LLC (Limited Liability Company) in Florida are required by law to file a number of documents and forms to the state every year, among these forms is the Annual Report. In this post, we will discuss some definitions, guide you through the process on How to File a Florida Limited Liability Company (LLC) annual report, all the information you need for the form, very simple step by step instructions with pictures of the process for the Florida annual report form with helpful tips along the way.

What Is a Florida LLC Annual Report?

An Annual Report allows the State of Florida to have updated information of your corporation in this case, Limited Liability Company (LLC) and to keep the Active status in the administrative system.

Why Should I File an Annual Report for LLC?

Filing the Annual Report allows your LLC to keep in good standing as a registered corporation in the State of Florida. Filing this report late may generate Late Fees for your company and failing to not filing it could make your company be filed as an Inactive Entity, creating an administrative dissolution of the company.

If the LLC is inactive, the state will no longer recognize your company as a legal entity.

When and How Long Is the Period to File the LLC Annual Report in Florida?

The LLC Annual Report is due from January 1st to May 1st. Filing after the date will generate a US$400 Late Fee.

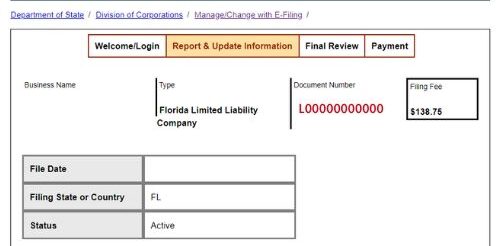

Florida LLC Fees

- Online Filing Form Fee: US$138.75

- Filing Late: US$400

- Make changes to filed Annual Report: US$50

What Do I Need to File the Annual Report Form Online?

Document Number: The 6- or 12-digit number assigned to your entity when the business entity was filed or registered with the Division of Corporations. You can find this on the top right of the formation document of your LLC. In case you don’t have any documents with you, you can search for your LLC Document Number here.

Entity Name: The official/legal name of your business.

Keep In Mind: The annual report does not allow you to change the name of your business. For this download and complete the appropriate amendment form.

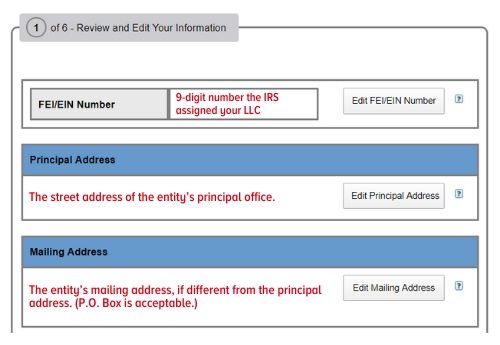

Federal Employer Identification Number (FEIN): The 9-digit number the Internal Revenue Service (IRS) assigned to the business for federal tax identification purposes.

Principal Place of Business Address: The street address of the entity’s principal office.

Mailing Address: The entity’s mailing address, if different from the principal address. (P.O. Box is acceptable.)

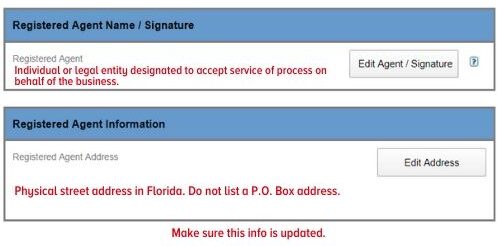

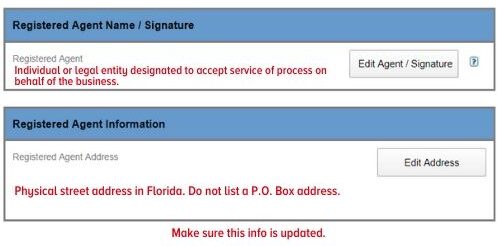

Registered Agent Name, Address, and Signature: The registered agent is the individual or legal entity designated to accept service of process on behalf of the business.

Keep in mind: A business entity cannot serve as its own registered agent. However, an individual or principal associated with the business may serve as the registered agent.

The registered agent must have a physical street address in Florida. Do not list a P.O. Box address.

If designating a new registered agent, the new registered agent must sign the report, confirming the Agent’s familiarity with the Florida Statutes and accepting the obligations of this designation.

