Panama is one of the best options for location-independent entrepreneurs and global citizens to establish a second residency in the world right now. It offers a friendly culture, a stable economy, and a territorial taxation system. For citizens of about 50 countries, the Panama Friendly Nations visa offers a fast-track to the permanent residency.

Chris started Globalization Guide to help entrepreneurs like himself to master the challenge of international business and living abroad. Since then he has helped hundreds of clients with their international structuring.

This article is for

✅ Location-independent entrepreneurs and digital nomads looking for a second residency for tax and compliance reasons

✅ Retirees and pensioners who want to enjoy a tax-free life in the sun

✅ High net-worth individuals looking to protect their wealth

The main benefits of Panama as a place for a permanent residency:

⭐️ Simplicity: The process is fast and straightforward

⭐️ Cost-efficient: The whole process only costs about 5000$

⭐️ Minimal presence: There are almost zero minimum presence requirements

⭐️ Excellent tax system: Very beneficial tax system for location-independent entrepreneurs

⭐️ Location: Excellent geographic location (“gateway to Latin America”)

⭐️ Culture: Western culture & Spanish-speaking

⭐️ Safe haven: Perfect as a dormant residence for emergencies

Panama launched the Friendly Nations Visa in 2012, in order to attract foreign capital and immigration to Panama. The Presidential Decree 343 of May 2012 initially included 22 countries that “maintain friendly, professional, economic and investment relations” with the Republic of Panama. The list has since been expanded to about 50 countries.

Living in Panama

Many times when looking for a second residency, the plan is never to actually live there long-term. Unfortunately, many countries that offer easy residency programs are not desirable places to stay long-term in the first place.

This is not the case with Panama. It is absolutely possible to live a very good life in this country.

Let’s jump into the reasons why Panama is a great place for your (first) second residency.

