Most of the foreign entrepreneurs choose the impressive low tax jurisdiction in Cyprus which is under the non-domicile status. Cyprus, an EU state member country, is an attractive tax destination for both high net worth individuals and companies. They use it as a place for their business transactions and for family relocation.

[toc]

The new 60 days or the previous 183 days rule allows any nationality to apply for the Non-Dom Tax Residency. It is a requirement for the Cyprus tax resident to pay taxes in Cyprus on his or her worldwide income under the said rule.

⭐️ Almost complete tax-freedom inside the EU

⭐️ Option to avoid the exit taxation of Germany, France etc.

⭐️ Access to social security and health care

Cyprus: The country

To benefit from Cyprus’ non-dom program as it stands today, you will have to spend at least two months on the island each year you want to be considered a tax resident. So let’s give you a little overview of this island in the Mediterranean, and what life here could look like.

Or skip this, and go straight to the Non-Dom Regime.

Cyprus fact sheet

- Language: English is widely spoken, Greek, Turkish

- Climate: 300+ days of sun per year

- Currency: €

- Rule of law: Moderate

- Political stability: Stable

- Corruption: Low to medium

Geographic location: Gateway to the Middle East

Cyprus has a strategic geographic location in the middle of three continents. Europe, Asia, and Africa. It’s the third biggest island in the Mediterranean, after Sicily and Sardinia (both 🇮🇹).

