Review of Levro Bank: Multi-Currency Banking for Global Startups

Though it’s a relative newcomer to the startup banking scene, Levro stands out as a neobank with a truly global perspective on business banking. Levro’s multi-currency account holds more than 34 currencies, all of which can be sent, received, and exchanged at rates that rival those of the best standalone FX providers. Low fees and fast payments rank among Levro’s main strengths, but the platform also offers a few other global banking features that help it to stand out.

I received a code to try out Levro’s invite-only international banking platform, and I came away impressed. Some of the tools and features are still being tinkered with, but I can already recommend Levro as a great option for businesses that manage multiple currencies and teams based in far-flung locations across the globe.

Business clients—including non-US residents and foreign-owned US LLCs—can open a Levro account completely online after signing up and securing an invite code. Let’s take a look at some of the pros and cons so you can decide if Levro is right for you.

Review of Levro Bank

-

Sign-Up Process – 10/1010/10

-

Design & Usability – 10/1010/10

-

Costs & Fees – 10/1010/10

-

Features – 10/1010/10

Summary

A multi-currency bank account with a modern interface, FDIC insurance, and features that should appeal to global startups.

Pros

- Multi-currency account with 34+ currencies

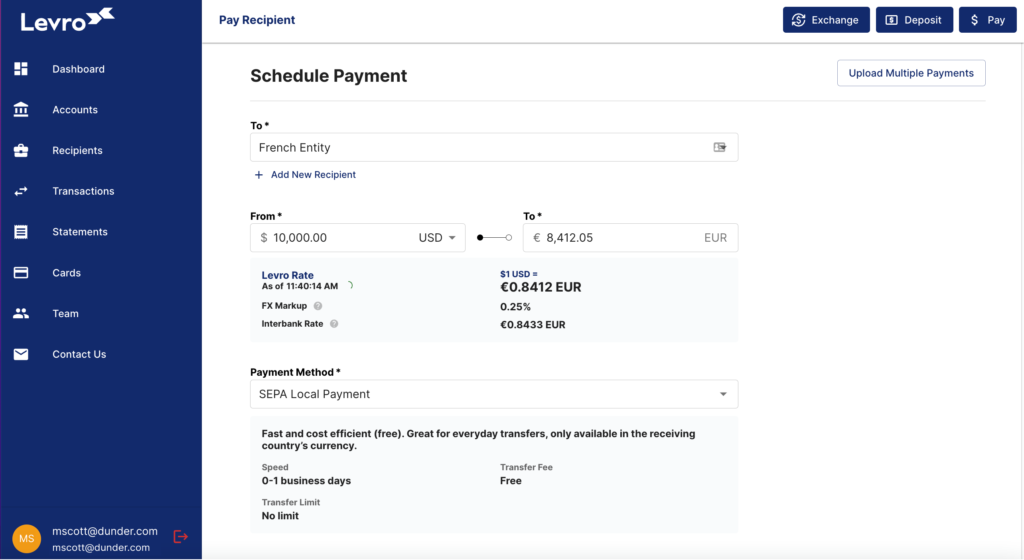

- Low 0.25% FX fees and same-day payments for money sent via wire

- Non-US resident friendly, with no SSN required

- Unlimited physical and virtual Visa cards

Cons

- Currently only available with an invite code

- Some features, like currency-cost averaging, still need to be perfected

- Only supports businesses with US entity

Table of Contents

What Is Levro?

Levro is a neobank that focuses on helping companies expand their business overseas. Founded in 2021 by two international founders, the company’s signature offering is a multi-currency bank account that can hold more than 34 currencies.

Clients can send or receive these currencies from more than 80 countries, making Levro a great option for businesses with globally distributed teams or customers and suppliers around the world.

What Makes Levro a Great Banking Solution for Global Startups

One Account for Dozens of Global Currencies

Whether they start their operations in the US or in another country, companies that expand internationally usually face a moment of truth. This is when the complexity of paying vendors, contractors, and team members in different currencies becomes too much, and the logistics of making timely local payments threaten to overwhelm day-to-day operations.

