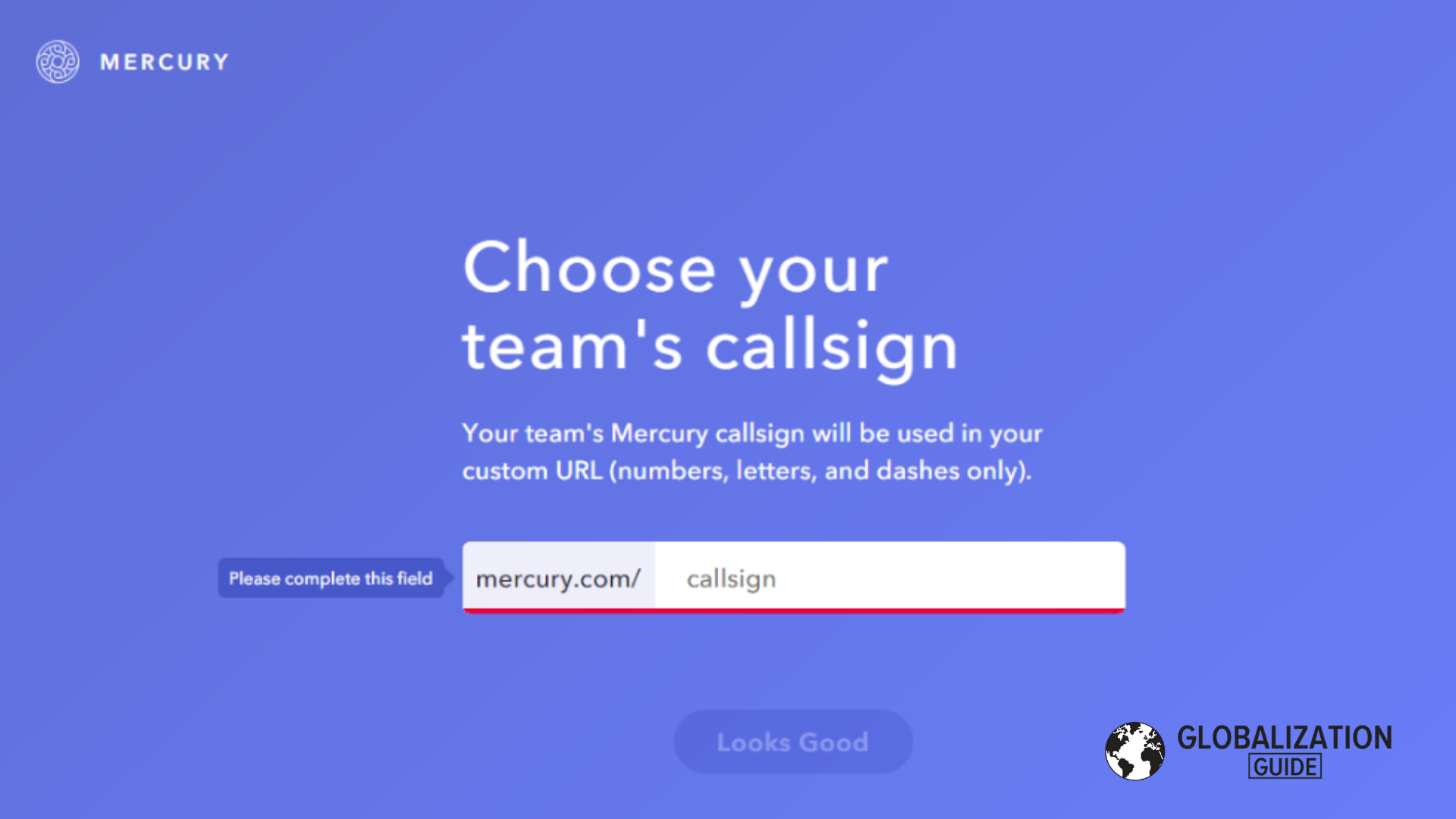

The system will generate a suggested “callsign”, you can modify this if needed.