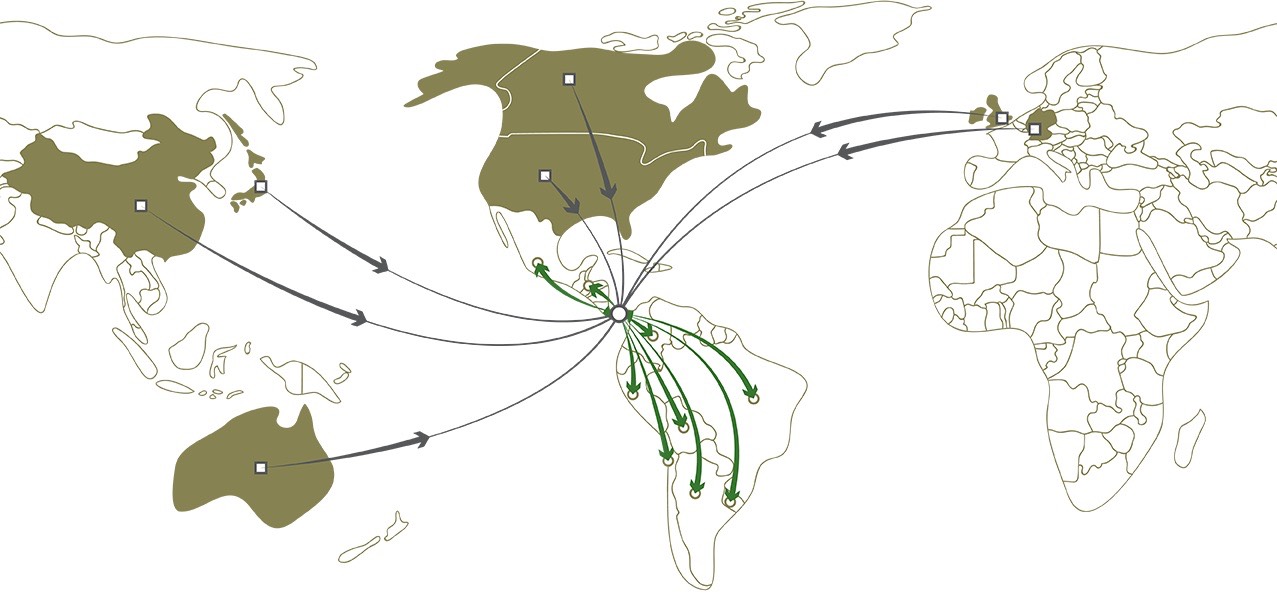

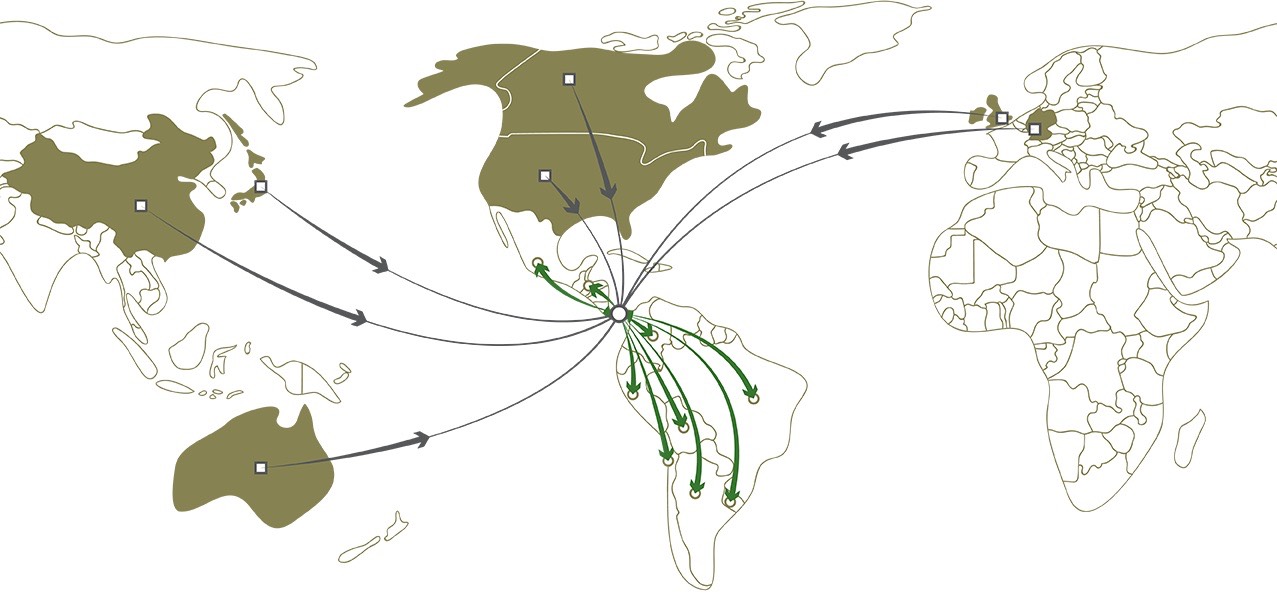

Geographic location: Panama is a great hub

Panama offers an excellent geographic location. Located in the middle of Central America, you can reach many different destinations within the Americas within hours.

There are flights leaving daily from Panama City’s Tocumen International Airport (PTY) to all parts of the world. And the airport is only growing, so you can expect more flights from and to Panama in the future.

Nature: Tropic Islands and Rainforest

Just 30 minutes outside of Panama City, the beautiful landscape of rural Panama begins. You will find a country covered in thick green fauna everywhere you look. There are excellent options for hiking and exploration.

Countless different islands are waiting for your visit. The most popular spots to visit are San Blas Islands and Bocas del Toro.