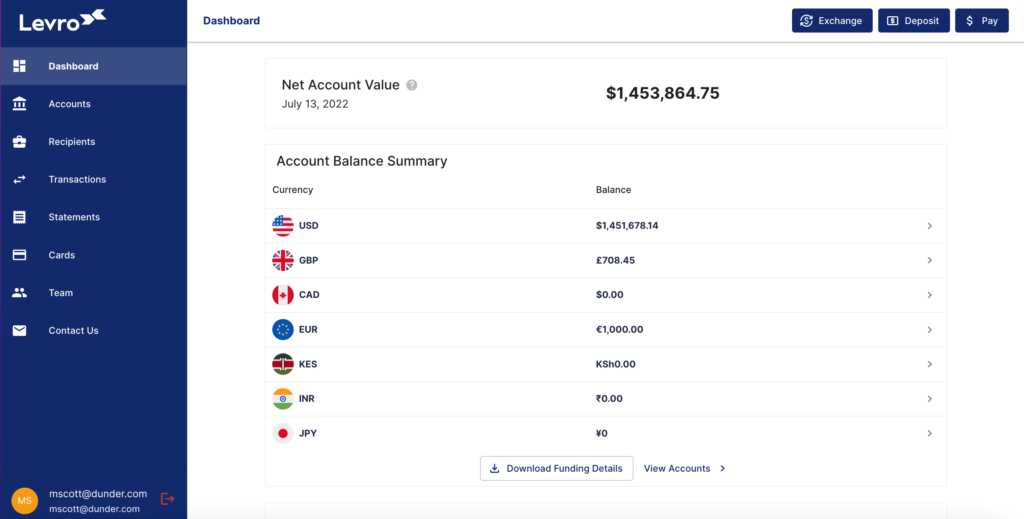

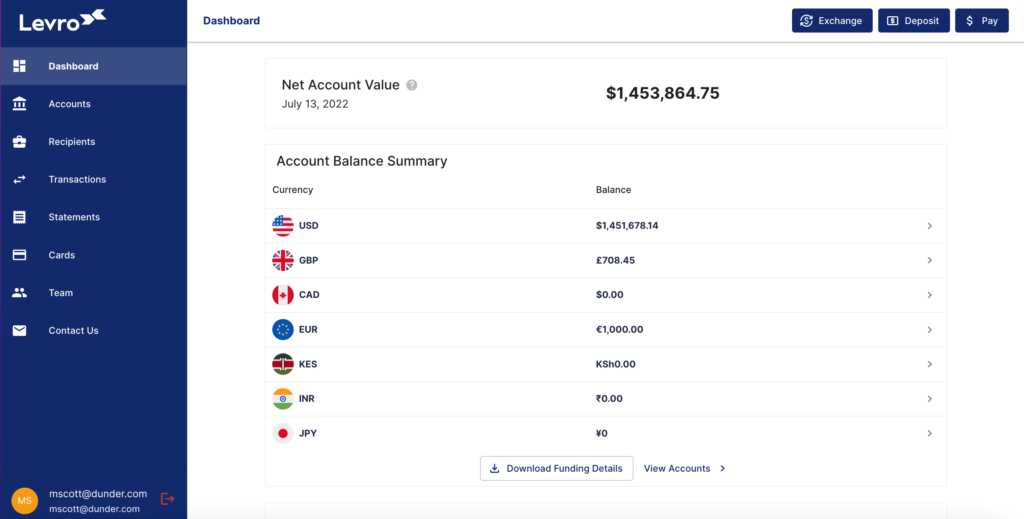

Levro solves this issue with its multi-currency account, which makes it easy to send international and domestic payments from a single interface. You can view your balance in every currency from the platform’s main dashboard. And all of these balances are added up to a single net account value, helpfully converted to USD.