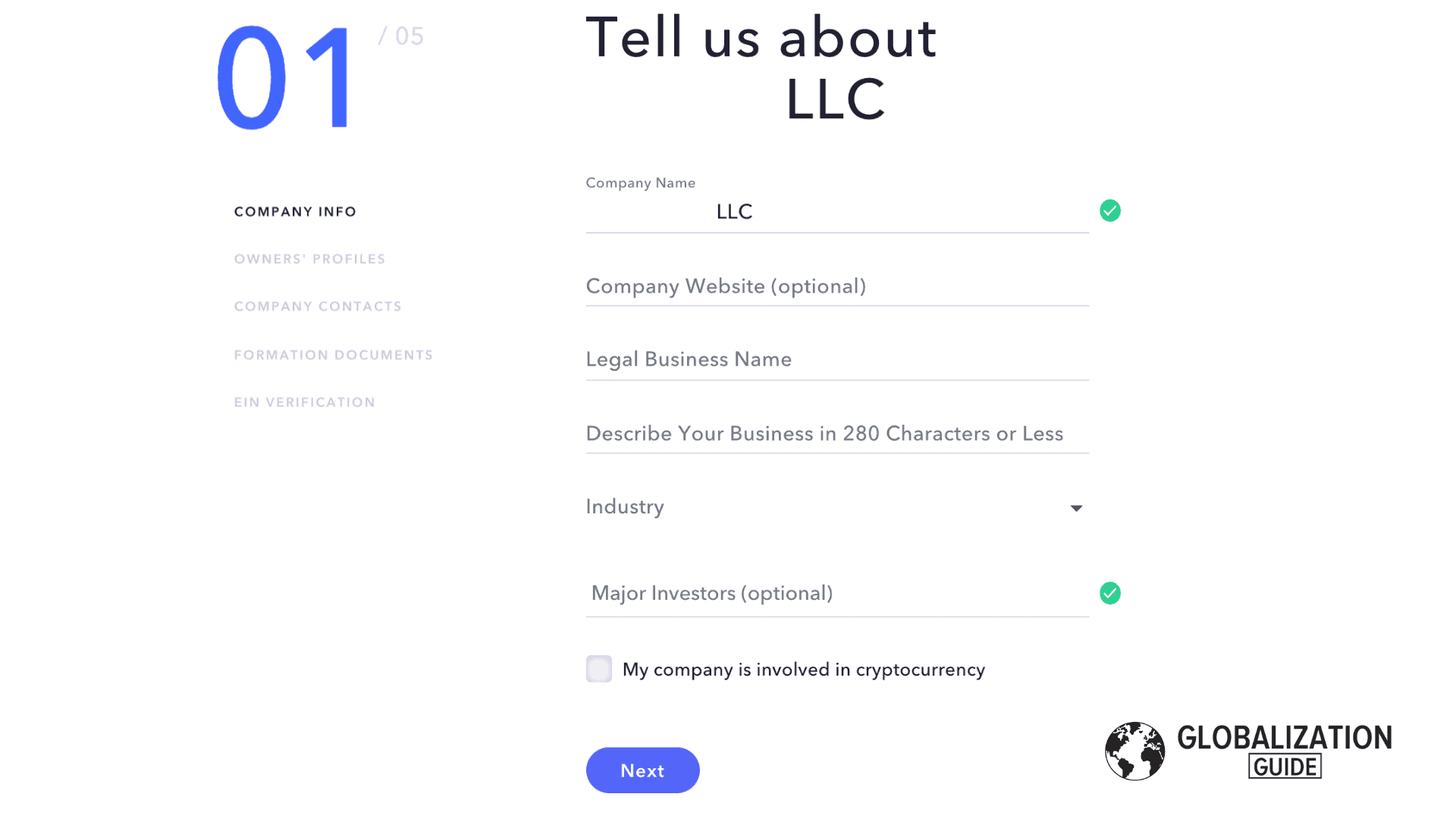

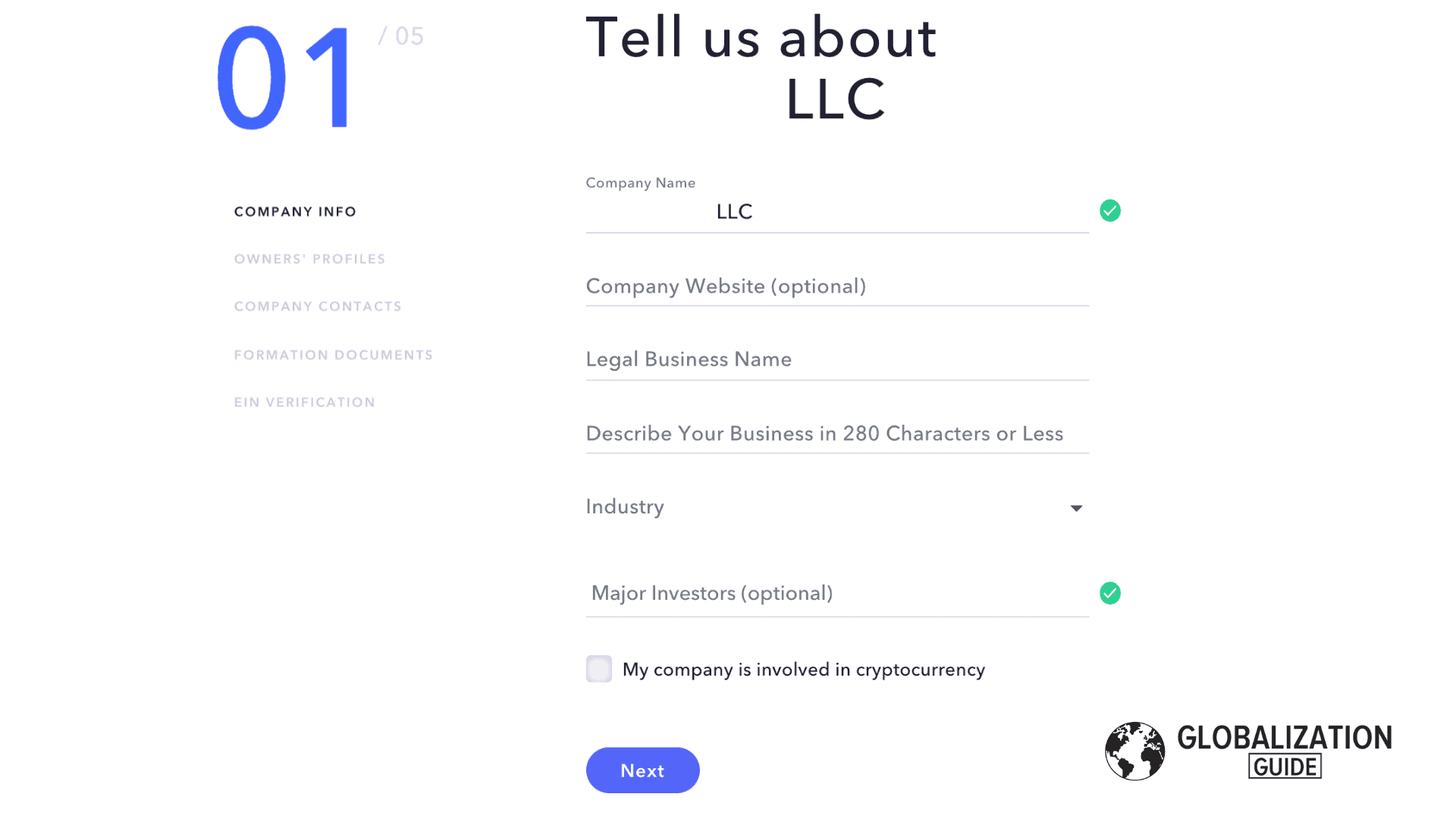

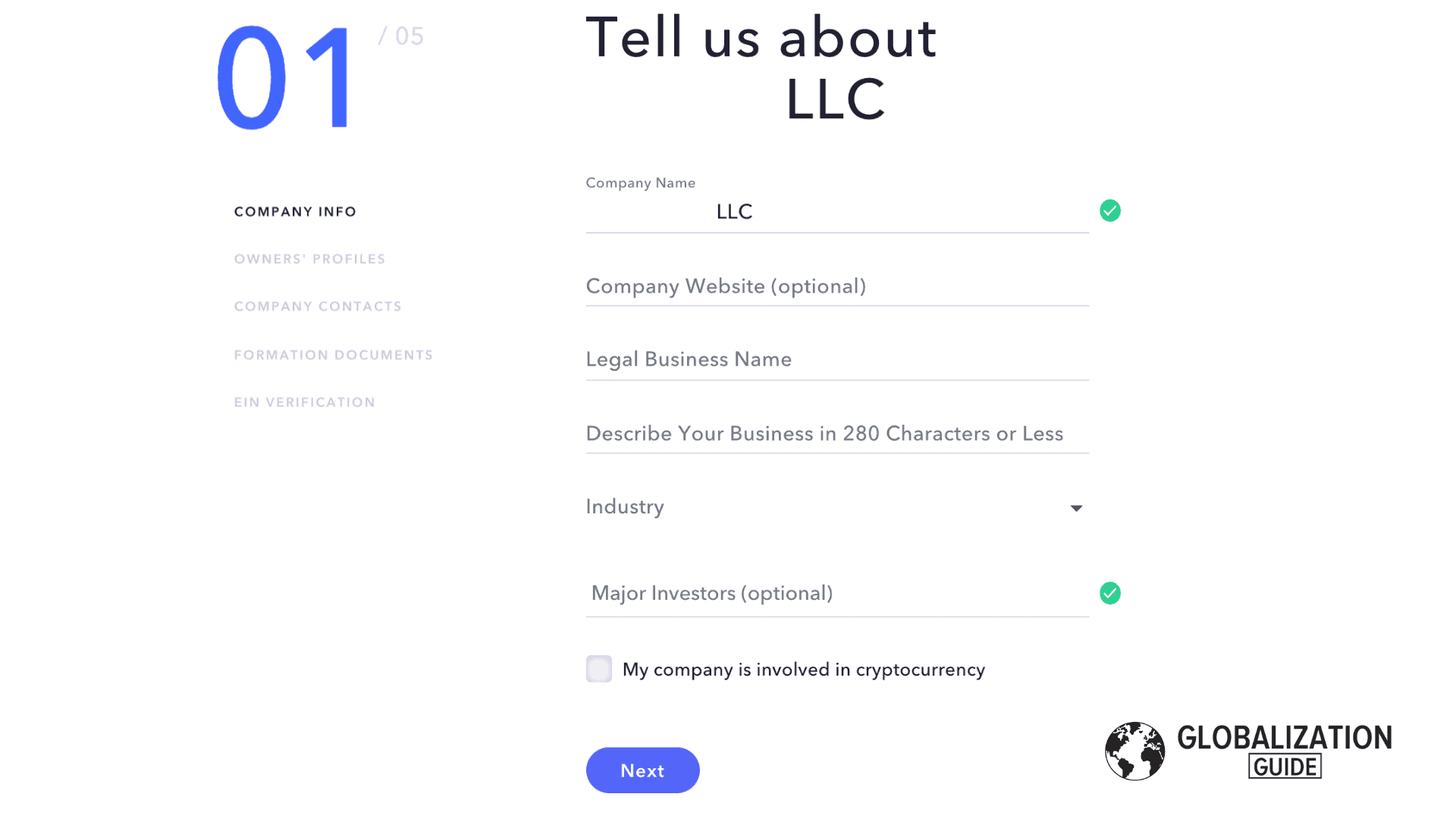

Here comes the detailed information section. Carefully, add the information as in the documents of your LLC.

If you are the only member of the LLC, your info goes here. If the LLC has more than one member, enter the information of each person.

