In this article I am going to cover the new reporting requirements for US LLCs owned by non-residents that were introduced for the 2017 tax year going forward.

Chris started Globalization Guide to help entrepreneurs like himself to master the challenge of international business and living abroad. Since then he has helped hundreds of clients with their international structuring.

Who Must File Form 5472?

Since almost any movement of money between the LLC and its foreign member is considered a reportable transaction, this includes pretty much all single-member LLCs that are actively being used.

When, Where and How to File Form 5472

How to File

Disregarded entities need to file Form 5472 together with a pro-forma Form 1120, that is otherwise only used for US corporations. On the pro-forma Form 1120, only basic information like name, address, and EIN need to be completed.

When to File

The deadline is on April 15th every year. It’s identical to the deadline for filing form 1120 as it applies to US corporations. An extension until October 15th can be requested, and is generally granted without questions.

Where to File

The completed documents can be faxed at a resolution of 300 DPI or higher to the following number: +1 855-887-7737 (Last updated: June 2020)

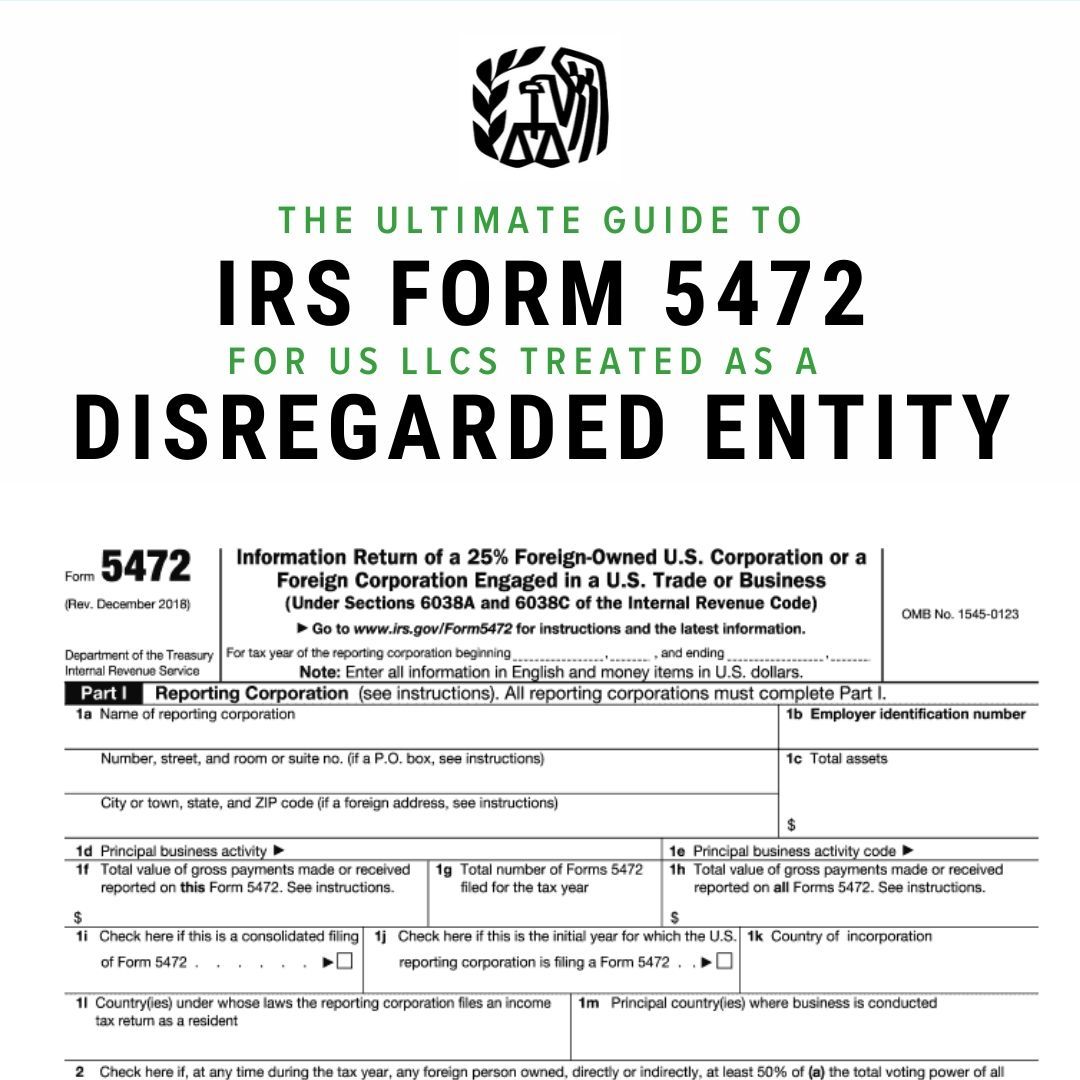

This Is How Form 5472 is Structured

The document is divided into a total of eight different parts, that all deal with different areas of the information return. In the following, I’m going to show what kind of information needs to be provided in each part.

Note: I am showing the general outline, if you need help filling the Form you should take a look at the detailed IRS Instructions.

Part I – Reporting Corporation

Part I is for getting the foundational information of the reporting entity.

This includes:

- Name of the reporting corporation

- Full address

- Employer identification number

- Total assets (at the end of the reporting year)

- Principal business activity + Principal business activity code

- Country of incorporation

- Country where the reporting corporation files an income tax return

- Principal countries where business is conducted

Part II – 25% Foreign Shareholder

The second part deals with the 25% foreign shareholder of the LLC. This could be both a natural person, as well as an entity.

Both direct 25% foreign shareholders, as well as ultimate indirect 25% foreign shareholder need to be disclosed.

The information they need to provide:

- Name and address

- U.S. identifying number (ITIN or SSN)

- Foreign taxpayer identification number

- Country of citizenship (natural person) or incorporation (entity)

- Country where the 25% foreign shareholder files an income tax return as a resident

Part III – Related Party

Part III deals with the ‘Related Party’. In the majority of foreign-owned U.S. DEs, this will be the natural person, single member of the LLC.

Requested information:

- Name and address of related party

- U.S. identifying number

- Foreign taxpayer identification number

- Principal business activity + Principal business activity code

- Relationship to reporting corporation (Related to reporting corporation, related to 25% foreign shareholder or 25% foreign shareholder)

- Principal countries where business is conducted

- Country(ies) under whose laws the related party files an income tax return as a resident

Part IV – Monetary Transactions

Part V – Reportable Transactions of Foreign-Owned U.S DE

For the vast majority of LLCs affected by the new reporting requirements, the transactions that are deemed reportable will happen in this section of the Form.

These transactions include amounts paid or received in connection with the formation, dissolution, acquisition, and disposition of the entity, including contributions to and distributions from the entity.

The different kind of payments should be separated and described in an attached statement.

Part IV – Nonmonetary and Less-Than-Full Consideration Transactions

Mostly left empty. Your CPA will know.

Part VII – Additional Information

Mostly left empty. Your CPA will know.

Need help to file Form 5472?

We can help you keep your company compliance

Frequently Asked Questions

In the following section, I will answer some commonly asked questions.

I just opened my LLC in December, and have not done any businesses yet, do I still have to file Form 5472?

The answer is most likely yes. You probably paid to set up the company from your personal bank account. In the eyes of the IRS, the cost for the formation of the company is already a reportable transaction. Therefore, even if you have not done any business in the tax year, you do have to file Form 5472 until April 15th the following year.