From a secondary “Accounts” dashboard, you can create new currency accounts when they expand into new areas of business. It’s all quite easy to navigate, though Levro does a good job of balancing simplicity with all the information you might need to send or receive payments.

FDIC-Insured USD Accounts and Multi-Currency Accounts with Tier 1 Providers

It’s probably important to mention that Levro itself is not a bank. But in terms of services and security, you shouldn’t be able to tell the difference. Levro partners with Blue Ridge Bank and Community Federal Savings Bank to offer an FDIC-insured USD checking account for any business that signs up for the platform.

Crucial information about the account—such as any details you’ll need to complete a SWIFT or ACH transfers—is available from the main dashboard or Accounts page.

Low Fees and Competitive Currency Exchange Rates

High fees and unfavorable exchange rates can really eat away at your business margins, especially if you’re transferring money between currencies on a regular basis.

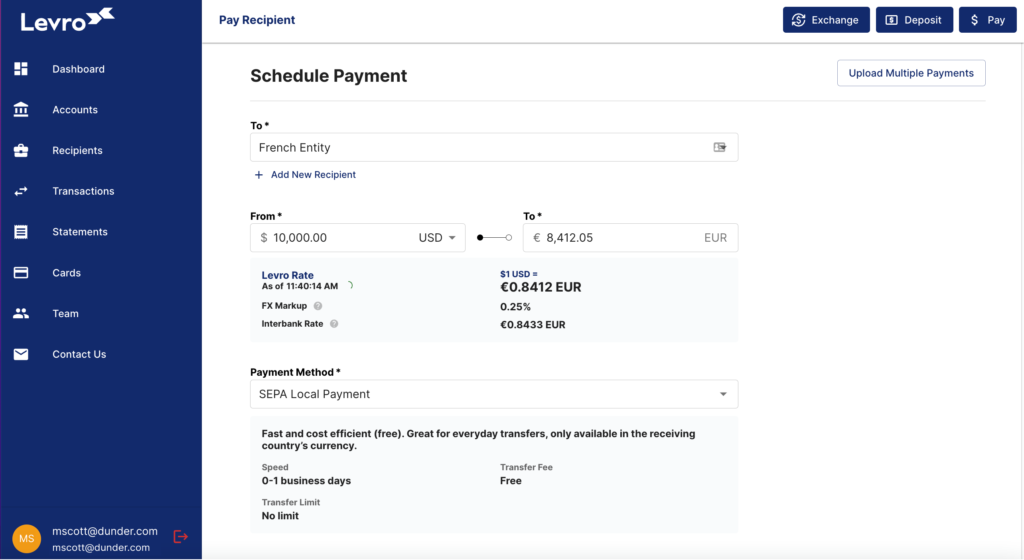

Fortunately, it’s not too expensive to move money between accounts with Levro. You’ll pay a flat 0.25% FX markup on every transfer, which beats the 1–2% charged by many traditional banks.

Maybe even more importantly, Levro charges this markup on the interbank rate, which is the rate banks use when they transfer money back and forth. As a general rule of thumb, the close your rate is to the interbank rate, the better. Levro’s rate for everyday transactions is up there with the best I’ve seen, even after the 0.25% markup.