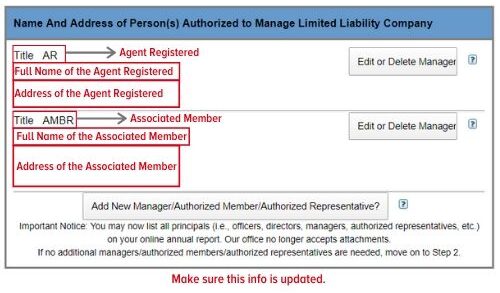

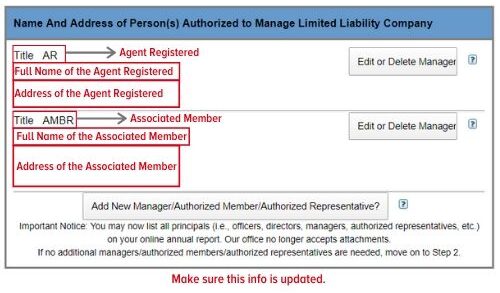

Principals (Officers/Directors/Managers/Authorized Representatives/General Partners) Names and Addresses: Review the principals associated with this business entity. You can edit, add or delete the information listed by clicking on the provided options.

Email Address: Provide a valid email address.

Keep in mind: Your filing confirmation, certification (if requested), and future email communications will be sent to this address.

Step by Step Guide to Fill a Florida LLC Annual Report:

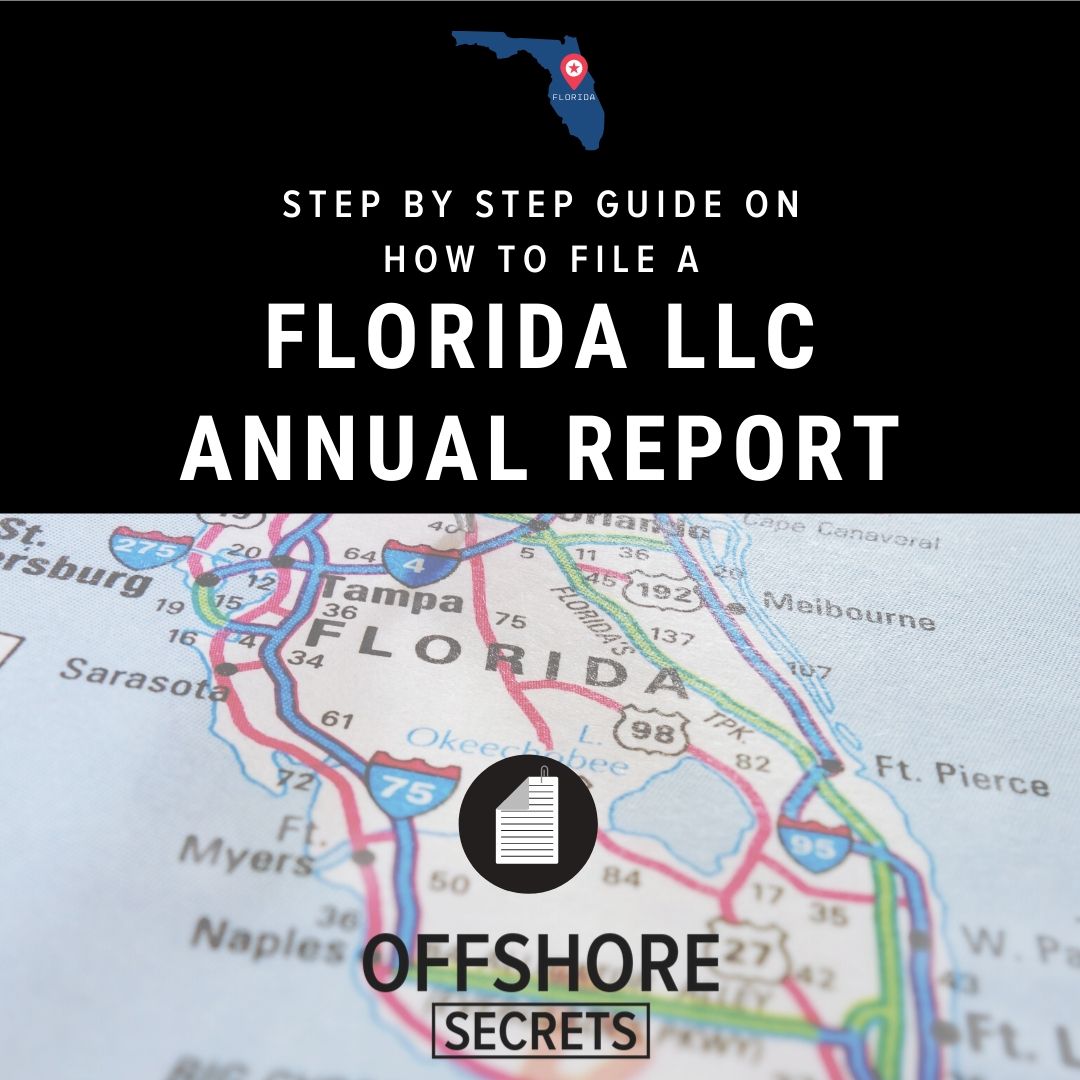

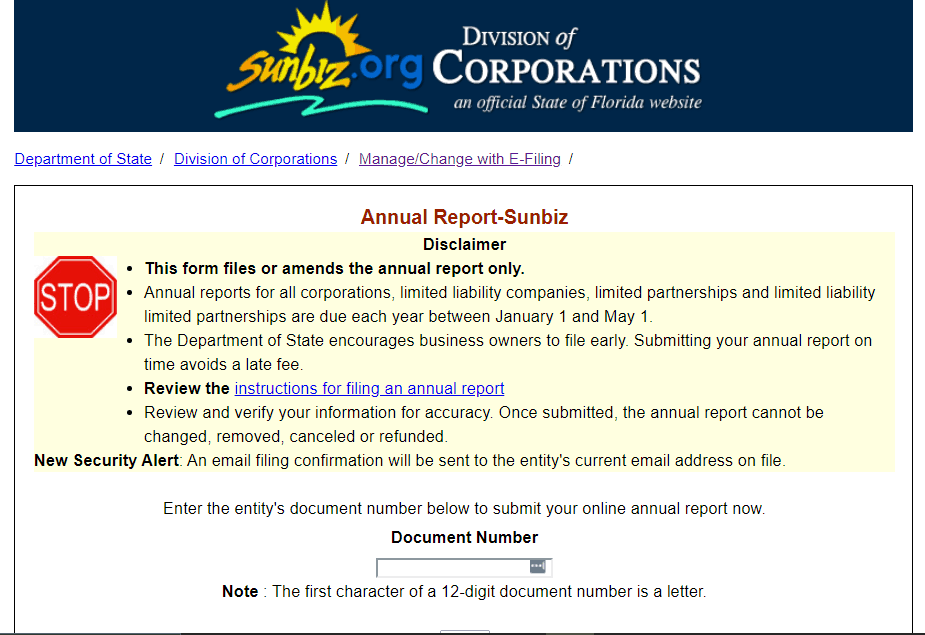

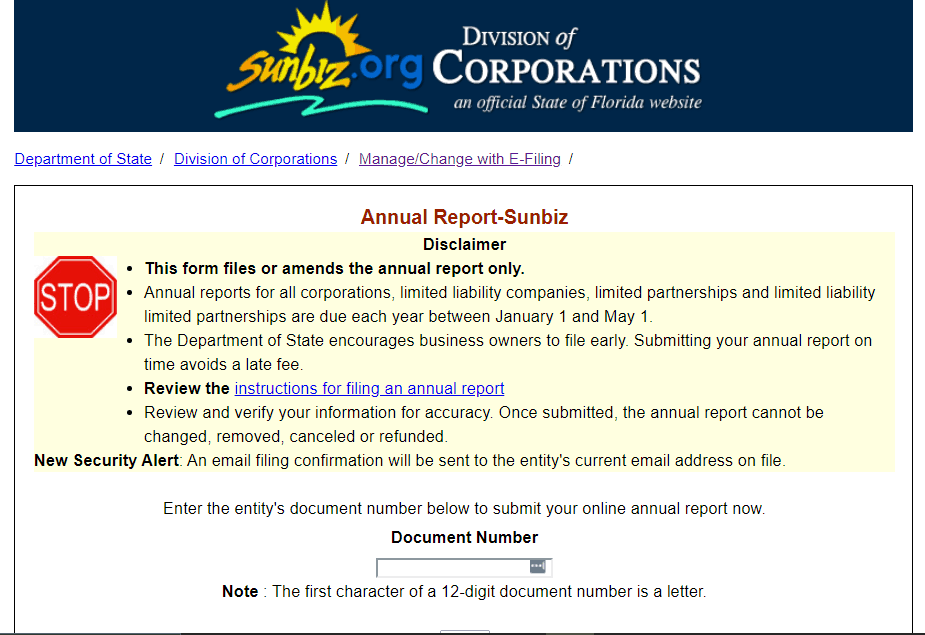

- Go to the State of Florida’s Online Annual Report Form and enter your LLC Document Number.