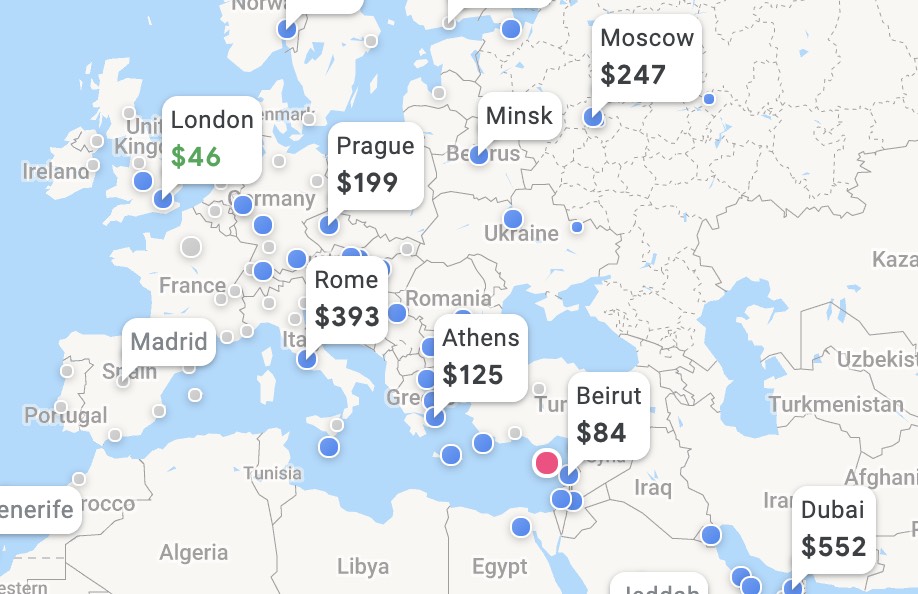

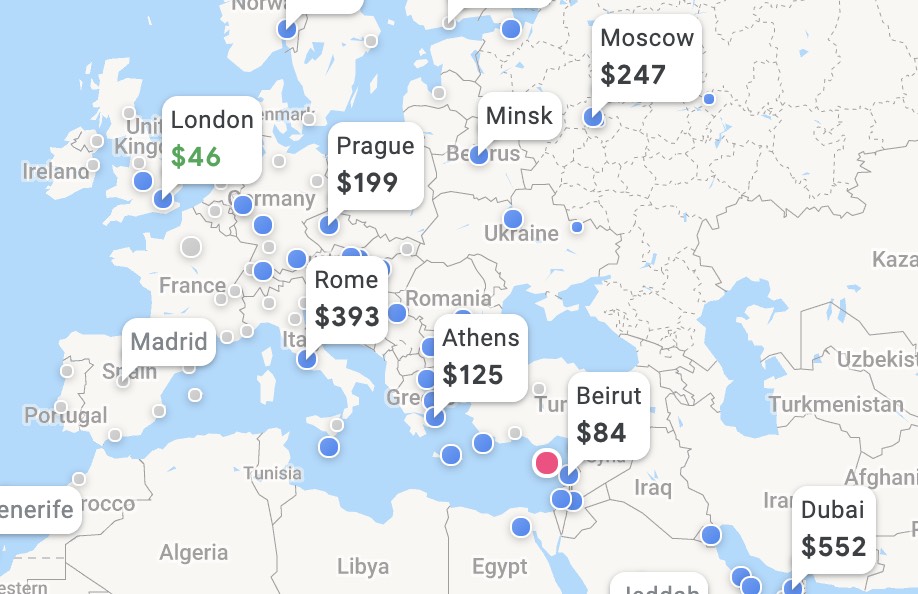

The islands biggest airport is the Larnaca International Airport (LCA). There is also a second airport near Paphos, that serves smaller routes.

There are direct flights to over two dozen major European cities, as well as to Russia, Egypt, Dubai and others.

If you’re doing business in Europe and need to travel regulary, Cyprus can serve as a good hub.

Weather in Cyprus: Intense Mediterranian

Cyprus has one of the warmest climates and warmest winters in the Mediterranean and in the European Union. In the peak of the summer heat, it’s not going to be enjoyable to be out in the open sun. But it can serve as a perfect retreat for the months of the year, where it is uncomfortably cold in most other parts of Europe.

An individual is a Cyprus tax resident if he or she spends more than 183 days in the country. Also, the new 60 days rule can be an additional application for individuals who want to have the non-domicile status.

Benefits on income and exemptions::

Cyprus Non-Dom: Quickstart

⭐️ Low tax rate: With the right structure, a total tax rate of less than 5% can be achieved.

⭐️ Small minimum presence: Only 60 days of presence are required to become a tax resident

⭐️ Long-term option: The program is guaranteed for 17 years

⭐️ Health care & social security: Access to EU-wide health care and social security system

Who can take advantage of this program?

Citizens of European countries, that are not considered domiciled in Cyprus. Particularly interesting for online entrepreneurs from countries with very high marginal tax rates, a high level of bureaucracy, or existing corporations, that would face exit tax when changing their residency to a non-EU country.

Three different models to become a non-dom-resident

Model One: Cyprus Limited

Model Two: Sole proprietorship

Model Three: High net-worth individual (HNWI)

Cyprus Non-Dom: Main characteristics

The application of the non-dom tax system is a remnant of the British colonization.

Non-dom is short for ‘non-domiciled’. Your domicile is the country you grew up in, where your parents are from, where you have strong ties. Being a non-dom in Cyprus means, that your parents are not from there, and you never lived a significant amount of time in the country.

If you pass this test, then you can take advantage of the substantial tax benefits given to non-dom-residents in Cyprus.

⭐️ No taxes on foreign dividends

⭐️

No “Remittance-base taxation”

All of the traditional non-dom countries like the UK, Ireland or Malta know and apply the system of “remittance-base taxation”.

Who can use the Non-Dom program?

Almost any European citizen without ties to Cyprus that would make him ‘domiciled’ can take advantage of the program.

- Profits from the sale of securities such as bonds, shares, debentures and others is an exemption of the Cyprus’ taxation.

- No withholding tax on the repatriation of income as royalties, interests and dividends.

- For the first 10 years, there is an exemption of 50% of remuneration from the employment in Cyprus. This rule applies for individuals who were not tax residents prior to the commencement of the employment and given that the annual remuneration is over €100.000.

- An exemption of income tax to any individual who gets an employment outside of Cyprus – from a foreign permanent establishment of a Cyprus tax resident employer for more than 90 days overall in a tax year.