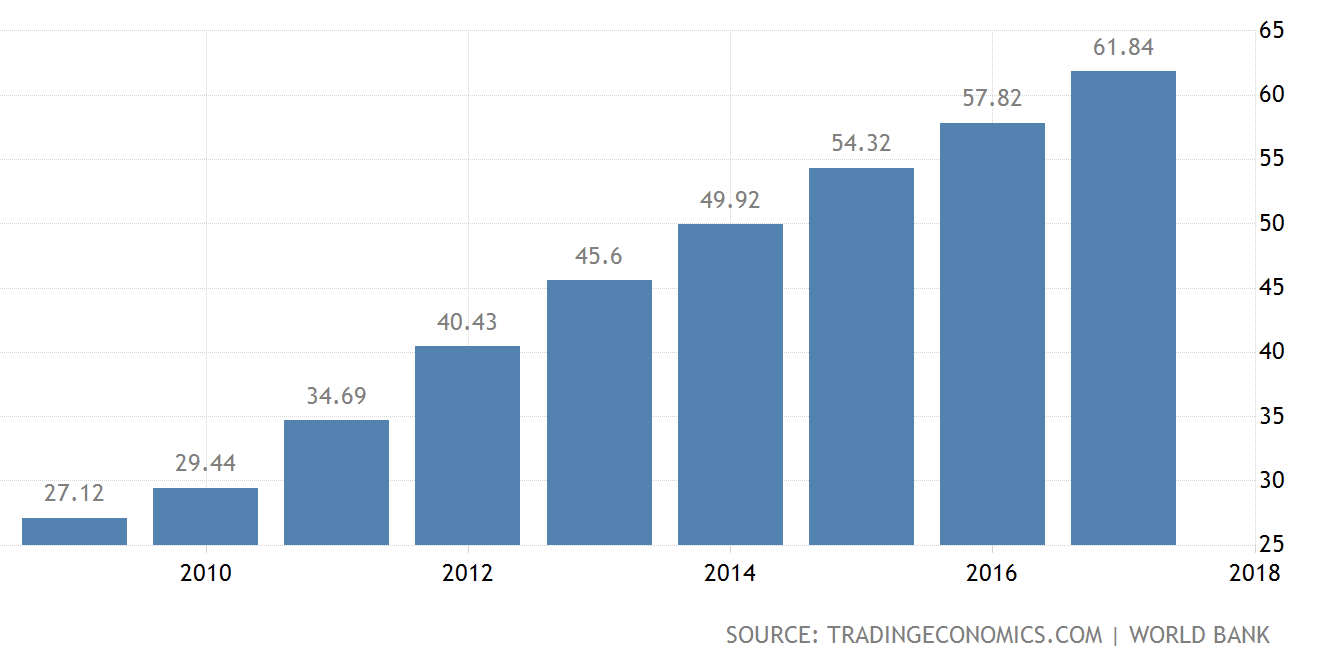

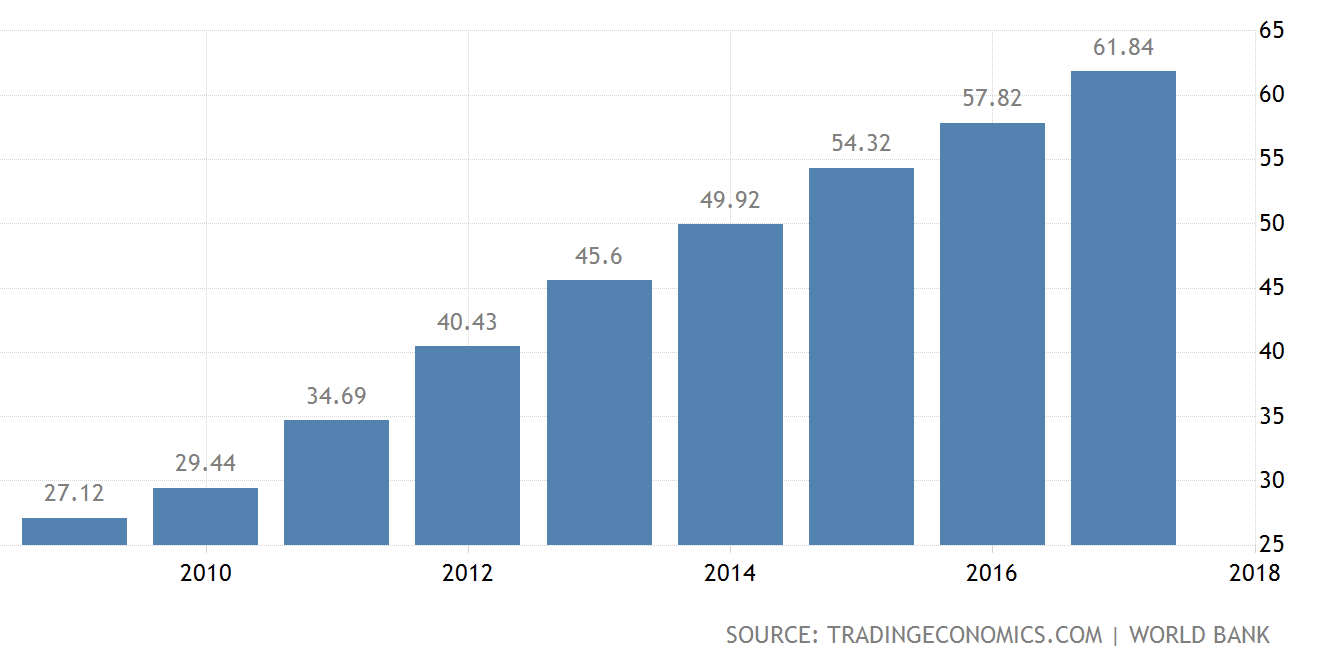

Stable Economy: Solid Growth with the Dollar as Currency

The Panamanian economy has developed very well over the last few decades. The banking sector is obviously playing a big role, and the Panama canal brings in constant revenue as well.

The fact that Panama uses the US dollar as it’s currency most likely plays an important role here as well. Many other Latin American countries struggle to keep their currency stable, and constantly face the risk of inflation. Panama does not have its own currency or central bank. So the government can’t just print money and inflate its currency to “generate” revenue to keep itself going. The money has to come from other sources (like certain programs to bring investors into the country 😉?)

But the dollar also makes it more expensive than most of the neighboring countries. Colombia, just one flight hour south, is considerably cheaper for example.

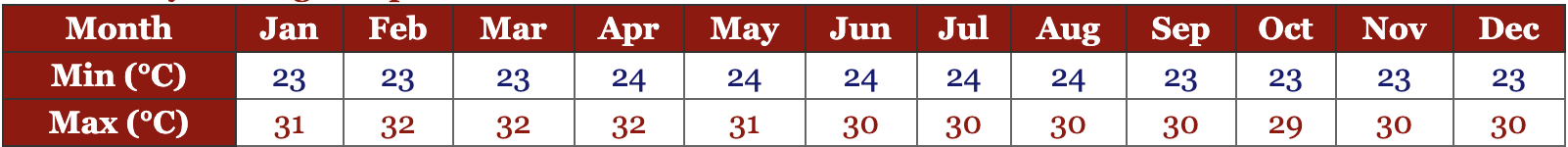