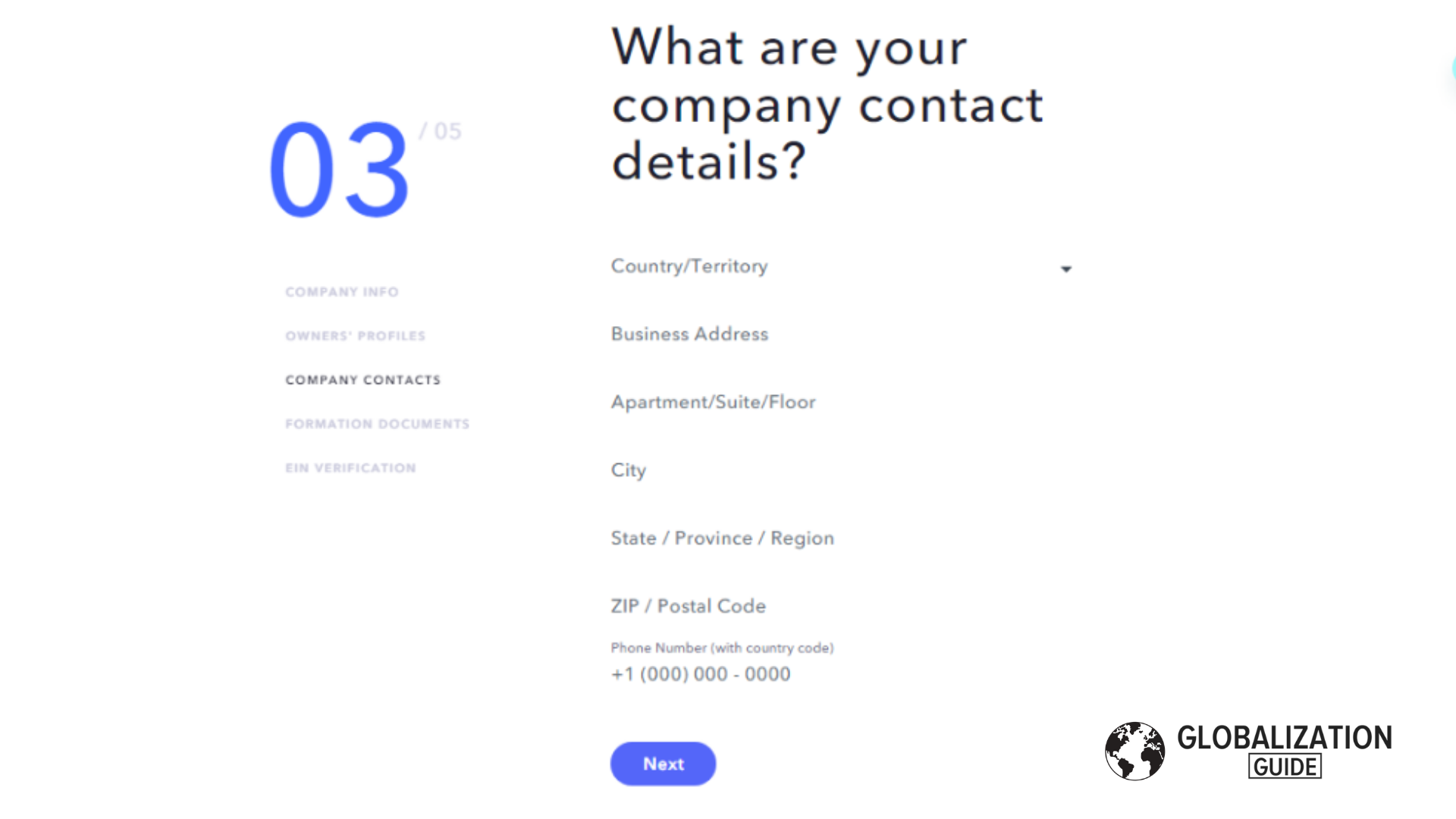

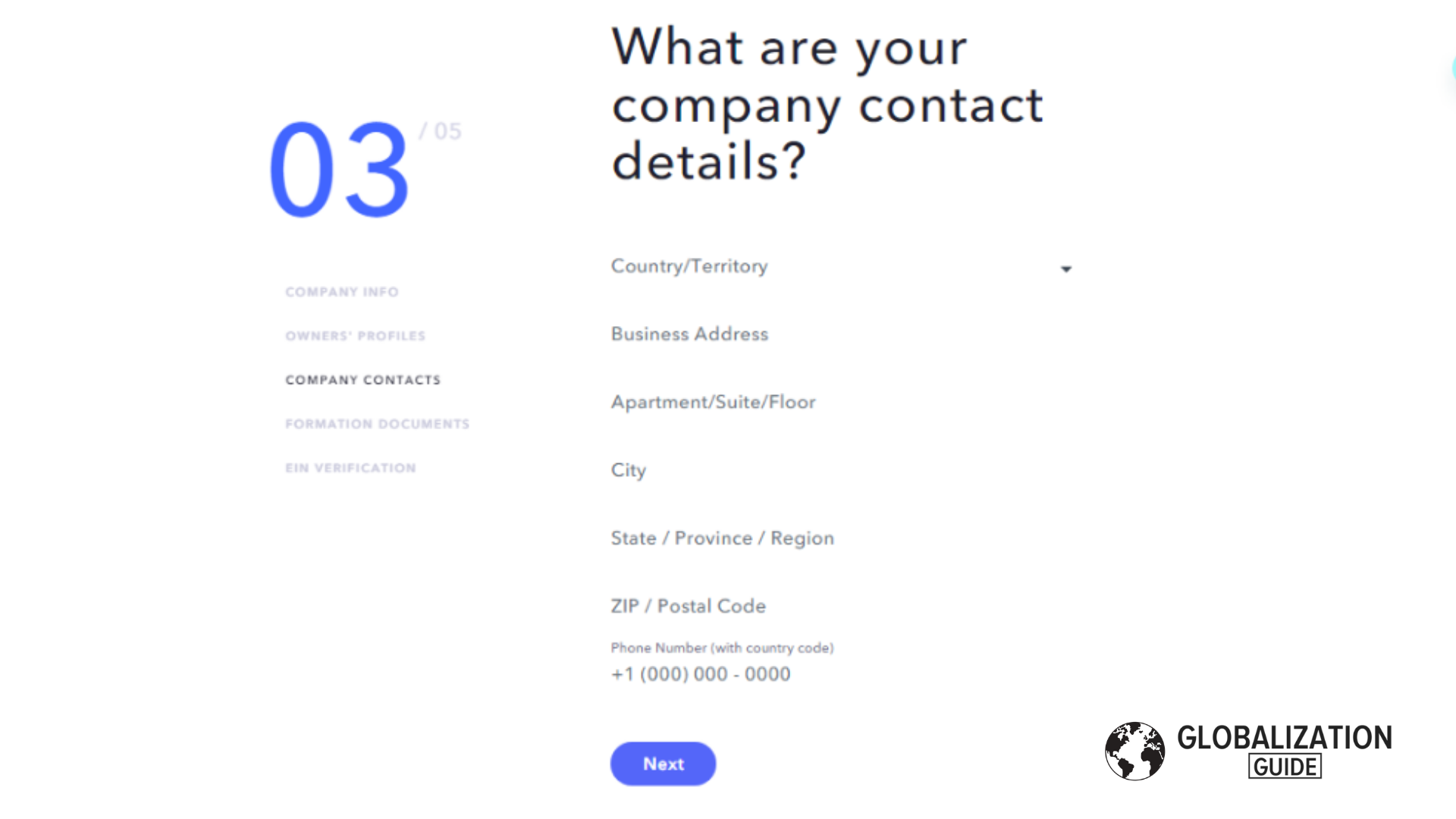

Submitt the mailing address from Anytimemailbox, which is the same in the LLC’s Formation Document.

