This article is for non-resident, non-US citizens without a Social Security Number, who want to open either a personal account or a business checking account for their US-based business.

I am going to cover the available options in detail.

Reasons Foreigners want Bank Accounts in the US

There are many reasons why foreigners would want to own a US bank account.

Be it to make it easier to receive payments from US clients, to invest in the US stock market, or also just to keep some money in a foreign account.

The USA as a Banking Jurisdiction

Especially compared to other jurisdictions where international citizens would typically want to store money, the USA offers strong features for banking.

Among them are:

High Reputation & Low KYC Requirements

The USA enjoys the highest reputation as a banking jurisdiction. Payments coming from the US or going into the US will generally not get flagged. Receiving large payments from US accounts or sending large payments to US accounts is such a commonplace occurrence, that banks do not ask many questions. This makes it much easier to deal with thank banks in typical offshore jurisdictions like Panama, Georgia, Cyprus or others.

Simultaneously the US makes it quite for non-residents to open accounts, something that has become harder and harder around the world.

No Automatic Exchange of Information

in 2014 the Organization for Economic Co-Operation and Development (OECD) created the Common Reporting Standard (CRS) as an information standard for the Automatic Exchange of Information, with the purpose of combating tax evasion.

Since then most G20, as well as most traditional offshore jurisdictions, are exchanging information according to this standard. This is the information that is being shared:

- Name

- Address

- Date of birth

- Place of birth

- Country/countries of tax residence

- Tax Identification Number

- Account details

- The total account balance/value of your accounts calculated at the end of the calendar year, including any interest (excluding the balance of any excluded accounts)

As of 2020, the USA is the only first-world country that has not yet ratified this treaty, with no immediate plans to do so. There is no automatic exchange of financial information with any foreign government or non-governmental organization.

You could say that this makes the USA the last remaining banking privacy haven in the world.

Deposit Insurance

Unlike the majority of offshore jurisdictions, the USA has a robust deposit insurance scheme. The FDIC (Federal Deposit Insurance Corporation) provides deposit insurance to depositors in U.S. depository institutions.

Almost all banks are part of this scheme. The insurance covers checking accounts, savings accounts, bank money market accounts as well as certificates of deposit. Up to $250.000 per qualified accounts are insured.

While in the case of a global collapse this probably would not help much, at least it protects your money in the case of a individual bank failure.

Personal Checking Account

Open Personal Account Online

As of the last update of this article (September 2020) there are no retail banks that will remotely open personal bank accounts in the US for non-residents without a SSN. The reason are the enhanced know-your-customer requirements demanded by the US patriot act.

There are three (potential) solutions:

Zenus Bank

Zenus Bank is marketing itself to be the first US bank for global citizens. They want to make it possible to open a multi-currency account remotely. The project has been going on for a while however and the launch date has been postponed multiple times. They are now targeting a date in early 2021.

Click here –> to join the waitlist.

Wise (aka Transferwise)

Wise will give you US banking details if you register as a resident of one of the following countries:

- All EEA countries (excluding Cyprus)

- American Samoa

- Andorra

- Anguilla

- Antarctica

- Armenia

- Aruba

- Australia

- Bahamas

- Barbados

- Benin

- Bermuda

- Bhutan

- Brazil

- The British Virgin Islands

- Brunei

- Canada

- Chile

- China

- Christmas Island

- Cocos (Keeling) Islands

- Cook Islands

- Costa Rica

- Dominica

- Dominican Republic

- Faroe Islands

- Fij

- French Guiana

- French Polynesia

- French Southern Territories

- Georgia

- Greece

- Greenland

- Grenada

- Guadeloupe

- Guernsey

- Guyana

- Haiti

- Holy See (Vatican City)

- Indonesia

- Ireland

- Isle of Man

- Israel

- Jamaica

- Maldives

- Marshall Islands

- Martinique

- Mayotte

- Micronesia

- Monaco

- Mongolia

- Montenegro

- Montserrat

- Morocco

- Nauru

- Nepal

- New Caledonia

- New Zealand

- Niue

- Norfolk Island

- Palau

- Paraguay

- Peru

- Philippines

- Pitcairn

- Puerto Rico

- Réunion

- Saint Helena

- Saint Kitts and Nevis

- Saint Lucia

- Saint Pierre and Miquelon

- Saint Vincent and the Grenadines

- Saint-Barthélemy

- Saint-Martin (French)

- San Marino

- Sao Tome and Principe

- Seychelles

- Singapore

- South Georgia and the South Sandwich Islands

- South Korea

- Suriname

- Switzerland

- Taiwan

- Thailand

- Turks and Caicos Islands

- United Arab Emirates

- The United States*

- Uruguay

- Jersey

- Åland Islands

You will receive personal US banking details, the account is held at Community Federal Savings Bank in New York.