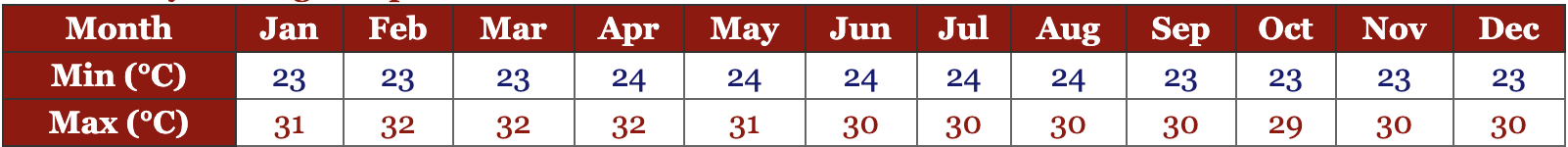

Tropical Climate and Weather

Panama is warm and rainy. The temperature is somewhere between 23-30ºC for most of the year. During the summer periods, it will rain for a few hours in the afternoon almost every day. The weather is surely one of the areas where Panama does not get top scores with most expats.

People and Culture: Generally Friendly and Lively

Latin American culture is generally friendly. Comparing it will neighboring Colombia, the Panamanian people are somewhat more reserved and aloof.

Personal Safety

Panama is generally safe. You should take care after dark in certain areas of the major cities. There is a higher risk for pickpockets than what you will be used to from Western countries.

Key to Tax-Freedom: The Panamanian Tax System

The Panamanian tax system is really the core element of what makes it such a great place for location-independent entrepreneurs, perpetual travelers and investors to get a permanent residency here.