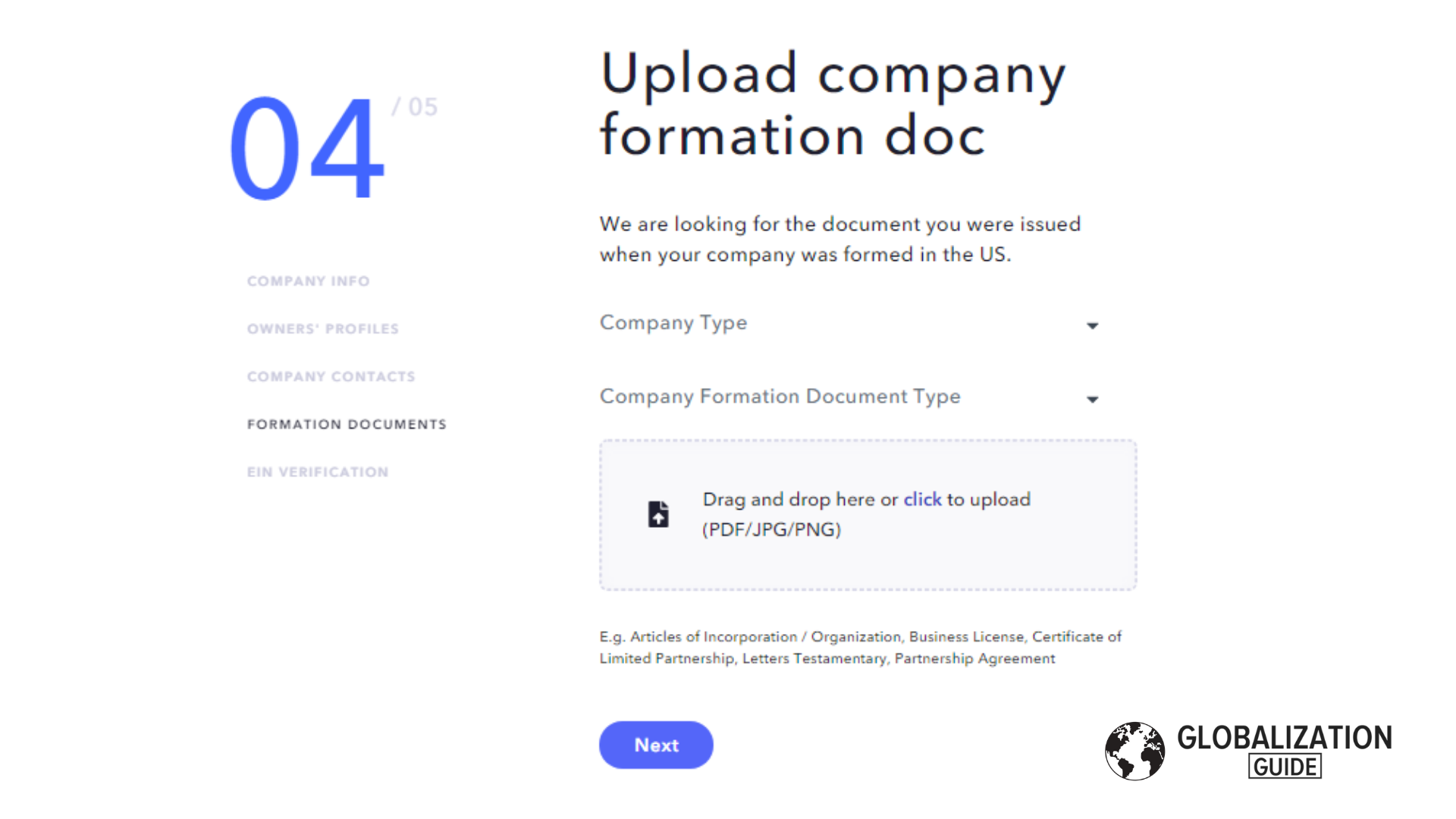

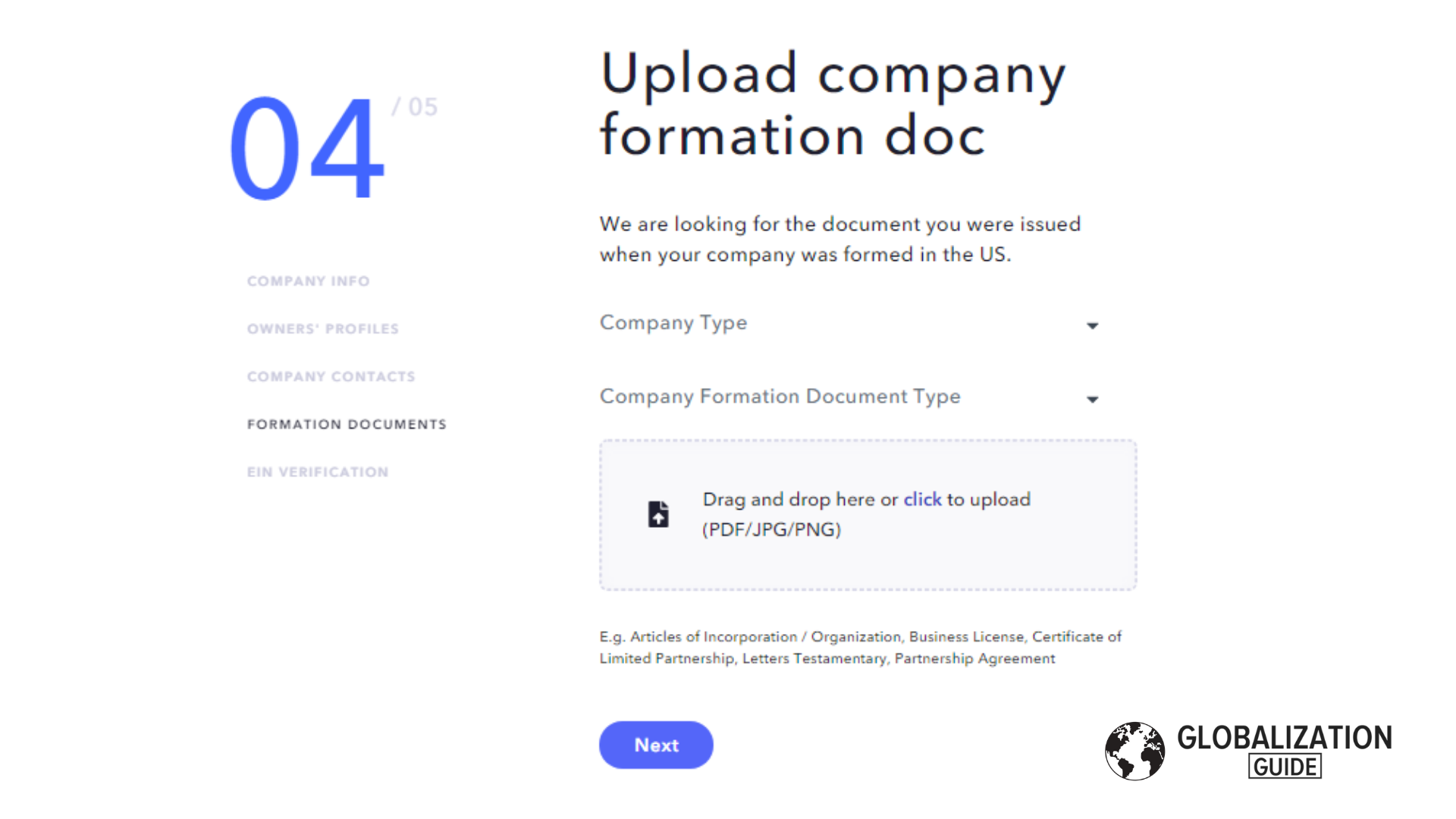

Look for the “Articles of Organization” document. The “Certificate of Good Standing” works for this too. Upload one of these documents.