Wise has created a special incentified offer for our clients. If you use this link to sign up, you will get a first free transfer, that will allow you to send up to £10,000 (or $13,500 US) fee-free, saving you up to $60 in conversion fees.

Before opening an account, we recommend you to read the Wise Acceptable Use Policy.

Payoneer

Payoneer will also provide you with US banking details, and even a physical debit card. At least a share of their accounts are placed at First Century Bank, and directly in the name of the Payoneer account holder.

There is one significant limitation however:

Payments must be made from registered businesses only; payments from personal accounts or from company accounts you own will be declined.

Open Personal Checking Account while in the US

If you have the opportunity to travel to the US through ESTA or on a visa, then you should not have too many difficulties opening a personal account.

Some general considerations upfront:

Opening accounts is more of an art than a science. The requirements are often not clearly defined, and you will get different requirements from different employees at the same bank. And the end, it is always at the discretion of the bank or individual account manager.

You will increase your chances, if you

- Dress and look professional

- Have a plausible reason ready why you want to open the account

- Have your documents in order

- Stay persistent and prepared to visit multiple branches of the same bank. It’s not uncommon to get rejected.

The following banks are known to open accounts for non-residents without a SSN:

- Bank of America

- TD Bank (Florida)

- Citibank

- Chase

There are of course hundreds more smaller local banks that you can try.

You will generally require the following:

- Two forms of ID (passport, driver’s license or national ID card)