You can search for your LLC Document Number here.

2. You will see the form prefilled with your LLC’s information. It is important to review if the info is updated and compare with your documents in every field and detail. Edit, if needed, the information to match your LLC documents.

It is important this section match the information in your LLC Formation Document.

Make sure the full name and address of the Registered Agent are correct. It could be any member of the LLC.

Edit, add or delete (if needed) the information of each member of the LLC.

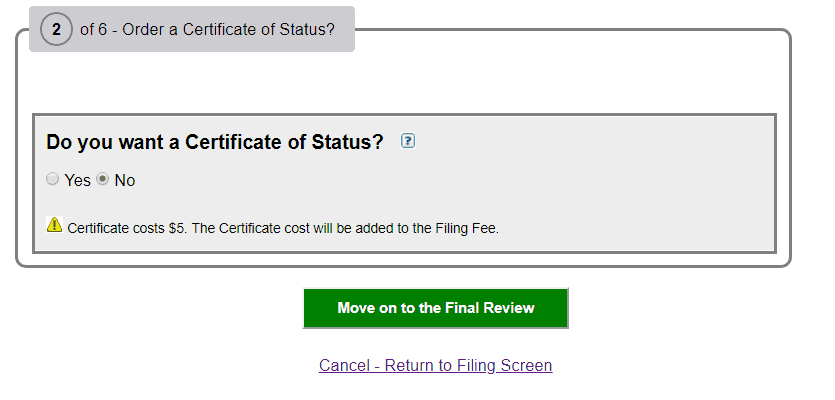

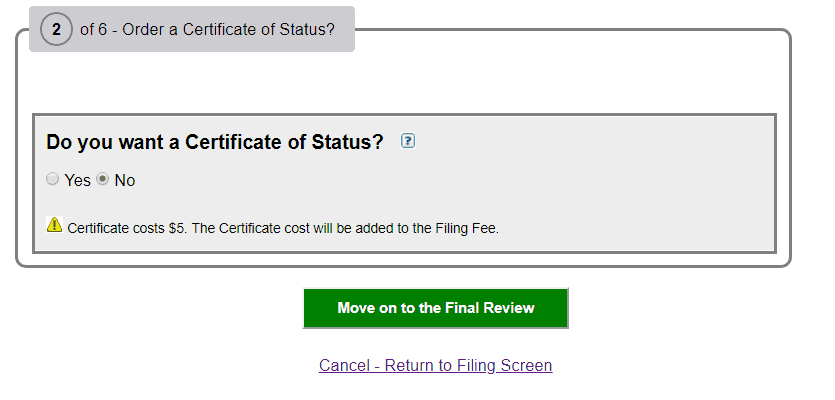

3. Mark “Yes” in case a Certificate of Status is needed for personal/administrative use. This document is not required for the filing of the Annual Report.

Before clicking the “Move on to the Final Review”, review all the information one more time to check everything is correct.

4. Once in the “Final Review” page, you can go back to the information page to make changes or you can proceed to add the email address.

Keep in mind: your filing confirmation, certification (if requested), and future email communications will be sent to this address.

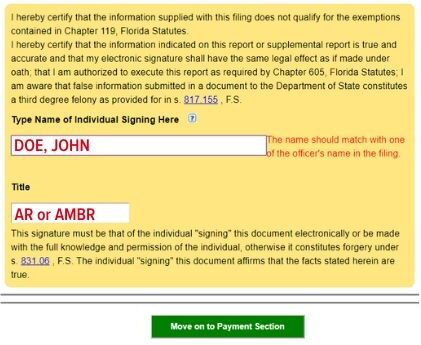

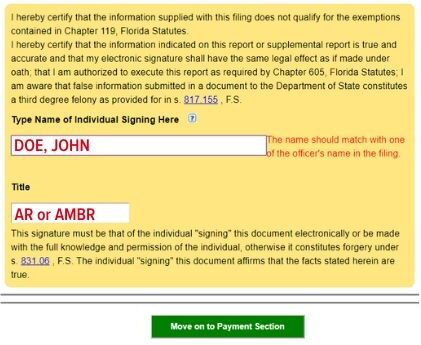

5. An electronic signature is required to file the Annual Report. It can be the Full Name in the format (Last Name, Name) just as the information submitted on the list of members of the LLC.