Personal Income Tax

Panama uses a territorial-based taxation system. Residents and non-residents are (only) based on their Panama-source income. That means any revenue generated outside of Panama is completely tax-free, and only revenue generated inside Panama is subject to tax.

The first 11.000$ of taxable (Panama-source) income are tax exempt. Even though average wages have gone up considerably over the last few years, a large percentage of the Panamanian population still pays no direct taxes.

Income from 11.000$ to 50.000$ is taxed at 15%, income exceeding 50.000$ is taxed at 25%.

There is a property tax that ranges anywhere from 0% to 0.7%.

There are no inheritance or wealth taxes.

Anti-Avoidance rules (or lack thereof)

A critical part of Panama’s tax system for location-independent entrepreneurs is the complete lack of CFC rules. You can manage tax-exempt offshore or onshore company anywhere in the world from inside Panama, without facing taxes on either salaries or dividends.

Value-added tax

The standard VAT rate is 7%. For alcohol and accommodations a special rate of 10%, and for alcohol, a rate of 15% applies.

Double-taxation treaties

Panama has 17 tax treaties and 10 information exchange treaties (Source).

| Panama Tax Treaties (2019) | ||

|---|---|---|

| Barbados 🇧🇧 | Czech Republic 🇨🇿 | France 🇫🇷 |

| Ireland 🇮🇪 | Israel 🇮🇱 | Italy 🇮🇹 |

| Luxembourg 🇱🇺 | Mexico 🇲🇽 | Netherlands 🇳🇱 |

| Portugal 🇵🇹 | Qatar 🇶🇦 | Singapur 🇸🇬 |

| South Korea 🇰🇷 | Spain 🇪🇸 | United Arab Emirates 🇦🇪 |

| UK 🇬🇧 | Vietnam 🇻🇳 |

Corporate taxation

The territorial taxation system also extends to corporate taxation. Panamanian companies are only taxed on Panama-source income. Any income generated outside of Panama is tax-free.

Panama also knows the concept of a non-resident company, when the central management and control is not exercised in Panama.

The corporate tax rate on taxable income is the greater of a 25% rate on net taxable income or a 1.17% rate on gross taxable income.

Withholding tax

Resident companies must withhold 10% on dividends distributed out of domestic profits and 5% on dividends distributed out of foreign-source profits or export profits.

Interests & royalties paid to a non-resident are subject to a 12.5% withholding tax.

The Panamanian Banking System

The official currency of Panama is the Balboa (PAB). Its symbol is the same as the American Dollar, to which it is linked. There is no central bank. The state-owned ‘Banco Nacional de Panamá’ fulfills certain functions of a central bank and is responsible for supplying US Dollars from the US Federal Reserve under a treaty signed in 1904.

Banks are organized into the Panamanian Banking Association (Panamanian and Foreign Banks). They are licensed and regulated by the Banking Supervisory Authority (Superintendencia de Bancos).

Two different kinds of banking licenses exist in Panama.

Class A license, general or full license. Most banks fall under this category. These institutions are allowed to do business in Panama and abroad.

Class B license, or international license. These banks are allowed to have a physical presence in Panama but are only allowed to do business with expats and non-residents.

There is no deposit insurance scheme, that would protect client assets in case a bank goes bankrupt.

But overall the Panamanian banking system is quite robust, and no Panamanian bank has ever declared bankruptcy.

List of Panamanian banks

There are more than 90 registered banks in Panama, and their tall office buildings dominate the city center.

Here is a list of some of the more popular options available.

- Atlas Bank

- BAC International Bank (once you are an official resident)

- Banco Aliado

- Banco Azteca

- Banistmo

- Banesco

- Bladex

- Canal Bank

- Capital Bank

- Global Bank

- GNB Sudameris Bank

- PKB Banca Privada

- Scotiabank

- Towerbank

- Unibank

Overview of All the Panama Residency Programs

While the Friendly Nations Visa is the easiest and most well-known residency program available in Panama, it is by far not the only one.