- No gift tax, wealth tax, estate duty or inheritance tax

- Low social insurance contributions

The program is especially attractive to location-independent entrepreneurs, investors and international high-earning employees, remote freelancers and even artists.

An individual who in the relevant tax year:

a. is not residing in any other country for a time period of more than 183 days in total and

b. does not have a tax residency in other country and

c. resides in Cyprus for at least 60 days and

d. has different other Cyprus ties such as:

- employment’s contract

- he or she is a business owner

- he or she is a director of a Cyprus Tax resident company

For both 60 and 183 days rules, the days count in and out of Cyprus territory are count as below.

- The day of departure from Cyprus counts as a day of residence outside Cyprus.

- The day of arrival in Cyprus counts as a day of residence.

- Same day departure and arrival from Cyprus counts as a day of residence in Cyprus.

Taxation

Cyprus has DTTs or Double Taxation Treaties with over 60 countries across the world including the United Kingdom. If you’re an expat resident in Cyprus and your country of origin has a DTT with Cyprus would mean of not being double-taxed on the same income. You will be rather paying tax on your certain incomes either in your country of residence or country of domicile depending on the DTT between the two countries.

The DTT between the United Kingdom and the Republic of Cyprus makes it highly captivating for the British citizens to retire, invest and set up a business in Cyprus. The implementation of the government’s policies is getting great positive impact on Cyprus’ image as a perfect destination for both expats and business relocation.

The final touch was an introduction of “The Non-Domicile Programme” by the government in 2015. The programme targets the foreign entrepreneurs who plan on moving their residence to Cyprus. These are the biggest winners as they see the Cyprus Non-Dom Programme offers a vast fiscal advantages.

The Non-Domicile Programme for Foreign Entrepreneurs and Private Individuals

The main goal of the Cyprus Non-Dom Programme is to have more wealthy private individuals and foreign entrepreneurs reside in Cyprus. This is the step that expects to help in reviving the country’s economic situation and to secure Cyprus’ position as a global business center. The programme offers far-reaching benefits for both wealthy individuals and entrepreneurs from the global setting.

The term “resident but not domiciled” or the Non-Dom Cyprus became a law in July 2015. Any individual who relocates to Cyprus and getting up Cyprus tax residency can mostly qualify as a Cyprus non-domiciled resident. Also, he or she can stay that way for 17 years of residing in Cyprus. Otherwise, those who are tax residents of Cyprus for at least 17 years out of the last 20 years prior to the relevant tax year are the “domiciled in Cyprus”. Their tax position is going to change.

An individual should have a domicile of choice outside of Cyprus. Also, he or she is not a tax resident in Cyprus for the last 20 years prior to the relevant tax year.

Doing Business in Cyprus

A business-friendly country like Cyprus has a good reputation being a global business centre and a gateway into the EU for years.

FinTech companies, IT innovators, creative people, traders, entrepreneurs, etc., find the island as attractive not only with its tax incentives. However, by the comfort of doing business there and by more chances the country offers.

Following the rise of the expat individuals and companies, the whole host of professional services grow quickly in the country. They offer businesses’ great expertise in various kinds of consulting such as the formation of the company, bank accounts, accounting and general management. This is why doing business and establishing a company in Cyprus is advantageous for many kinds of various companies.

The following are the list of the reasons on why incorporating in Cyprus is beneficial to both business owners and entrepreneurs:

- Cyprus has 12.5% in terms of the corporate tax rate and is considered to be one of the lowest.

- It has a simple incorporation process. What you need is to list one shareholder and one director who can be individuals to come up with a unique company name.

- The company’s directors (whether entities or individuals) can be foreign and reside in any place of the world.

- All necessary registration documents can be filed in English.

- Cyprus is a prominent jurisdiction for all types of companies such as security traders, controlled foreign companies and holding companies.

- Opening a bank account in Cyprus is easy after establishing a company. There is no need to appear there physically. This is possible through an eligible introducer who provides a notarized document, needed identification documents and paperwork that are included by the shareholders and the directors.