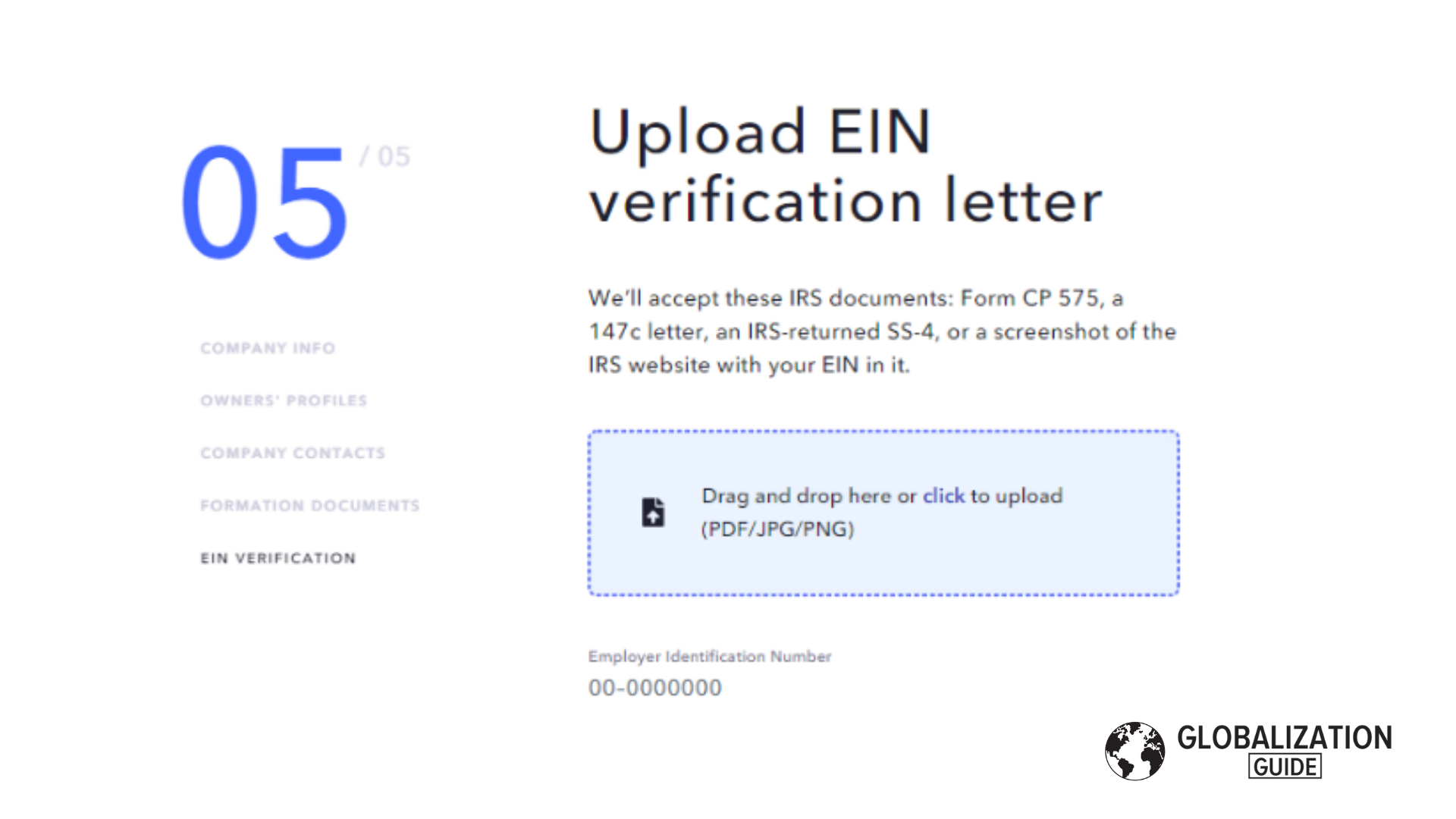

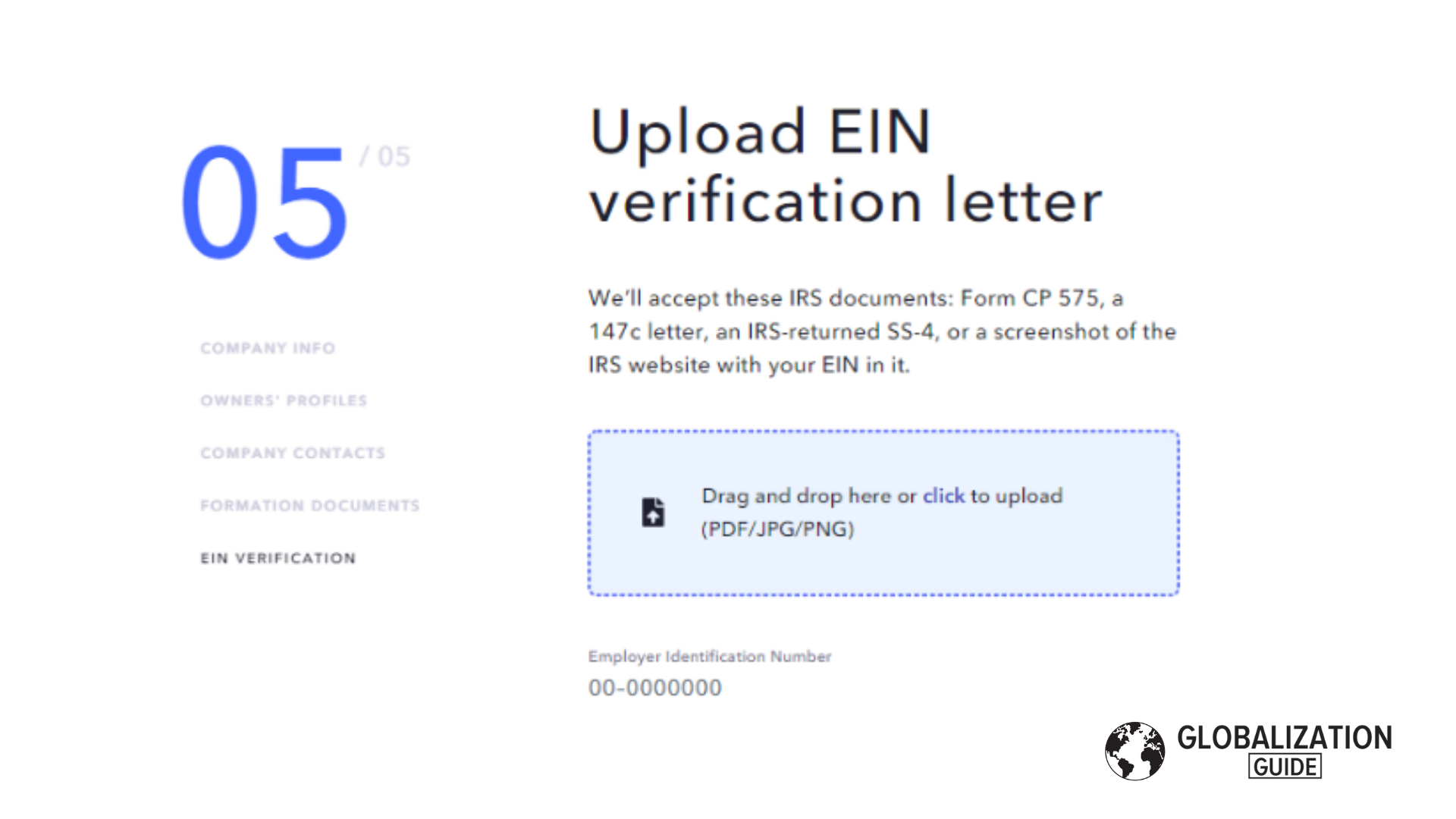

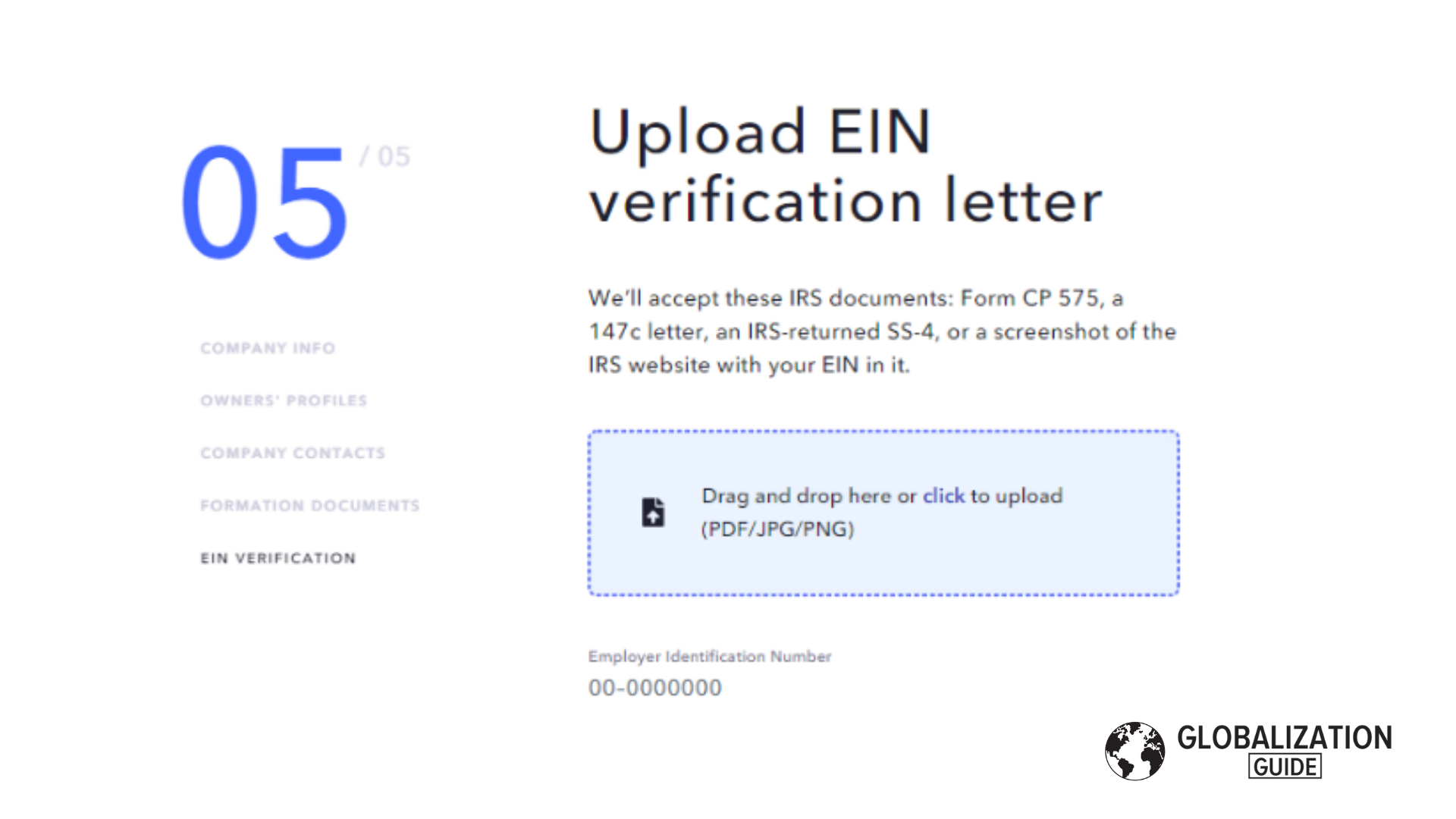

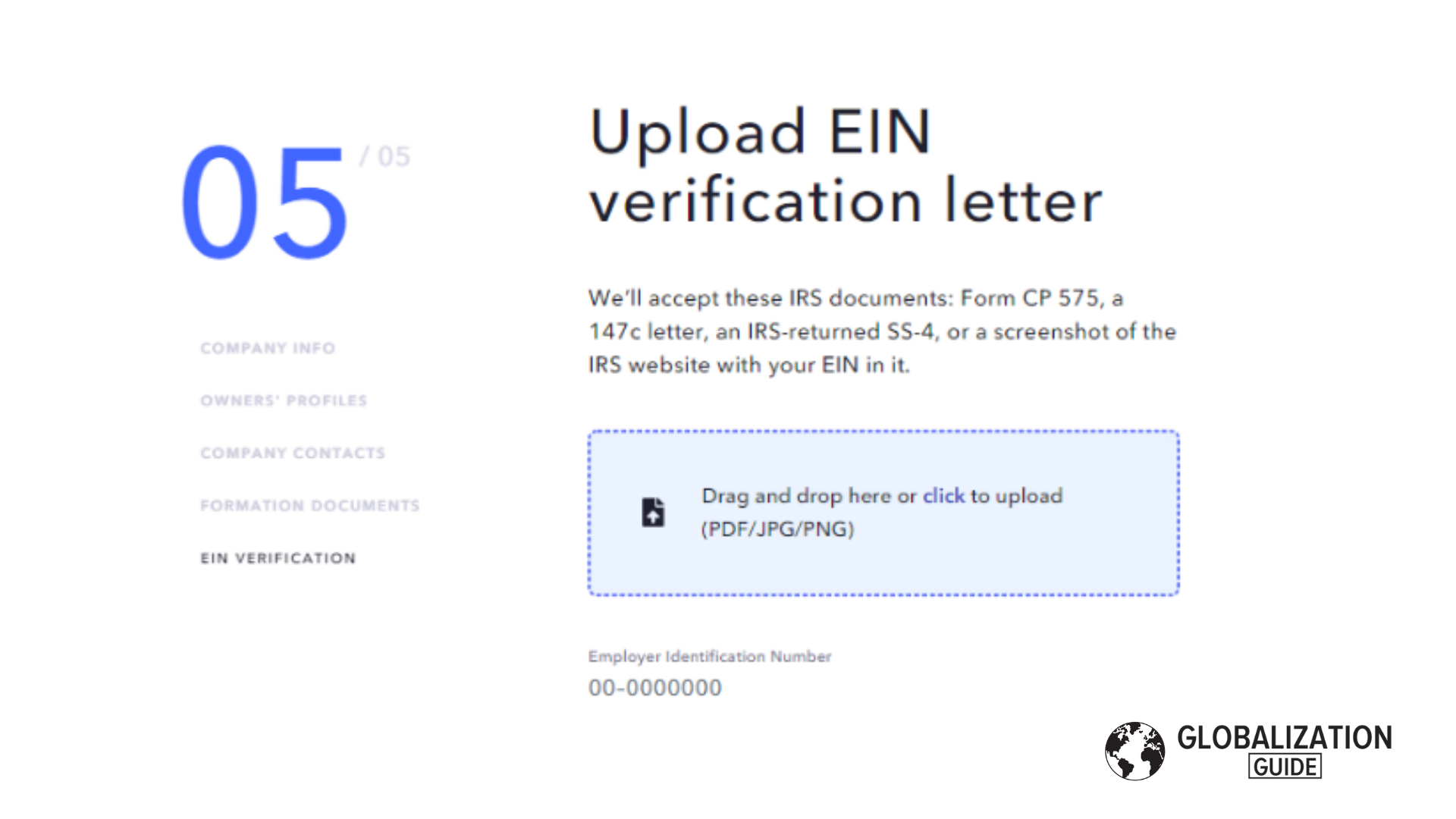

As the last requirement, you will need to present a document that verifys your EIN.