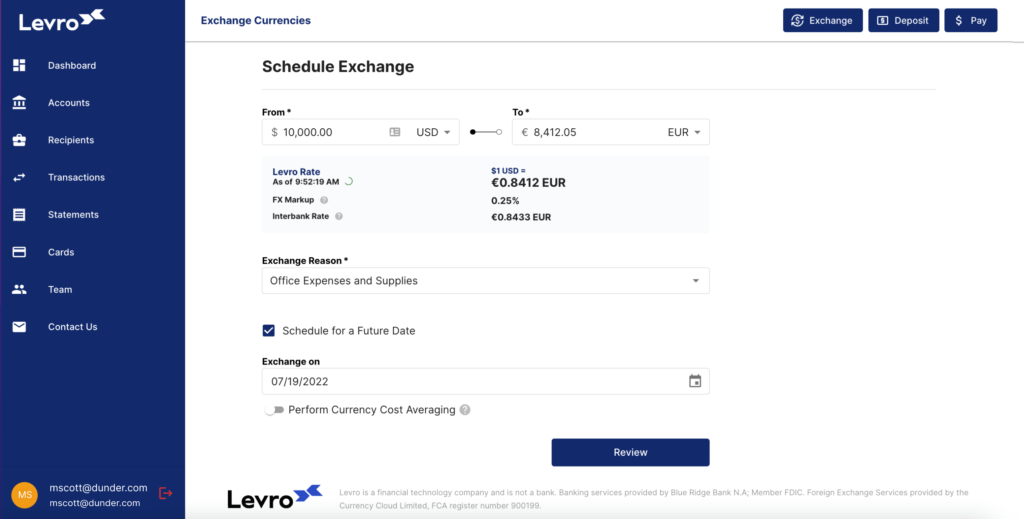

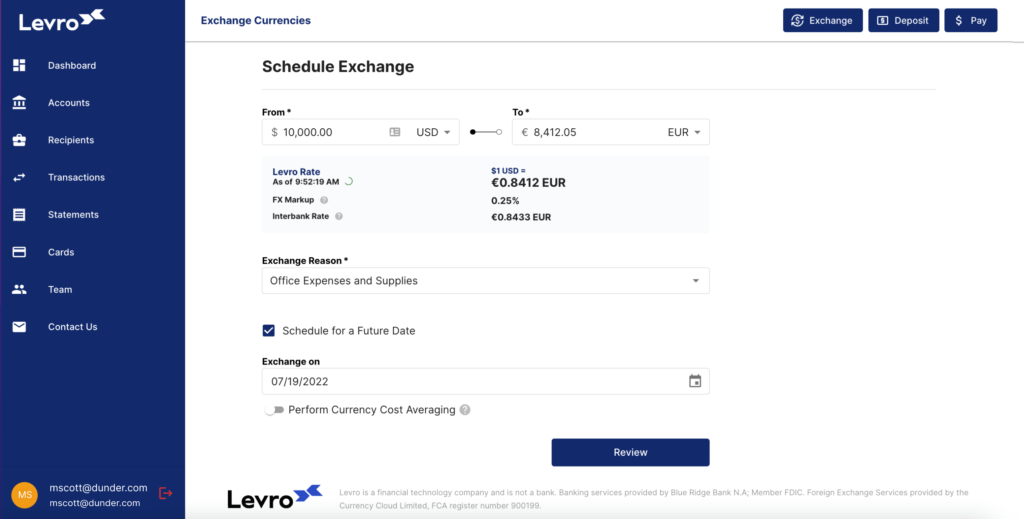

Currency-Cost Averaging

As of today, it’s still a pretty basic feature without much customization available within the dashboard. But it shows that Levro is thinking about ways it can help global startups save money.