The other available Panama residency options are:

- The Pensionado (Retiree) Visa ($1000 minimum monthly pension)

- The Panama Agricultural Investor Program ($60.000 minimum investment in an agricultural business)

- The Reforestation Investor Visa ($80.000 minimum investment in five hectares of a certified reforestation project)

- The Business Investor Visa ($160.000 minimum investment in a Panamanian business)

- The Economic Self Solvency Visa ($300.000 investment in real estate and/or a Panamanian fixed-term deposit account)

Panama also offers the common paths to residency available in most countries, such as residence through marriage to a Panamanian or by being parent to a Panama-born child.

The Panama Friendly Nations Visa Process

Alright. Let’s get into the exact outline of the process.

Qualifying Nationalities

First we need to make sure that we even qualify for this visa type. While there are visa options that are open to more citizenships, the Friendly Nations Visa is available for nationals of the following countries. Make sure, that yours appears on here.

| Friendly Nations (2019) | ||

|---|---|---|

| Andorra 🇦🇩 | Argentina 🇦🇷 | Austria 🇦🇹 |

| Belgium 🇧🇪 | Brazil 🇧🇷 | Canada 🇨🇦 |

| Chile 🇨🇱 | Costa Rica 🇨🇷 | Croatia 🇭🇷 |

| Cyprus 🇨🇾 | Czech Republic 🇨🇿 | Denmark 🇩🇰 |

| Estonia 🇪🇪 | Finland 🇫🇮 | France 🇫🇷 |

| Germany 🇩🇪 | Greece 🇬🇷 | Hong Kong 🇭🇰 |

| Hungary 🇭🇺 | Ireland 🇮🇪 | Israel 🇮🇱 |

| Japan 🇯🇵 | Latvia 🇱🇻 | Liechtenstein 🇱🇮 |

| Lithuania 🇱🇹 | Luxembourg 🇱🇺 | Malta 🇲🇹 |

| Monaco 🇲🇨 | San Marino 🇸🇲 | Mexico 🇲🇽 |

| Montenegro 🇲🇪 | Netherlands 🇳🇱 | New Zealand 🇳🇿 |

| Norway 🇳🇴 | Paraguay 🇵🇾 | Poland 🇵🇱 |

| Portugal 🇵🇹 | Serbia 🇷🇸 | Singapore 🇸🇬 |

| Slovakia 🇸🇰 | Spain 🇪🇸 | South Africa 🇿🇦 |

| South Korea 🇰🇷 | Sweden 🇸🇪 | Switzerland 🇨🇭 |

| Taiwan 🇹🇼 | USA 🇺🇸 | Uruguay 🇺🇾 |

| United Kingdom 🇬🇧 | Australia 🇦🇺 |

If you are an Italian citizen, and you couldn’t find your country on the list, don’t worry! Since 1966, Italy and Panama have had a bilateral immigration treaty which allows citizens of both countries to become resident in each others’ countries with even fewer requirements than this visa.

Requirements

If you qualify through your citizenship, there are three more requirements that need to be fulfilled, in order to apply for the permanent residency visa.

- You must show economic or professional ties with the Republic of Panama.

- You must show proof of financial solvency

- And you must provide the required supporting documentation.

Establishing Economic and Professional Ties

The most common way to show economic or professional ties with Panama, is by incorporating a local company. You could also buy an already existing company. A 50% share is enough. The company does not have to anything but exist. After you have completed the visa application, you can close it, sell it, or keep it going.

Proving Financial Solvency

In order to prove financial solvency, it is enough to deposit $5,000 into a Panamanian bank account in your name. For each family member that is also applying for residency, you will have to add $2,000.

In order to open the bank account, you will have to show funds and financial statements as well.

These are the documents need to open a bank account:

✅ Passport

✅ Secondary identification document (National ID, driver’s license)

✅ Two (2) bank references

✅ Two (2) personal references

✅ Financial report / tax return

✅ Proof of business / earnings

✅ KYC documents

Required Documentation

In order to apply for the residence you will need the following documents:

✅ Passport

✅ Secondary identification document (National ID, driver’s license)

✅ Clean criminal record with apostille for Panama

✅ Six (6) passport photos

✅ Medical certificate (done in Panama through law firm)

✅ Proof of housing or hotel stay

✅ Bank reference (to open company)

✅ KYC forms

Duration & Costs

Let’s look at the investment in time and money that is required to start and finish this process.