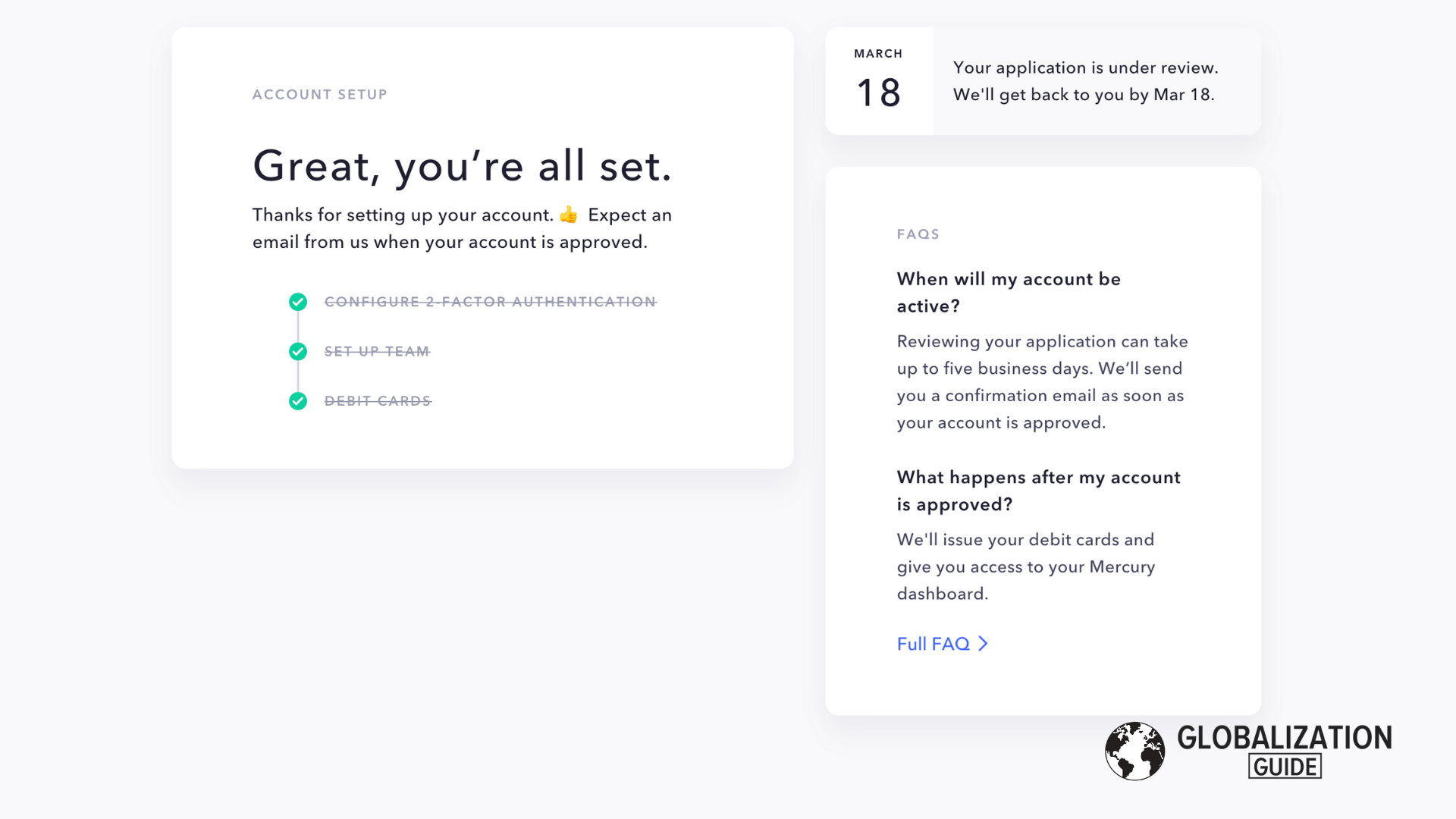

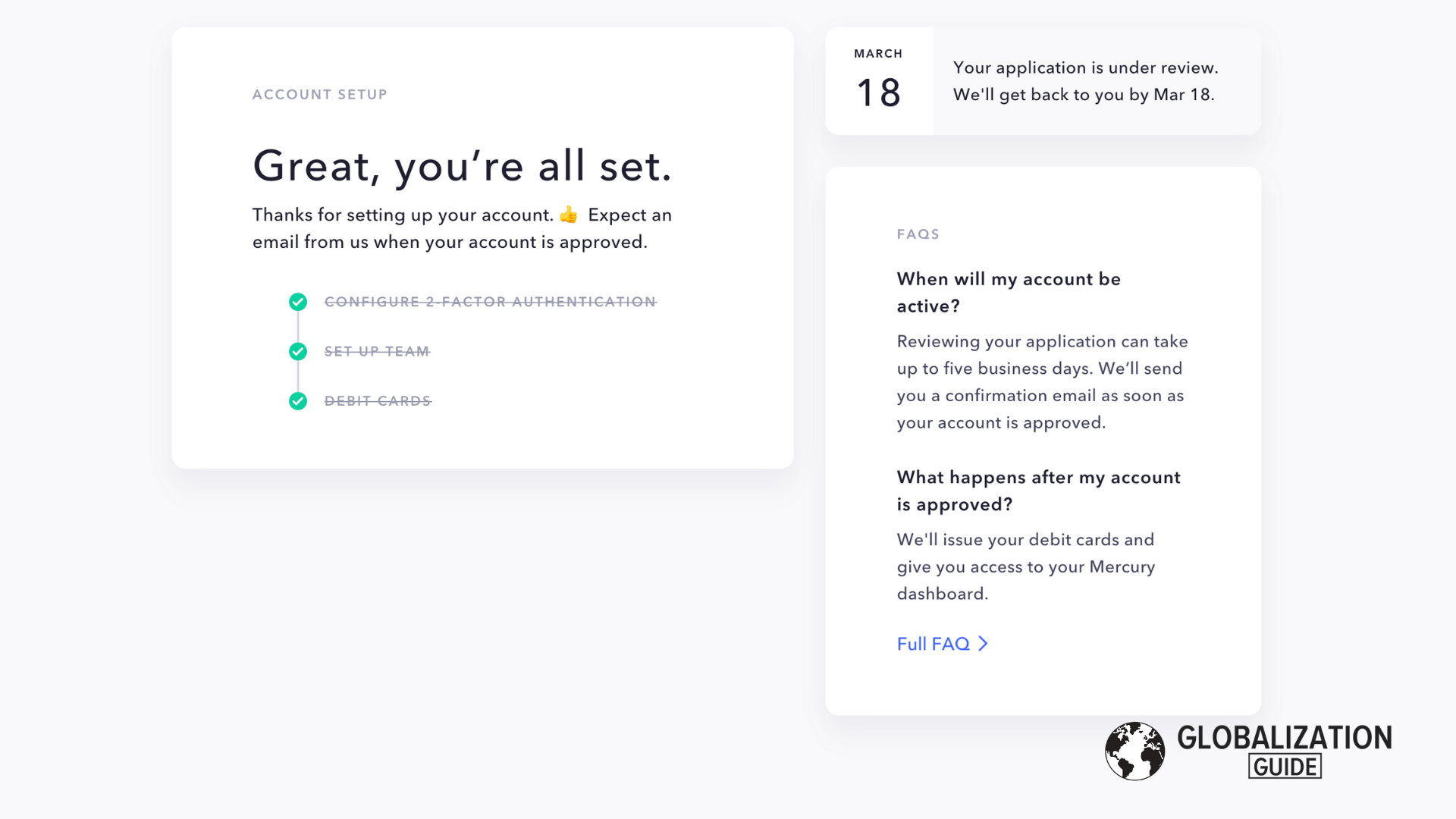

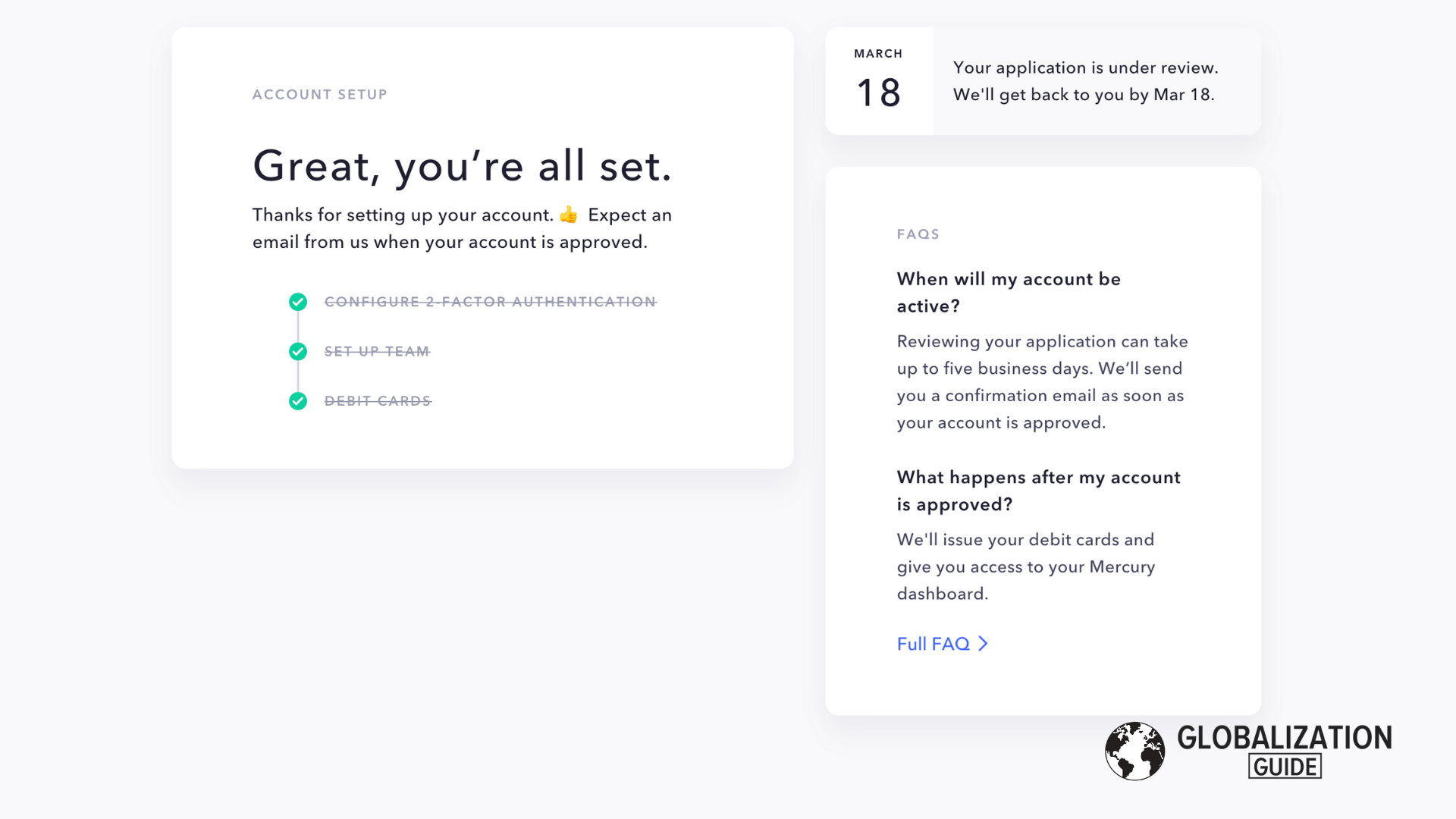

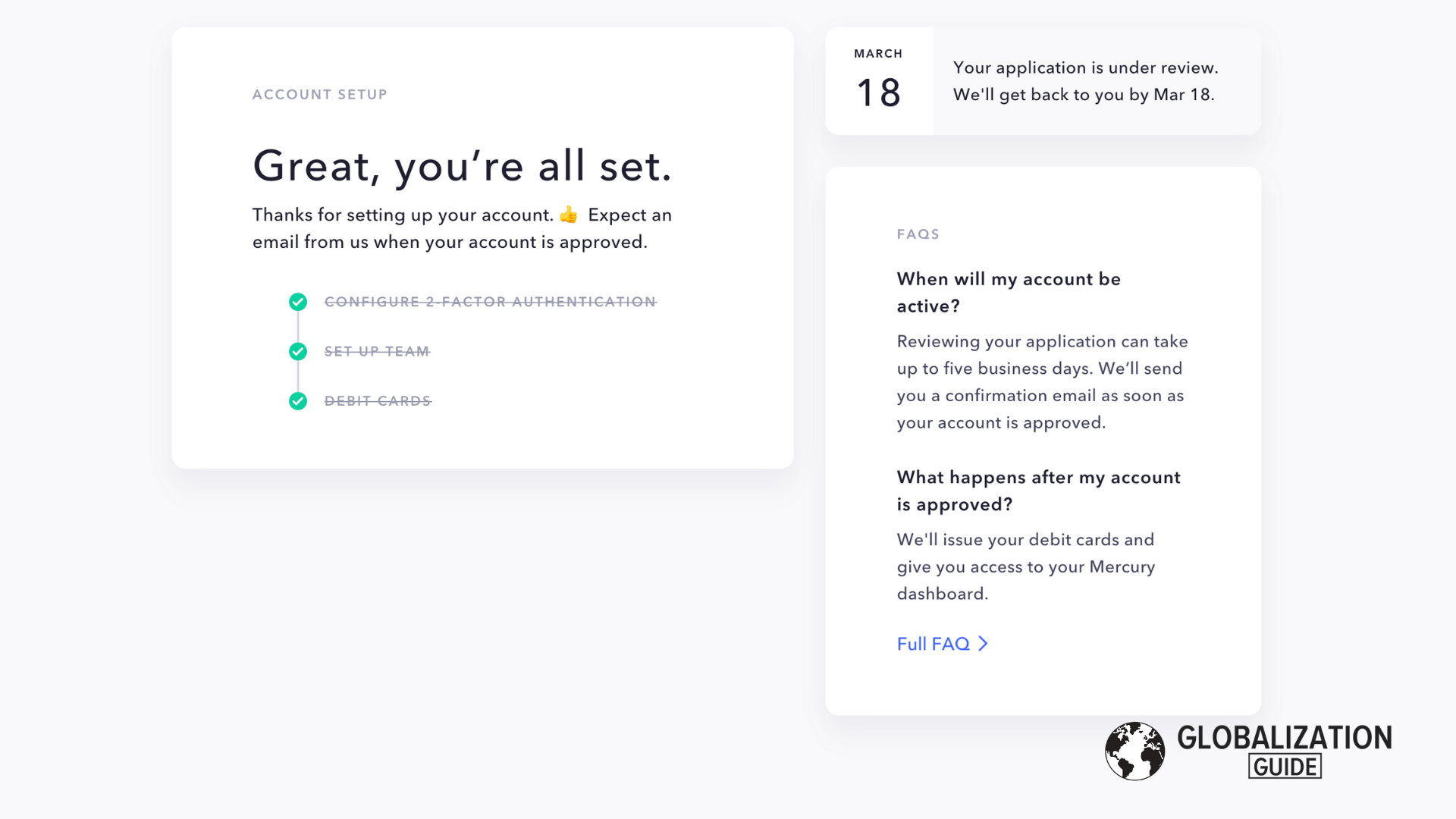

After all your company’s information and documents were submitted, the review process will start and you will hear from Mercury bank in a couple of hours, a maximum of a couple of days.

Mercury is a modern bank built with the requirements and expectations of digital companies in mind. Accounts can be opened completely online, and registration is possible even for non-US residents. The main strengths of Mercury are in its elegant and user-friendly design and interface, a low and straightforward fee structure, the option for multiple physical as well as up to 50 virtual debit cards, sub- and savings accounts, and solid user management.

I have been using Mercury at Globalization Guide from the beginning, and while we also have accounts at a number of other banks, so far this is the primary account we use.

Review of Mercury Bank

-

Sign-Up Process – 7/107/10

-

Design & Usability – 10/1010/10

-

Costs & Fees – 10/1010/10

-

Features – 9/109/10

Summary

Modern FDIC-insured bank that supports US LLCs owned by Non-Residents.

Pros

- No SSN required, non-resident friendly

- Modern interface with a multitude of features

- Multiple physical Mastercards + virtual debit cards possible

Cons

- Officially only supports businesses with US operations or clients

What is Mercury?