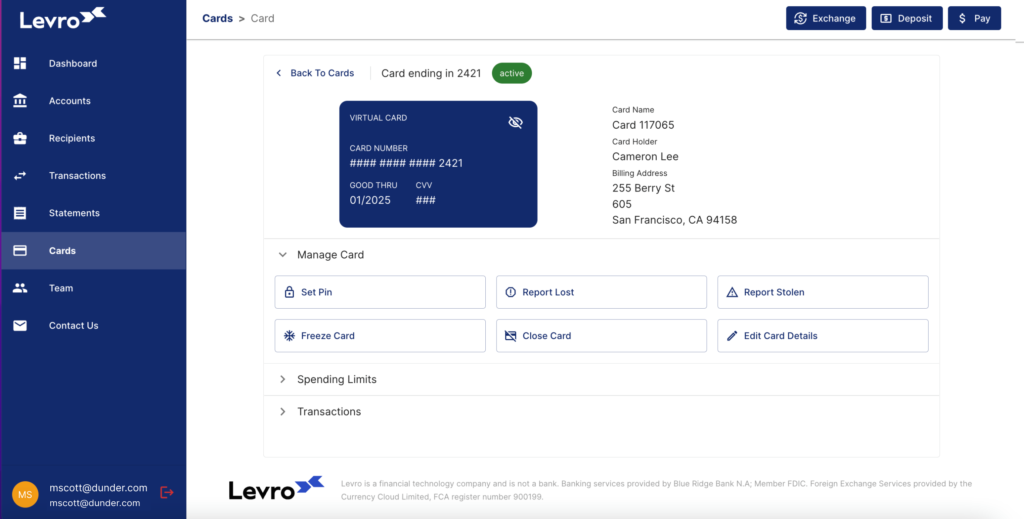

Flexible and Secure Debit Card Features

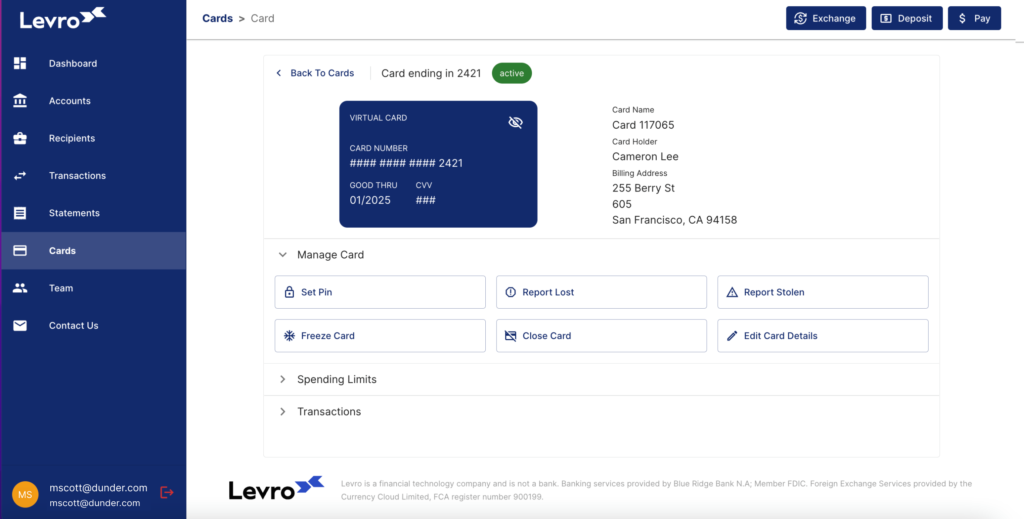

In terms of payment cards, Levro supports everything an international business might need. Let’s take a look at the specifics.

Unlimited Physical and Virtual Cards

You’ll need to provide a 6-digit confirmation code sent to your phone number when adding new card numbers, but otherwise it’s easy enough to do from the “Cards” section of the platform.

Customizable Card Controls

No Annual Fees or Foreign Transaction Fees

You also won’t have to pay any transaction fees on foreign transactions. We’d expect this from a company that’s focused on global startups, but it’s nice to see regardless.

Account Security and Access Controls

- Regular penetration testing to identify and fix vulnerabilities

- Encryption of all data, whether in transit or at rest

- Multi-factor authentication for account logins

- Customizable access permissions, with admin approval required for certain transactions

- Email alerts and notifications to help you stay on top of payments and approvals

Compliance and Accounting Integrations

How to Open a US Business Bank Account with Levro

Now that I’ve run through some of the major highlights, I’ll walk through what it’s like to actually open a bank account with Levro.

Eligibility

Once you have an invite code in hand, the application process is pretty straightforward. One thing to note is that Levro does require you to have a US business registered. If you don’t know how to do this, check out my guide on how to open a US LLC as a non-resident.

Other documents you may need to have on hand (for yourself as well as for any beneficial owners of your business) include:

- ID verification. Accepted documents include a driver’s license or passport.

- EIN verification. This should be via a letter issued by the IRS.

- Address verification. This can be via a bill with your address clearly listed on it.