Total Costs of the Panama Friendly Nations Visa Process

Compared with most other residency programs, getting permanent residency through the Friendly Nations Visa is quite affordable. You need around 10.000$ in liquid funds, and the total costs not including flights and accommodations, are about 5000$.

Here is how they break down:

1. Company Incorporation:

Time required for incorporation: 3-7 days

Setup costs for the first year: 900-1600 USD (government fees ~100 USD).

Yearly costs after that: 600-1200 USD (government fees ~0-100 USD).

If you are not planning to use your company, you can close it or sell it once the residency process has finished. This process will cost around the same amount as keeping it open for another year. One company is enough for two non-related people to get their residency. Do the process with a friend, and you can save half of the cost here. As an alternative to the company, you can use a Private Interest Foundation. The initial setup costs for that are 2500$.

2. Deportation Retainer: 800$. The Panamanian government actually wants you to pay security in case you commit crimes and need to be deported. I have to say, a brilliant idea.

3. Multiple Entry Visa, ID Documents, Translations etc.: ca. 600$

4. Banking service: 250$ (+50$ fiduciary)

5. Attorney Fees: 2000$

All in all, we are looking at an investment of a little over 5000$ for one person. The cost per person for a family is considerably lower.

You also need an additional 5000$ in liquid funds to make the bank deposit. You can immediately withdraw them again, once you have received your banking statement showing those funds.

You should add the costs for flights to and from Panama (most likely two times), as well as renting a hotel or Airbnb in the city.

Total Duration of the Panama Friendly Nations Visa Process

The process consists of two distinct phases.

The offsite phase, which you will do outside of Panama, most likely in your home country. And the on-site phase, during which you will have to visit Panama.

During the offsite phase, you will first collect the required documents. This can take anywhere from 7 to 30 days, depending on your country. Getting criminal records, and then getting them apostilled, is often the bottleneck.

Once all the documents are assembled, the lawyers will remotely open the company for you. This will take about 3-7 days.

You could already wire your banking deposit to an escrow account in Panama, to make things easier for the next phase.

For the on-site process you will come to Panama.

Between opening the bank account, depositing money, two visits to the National Migration Service (Servicio Nacional de Migración) and waiting for your Multiple Entry Visa, you should calculate about 10 to 14 days. How long it will exactly take varies, depending on how busy the migration services are. Your lawyer will be able to give you exact times.

The Onsite Process

After your arrival at the Tocumen airport, a driver will take you from the airport, past the skyline of Costa del Este into Panama City.

Depending on the time you arrive, either in the afternoon or the next day, you will meet your lawyers in the banking neighborhood of the city: Obarrio.

This is where all of the big banks, as well as most of the law firms are located.

Your lawyer will receive the documents you have prepared and answer questions you might have about the process, the city, or your stay in Panama. Then you will schedule the banking appointments as well as the visits at migration.

Open Your Bank Account

The first step will be to open your local bank account. The law firm will have arrangements with several different banks, and choose the best one for your particular situation.

They will bring you to your appointment, a guide you through the process. With your prepared documents, you will have no difficulties getting your account set up.

Once the bank account has been opened, you need to deposit the 5000$ (+2000$ for each family member) into your account. You should have already sent the money to Panama, to speed up this process.

When the money has been fully deposited, you will print out a bank statement, showing that the funds are in your account. The second you hold this piece of paper in your hands, you are already free to withdraw the money again.

The next stop will take you to National Migration Service, or “Servicio Nacional de Migración”. Since there are quite long lines, a paralegal will pick a number for you, and call you when your turn is about 30-60 minutes away.

You can then leave your hotel and arrive at Migration just in time for your procedure. A few signatures, pictures and fingerprints later, you are done for the day.