Mercury was founded in April 2019 by Immad Akhund, Max Tagher, and Jason Zhang. In Roman mythology, Mercury was the god of financial gain & commerce (among other things).

“As an entrepreneur, I felt the pain of dealing with incumbent banks. I was very frustrated with the lack of basics like transparency in customer service, and also felt like they didn’t launch any new tools to progress. Those are the main inspirations. I wanted to fix something for myself. I like entrepreneurs a lot, and I was excited about making something that would be helpful to others like myself”.

Immad Akhund for hackernoon.com

Mercury has attracted an impressive portfolio of venture capital backing, among them Andreessen Horowitz and Naval Ravikant.

It is built on the banking platform of SynapseFi, which is why you will find a lot of similarities in terms of features with RelayFi, which uses the same platform.

What Makes Mercury a Great Banking Solution

In the following section, I am going to list and explain all of the areas where I think Mercury really is ahead of most traditional banks in America.

FDIC-insured business checking account with up to 14 sub accounts

You will receive an FDIC-insured business checking account (provided by Evolve Bank & Trust) when you sign-up for Mercury.

Per default, you will also receive a standardized savings accounts, that allows six outgoing transactions per month.

You can also have up to 14 sub-accounts, each with its own individual account information. The platform makes it very easy to create new accounts.

Modern & User-Friendly Interface

I personally find the usability of any service, software or product that I use very important, if I want to keep enjoying using it.

Traditional banks are not known for having a great user experience. And from what I have seen so far, American banks are in this regard even worse than the European banks.

So I was quite happy to see, that banking solutions like this exist in the US as well.

Mercury has an overall excellent user interface. It looks and feels modern, and the user experience is lightyears better than for example at Bank of America. If you like the way Stripe looks and feels, you will feel right at home when using Mercury.

There is also a native iOS app, which allows you to quickly access your financial information on your phone. Not all of the management features can be accessed this way however.

There is full support for two-factor authentification via standardized authenticator apps.

Excellent Payment Card Features

When it comes to its payment cards feature, Mercury supports really every important category a flexible business needs.

- A physical Mastercard for each user

- Up to 50 virtual debit cards

- Solid individual card control features

Physical Mastercard

You can request a physical Mastercard for each enrolled user on the account, right after signup.

The card supports Apple Pay and wireless payments.

There are no international transaction fees.

The debit card can be used at ATMs (also internationally). Mercury doesn’t charge any fees on top of the ATM operator charges. In the US it is part of the Allpoint network.

Virtual Debit Cards

It takes just a few clicks to issue a new virtual debit card from within the web app. Each card is assigned to a specific user and a specific sub-account. Cards are usually ready to go within a minute.

Up to 50 of such cards are currently supported. A really useful feature, if you want to use certain cards for certain services, and track individual spending for each card.

Card Controls

Account administrators can individually control each card.

Each card is assigned to a specific user, as well as to a specific sub account.

You can turn on or turn off (freeze/unfreeze) each card with a simple switch.

All cards can be canceled by the user, and all carts support a daily transaction limit.

You can also set a new PIN for your physical debit cards through the web interface.

Online Check Deposits

Mercury supports both sending and depositing checks, without having to ever physically visit a bank.

You can send checks for free through your dashboard, by going through the Send Money flow.

You can deposit checks by using the Mercury iOS app. Just endorse the check, then take a picture of the front and the back and upload it through the app. Most checks get verified and credited to your account within 1-3 days.

Security and Teams

The platform makes it very easy to manage users. Your account can have multiple team members with two different permission levels: Administrator or bookkeeper. You can also define custom roles.

Excellent, if you want to give regulated access to employees, business partners, and contractors.

There is required 2-factor-authentification, which supports standard authenticator apps like Google Authenticator, Authy or 1Password. The databases are encrypted, the passwords hashed and HTTPS/HST required on all pages.

Simple and Straightforward Pricing Structure

Mercury has a simple and straightforward pricing structure.

Even without any minimum balance, the account is free to sign-up and there are no monthly fees. There are also no overdraft fees or other hidden fees.

All incoming transactions are free, that includes international wires.

Outgoing ACH transfers are also free.

Domestic wires are charged at $5, and international wires cost $20 per wire.

Accounts with over 250k$ in deposits become members of the Tea Room, and will receive free domestic wires as well as other partner rewards.

Software Integrations

Mercury comes with native integrations for the two biggest bookkeeping software solutions out there: Xero and Quickbooks.

Through the use of Plaid, it will also integrate with a large number of other services, for example, Wave Accounting (which is what we currently use and recommend often).

How You Can Open Your Mercury Account

I have applied for and received accounts at Mercury for many of my clients. In the following section I am going to share what I have seen so far.

Eligibility

The service works exclusively with U.S. businesses. If you do not already have your US business registered, you can read my guide on how to open your US LLC.

Mercury proudly has this quote on their website:

[…], we’re proud to support U.S. companies founded by people all across the globe. You can open your account right from your laptop without needing to visit the U.S.

While this is the case, I have seen companies getting denied, in cases where:

- The owner is not a US resident

- The business is not serving US clients

If your business does not currently serve US clients, I would make sure that you at least create that appearance during the sign-up process. If you need help creating a compliant website, send an email to [email protected], and we can help you.

Money service businesses or companies involved with adult entertainment, marijuana or internet gambling are not supported.

LLCs with owners that live in countries on the US embargo list are also prevented from opening accounts. Currently, those countries are Belarus, Burundi, Central African Republic, Cuba, the Democratic Republic of the Congo, Iran, Iraq, Lebanon, Libya, Nicaragua, North Korea, Somalia, South Sudan, Sudan, Syria, Ukraine, Venezuela, Yemen, and Zimbabwe.

Verification Process

You will need to following information and documents.

- EIN verification letter.

- Company formation documents

- Company contract and contact details.

- Social Security Number (Not needed for foreigners)

- Government ID.

- Filling the company profile on Mercury bank website.

First, you click on “Open account” at Mercury’s website. Then you fill the form with simple requirements. You’ll receive an email verification request.

Once the email address is verified, you can proceed to add your LLC’s information and indicate your role.

The system will generate a suggested “callsign”, you can modify this if needed.

Here comes the detailed information section. Carefully, add the information as in the documents of your LLC.

If you are the only member of the LLC, your info goes here. If the LLC has more than one member, enter the information of each person.

Submitt the mailing address from Anytimemailbox, which is the same in the LLC’s Formation Document.

Look for the “Articles of Organization” document. The “Certificate of Good Standing” works for this too. Upload one of these documents.

As the last requirement, you will need to present a document that verifys your EIN.

After all your company’s information and documents were submitted, the review process will start and you will hear from Mercury bank in a couple of hours, a maximum of a couple of days.

Hello,

You wrote:

LLCs with owners that live in countries on the US embargo list are also prevented from opening accounts. Currently, those countries are ……Ukraine……

The US embargo does not apply to the entire country, but only to its region. The Crimea exactly. The proble is that all companies ignore it. They just reject application as soon as they see the Ukraine as country of residence. Can you help to open Mercury account considering this fact? I don’t know how to get through this wall. And of course it’s not fair when US uses embargo to protect democracy and as the result blocks the whole country!

Hello Kyryll.

While this might put you in an unfortunate position, I am not sure that at this moment anything can be done. The penalties for financial institutions that go against the embargo are quite steep, so of course everybody just plays it safe. Unfortunately this will most likely leave you hanging.

Depending on how you want to use your LLC, you could open an account in a European country, for example with Paysera.

Thank you for reply. As I know, the Paysera doesn’t support USD as a currency. Can you please provide any solution to get online business account with

1. USD and US bank details with get and send options

2. Stripe support

3. Online filling without personal visit.

I’m looking for solution last year but still at the same point.

I have written this article, that covers all banking options available in the US to non-residents.

https://globalisationguide.org/usa/llc-non-resident/open-bank-account/

Hello,

I wrote by mistake that the company doesn’t have activity in the US and I got rejected. It is misunderstanding because our end users are normally out side of the US but our clients are from US as well.

Is there a way I can try to explain Mercury about that misunderstanding and convince them to reconsider their decision?

Thank you

Elie

You could present them with proof that of your US clients. Invoices for example would be my first go to approach to show US clients.

Hello thank you for the article

I have a question: Do we have to use VPN/Proxy when creating an account in mercury?

Generally that won’t be required with Mercury.

Hi I can us outside usa ?

Hi Mahmoud.

Yes, you can be located outside of the US. However your business needs to have a US focus, in order to be approved by Mercury. Either targeting US customers, or having some form of US operation.

hi

do you know alternative for mercury that accept payments from adult affiliates companies ?

i have checked brex but it’s not clear if they are against or not

Hi Adam,

I don’t know of a bank that will open accounts remotely that explicitly allows that kind of business. I would read the terms of service of both Mercury and Brex closely, they should tell you.

hi chris

i have been told that relayfi,mercury ,revoult,wise wont open for this business . i have sent brex my application aswell e-mailed their sales department but no response in 5 days . their TOS say restricted business and may be accepted in certain circumstances . actually i was excited about brex but some reviews complain from immediate account closures .

Hi Kyryll,

did you find a solution?