- Proof of address

- US phone number

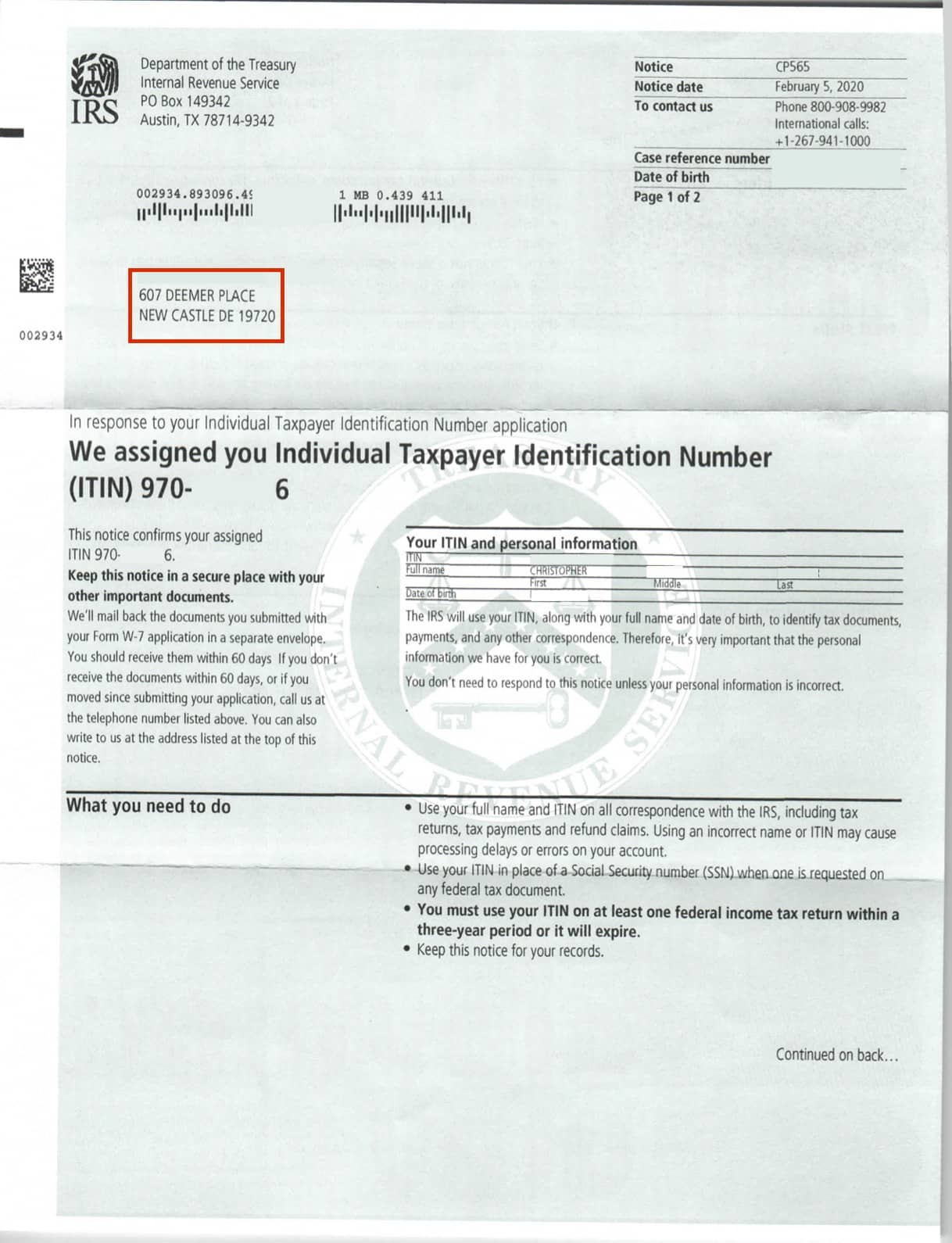

- ITIN (optional, but very helpful)

In some cases, the bank will accept a foreign proof of address. In other cases, they will ask for a US utility bill. Read below, how you can get such a document.

You should also have access to a US phone number.

Having an ITIN can make the process considerably easier.

Firstly, the address on your ITIN result can serve as your required proof of address. Secondly, with an ITIN the bank tends to no longer treat you as a non-resident.

Business Checking Accounts

Now let’s look at what it takes to open business accounts for your US LLC or C-Corp.

Open Business Account – Remotely / Online

As of August 2022, there are five banks or services that will allow you to remotely open accounts for your US LLC or C-Corp as a non-resident, without requiring a Social Security Number. For folks with an SSN, there are quite a number of additional services, which we won’t list here.

The four options are:

- LEVRO (Click to open review)

- Mercury

- Relay

- Payoneer

- Wise (aka Transferwise)

Here are some of the main features and characteristics of these services.

Levro

- FDIC-insured business checking account

- Physical and virtual corporate cards with cashback

- Works with Stripe: Yes

Mercury

- FIDC-insured business checking account

- Physical Mastercard

- Virtual Mastercards

- Works with Stripe: Yes

I generally recommend Mercury together with Relay as the first choice for US business banking.

Read our full review here, including the exact signup procedure.

Relay

- FIDC-insured business checking account

- Physical Mastercard

- Virtual Mastercards

- Works with Stripe: Yes

Payoneer

- FIDC-insured business checking account

- Physical Mastercard

- Works with Stripe: Mixed Results

Wise

- Business checking account

- Physical Mastercard (depends on residency)

In order to get US banking details, the owner of the company needs to fulfill the same residency requirements as for a personal Wise account.

If you do, Wise can even give you US banking details for your non-US business.

All four services have more or less the same KYC requirements.

You will need to provide the following documents:

- Articles of Organization (LLC) / Articles of Incorporation (C-Corp)

- Statement of the Organizer (LLC) / Statement of the Incorporator (C-Corp)

- Passport of each member or shareholder with more than 25% ownership

- Description of business model + supporting documentation (website etc.)

Open Business Account – On-Site

A visit to the US allows you to open accounts with the big American banks.

The three most popular options are:

- Bank of America (easiest)

- Chase

- Wells Fargo

There are also hundreds of smaller local banks that might be worth checking out.

In order to open a business checking account with a retail bank, an authorized signer has to personally visit a branch. The authorized signer would typically be the company owner. If you want someone else to serve as the authorized signer, you need to prepare a “Banking Resolution”.