- This jurisdiction is working with the highly reputable IFRS or the International Financial Reporting Standards.

Holding Companies

Cyprus is an ideal place for holdings. Favourable tax legislation has made Cyprus one of the best jurisdictions for holding companies.

Holding a company in Cyprus can take advantage of the following:

- collect dividends at small rates of withholding tax build on its double tax treaty network;

- exclude the incoming dividend from tax subject to some plain conditions;

- disseminate the dividend to its non-resident shareholders (even if they reside in the EU or not or in a country with which Cyprus has a double tax treaty) without any charges of withholding tax in Cyprus.

Moreover, the demolition by a Cyprus company of its underlying shareholding will not bring capital gains tax unless it is a immovable property in Cyprus. As a whole, the reorganization rules offer significant tax planning opportunities and flexibility for revamping via Cyprus.

Personal Income Tax

Personal income in Cyprus is taxed on a tiered basis with quite an essential tax-free allowance of €19,500. Cyprus’ maximum income tax rated based on personal income is presently set at 35% for income in excess of €60,000.

Moreover, there are exceedingly favorable tax conditions for expat retirees in Cyprus, having a 5% flat tax rate on pension income.

Cyprus Non-Dom for Every Budget\

What an individual have to do is register as self-employed in Cyprus or sign up as a well-to-do person. Registering as a self-employed in Cyprus is more interesting because you can do it for as low as €1,250 and this will allow you to enjoy the tax advantages of the non-dom program even without setting up a company.

With the registration, a payment of 14.8% in Social Security on a minimum of € 8,500 is required. It is not advisable to use this registration to invoice much more, as from €19,500 (minimum amount for free of taxes) your income will be advised to progressive taxation of up to 35%.

Conclusion

All in all, Cyprus offers brilliant opportunities both for businesses and individuals. Many foreign entrepreneurs view the country as a perfect connection point between the EU and other trading blocks and countries. Countries like Middle East, Asia and Africa.

Cyprus has an advanced legal, banking and accounting systems, extremely skilled and multilingual manpower. Also, it has a convenient year round flight connections and excellent telecommunication systems. Throwing into its business-friendly tax policies for both individuals and businesses, beautiful beaches and weather will get you to the ideal place in establishing a company in the European Union.

Hello,

I would like to relocate to Cyprus and apply for Non-dom resident status. I do trade cryptocurrencies to make money but i am and want to be employed as well for now. I like that i do not need to spent 183 days in Cyprus but only 60 with some additional requirements.

My question is how is cryptocurrencies taxed in Cyprus? Is it considered Capital gains and therefore exempt from taxes? does any of these rules apply?

– Capital gains tax does not apply to profits from the sale of overseas property by non-residents, offshore entities, or residents who were not resident when they purchased the asset.

-Under the Capital Gains Tax (Amendment) Law, No. N119(I) of 2002, effective from 1 January 2003, gains accruing from disposal of shares listed on any recognised Stock Exchange are exempt from tax.

If i set up a company in Cyprus does any of these rules apply for trading cryptocurrencies?

-Profit arising from the sale of securities is exempt of taxes

-Royalty income, embedded income and other qualifying income derived from qualifying intangible assets in the ‘old’ Cyprus IP box are exempt of taxes

-Royalty income, embedded income and other qualifying income derived from qualifying intangible assets in the ‘new’ Cyprus intellectual property (IP) box (provision applies with effect from 1 July 2016) are exempt of taxes

I found some tax benefits that non-dom status brings such as :

-100% exemption on remuneration for salaried services rendered outside Cyprus for more than

90 days in a tax year to a non-Cyprus resident employer” – does this mean that if i work as self employed back here in Czech for example, i will not pay taxes on my income?

-Dividends and interest are exempt from Cyprus income tax and subject only to SDC in the case

of domiciled tax residents. – does this mean i do not pay taxes on dividends from my company established in Cyprus?

Thank you for your time,

Regards,

Jan Mares.