Once the “Move on to Payment Section” is clicked, no changes can be made.

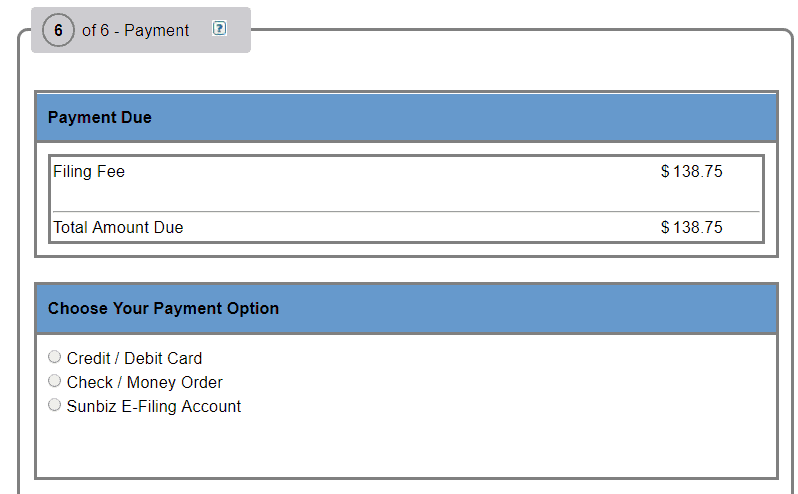

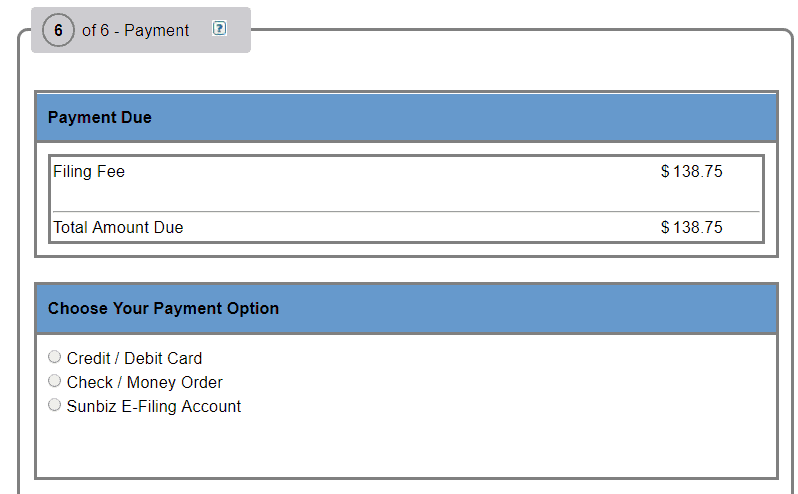

6. Online payment options are recommended. Allowing the process to be immediate.

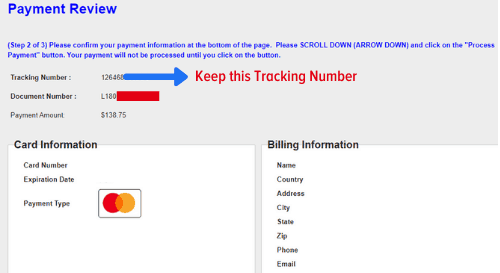

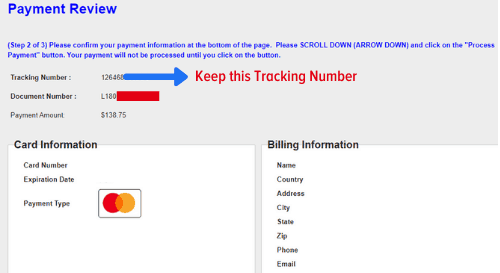

Keep the Tracking Number on your records just in case you need it.

Once the payment is processed, you can print or download your receipt for your files. It may take up to 24 hours for the annual report to be available for viewing.

For more information on Limited Liability Companies, you can check out our Ultimate Guide to US LLCs for [NON-RESIDENTS] and you can Contact Us for additional questions and expert consultation.