Some banks require the authorized signer to be in possession of an SSN. That basically disqualifies non-residents without US contacts.

Aside from the standard company documents, you will also need a proof-of-address for a US address in your name.

There are two ways to tackle this requirement.

Having an ITIN

If you have an Individual Taxpayer Identification Number, you are good to go. Although it does not make a lot of sense to me, your ITIN result document can serve as a proof-of-address for the address on the same document.

Click here to order your ITIN through Globalization Guide.

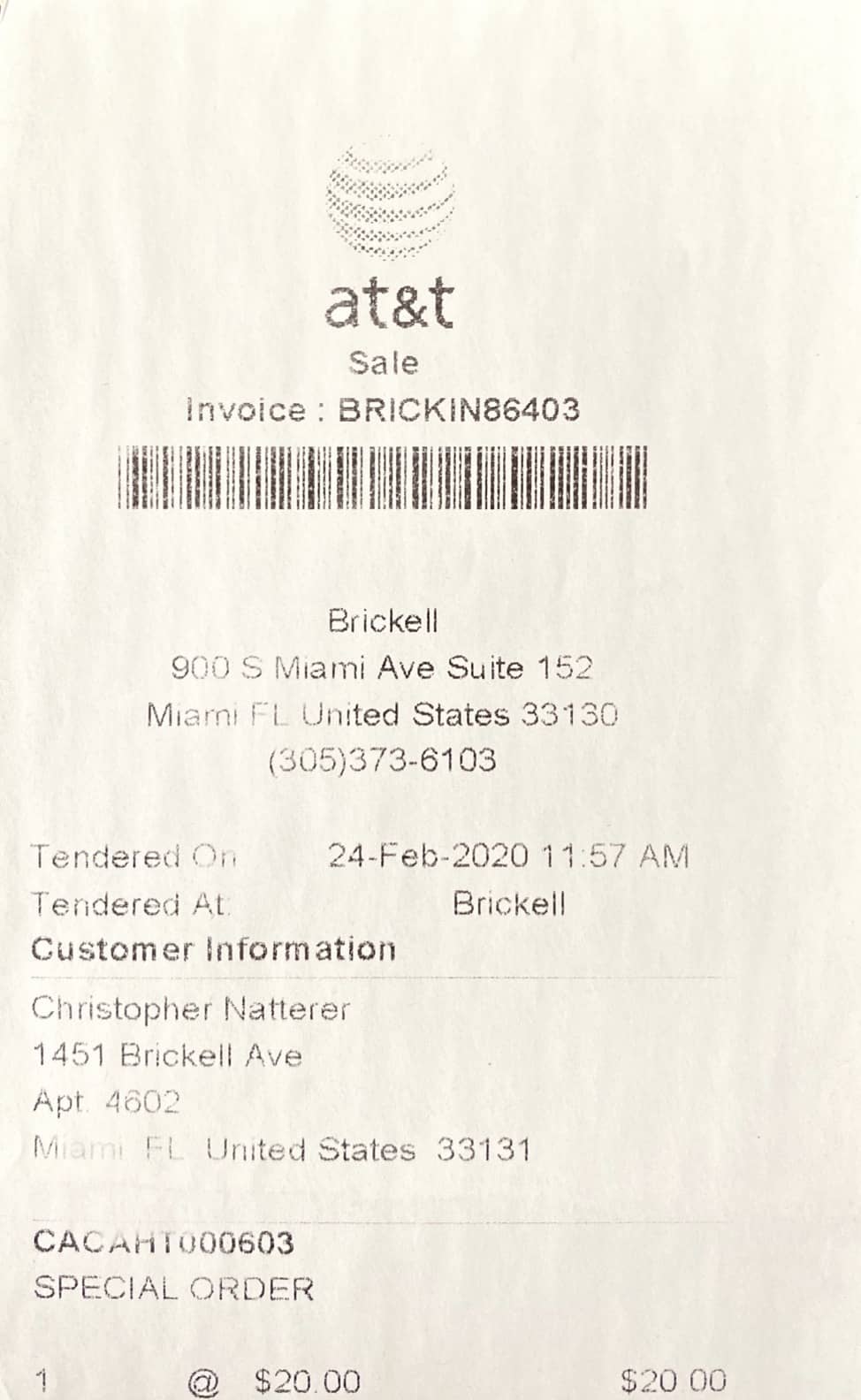

Hacking a Proof-of-Address via AT&T

There is a simple method to legally obtain a document, that US banks can accept as valid proof of address.

Banks like Bank of America will accept an invoice from a communications provider like AT&T (and maybe others like T-Mobile) as an utility bill/proof of address. Even if that invoice is for a prepaid mobile phone contract.

Go to a random AT&T store near your bank and ask for the cheapest prepaid plan they offer.

Fun anecdote:

When I did this myself in Miami in March 2020 (only weeks before the world shut down), the AT&T store owner immediately knew what I was trying to do. He asked me if I needed the invoice for the bank and when I said yes, he gave his employee instructions about how to print the invoice, and to cancel auto-renewal before even giving me the documents. Now that is service!

How to Open Accounts as a Non-Resident US Citizen With SSN

If you are a US citizen living abroad, or a former resident of the US with a Social Security Number, then opening a new US account online is a piece of cake.

There are dozens of modern options available.

Summary

As you can see there are many options available for non-residents to get banking in the US. Especially by setting up a US LLC, it is almost always possible to receive a fully functional US checking account.

Please share this article if it was useful!

Frequently Asked Questions

Can a Foreigner Open a Bank Account in the US?

Yes, foreigners can open bank accounts in the US. Some options are available for foreigners visiting the US as a tourist, others can be opened even completely online without having to be in the US.

Can I Open an Account in the US as a Tourist?

Yes, it is absolutely possible to open a personal account in the US as a tourist

Dear Chris,

Thank you so much for your wonderful video and useful info on bank account opening,etc.

I am a non-us resident and keen to open a bank account in US, remotely. I have lived in US before doing my post-graduate there and did have a SSN. The SSN Card is given more than 20 years ago. Is that still valid and can I use this for bank account opening?

Thanks

Soon

Hi Soon.

You should still be able to use that card for the purpose of opening bank accounts.

Thank you very much Chris.

Would you please name a few banks that open online checking account with a SSN but no US address?

Thanks so much for all your tips.

Best!

You will need a US address as well as a US phone number for all banks. You can use virtual address services.

My non-profit organization is based in the US. I need a bank account for that. Please specify a bank account other than mercury, transferwise, payoneer.

The only other bank that opens accounts remotely is Relay (relayfi.com) – but they are currently invite only.

Hi

I am living in London and i want to open business bank Account in us can u plz guide me what I have to do for non residents business bank account

You first have to open a US business entity, either an LLC or a C-Corp. Send an email to [email protected] and we can help you with that.

Dear Chris,

I lived and worked in the USA during the period 1999 – 2004 (legally via H1B). I have since returned to my home country and have lost my SSN details. My SSN was issued in Milwaukee, WI and my driver’s license in Arlington, IL. However, I have lost those documents and can’t remember the SSN. Is it possible to retrieve such?

Hi Rodney.

I would assume that it is possible, but that’ is outside my expertise. I would recommend to call the IRS.

Hello, can you tell me one thing. How much amount is must deposit as security (refundable) for open an account in Chase bank for non US citizen ( citizen of UAE).

Hi Chris,

What do you do if the bank asks you about your AT&T bill and if it is prepaid? What did your bank told you when you went there?

Thanks

Hi, Can I use a Verizon utility bill?

Hi Cay,

a utility bill from Verizon should work the same way as one from AT&T.

Hi,

I’m noticing blogs that express that non-residents can open but really don’t advise which ones or which one you’ve been successful at … That would be useful and an effective blog.

Not quite sure what you mean. The banks listed on this page are pretty much all of the available options. They are put in order, from the most to the least recommended option. I have accounts at all of those banks – as a non-resident.

Hi Chris Natterer,

If i have ITIN or own C-Corp of USA can i open personal bank usa account with my name is Nguyen Tu Quang? ( not name company) thanks.

Hi Nguyen.

An ITIN or a C-Corp will not really help you to open a personal US bank account. Only US residents with a SSN can open personal accounts online.