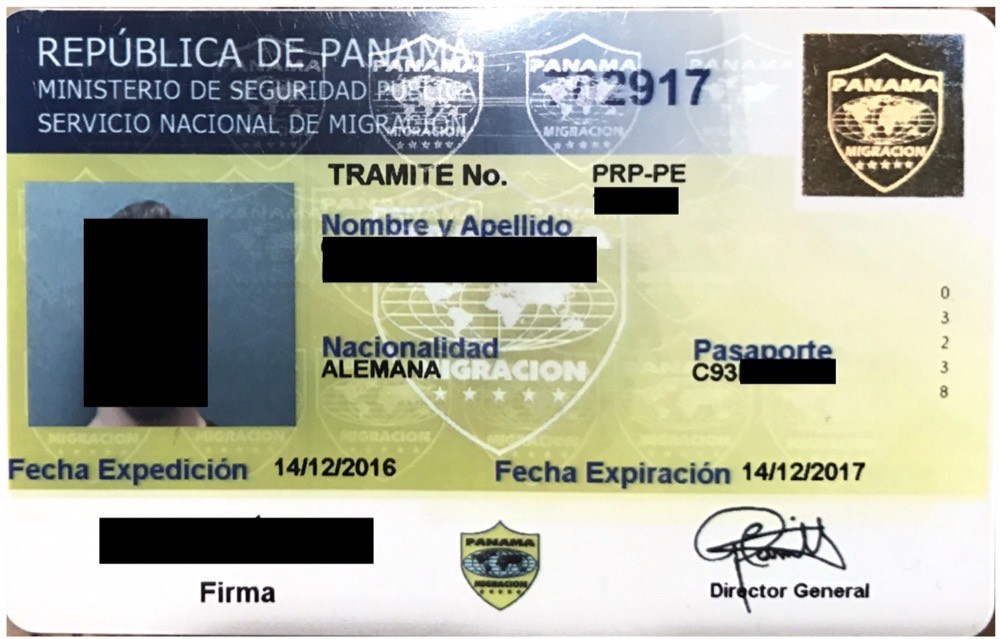

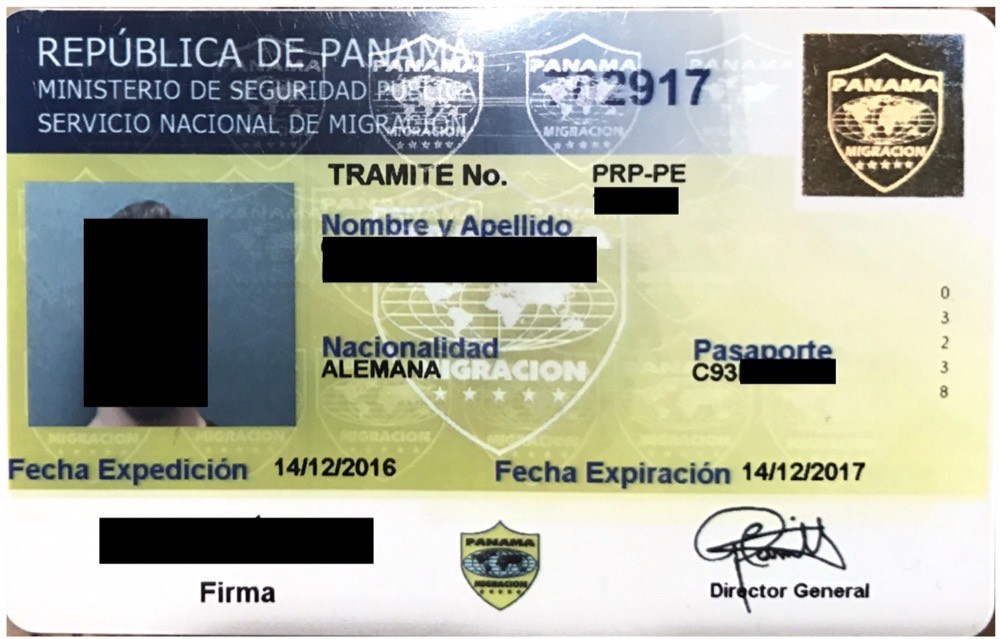

After a second visit to Migration a few days later, you will receive your temporary residency card.

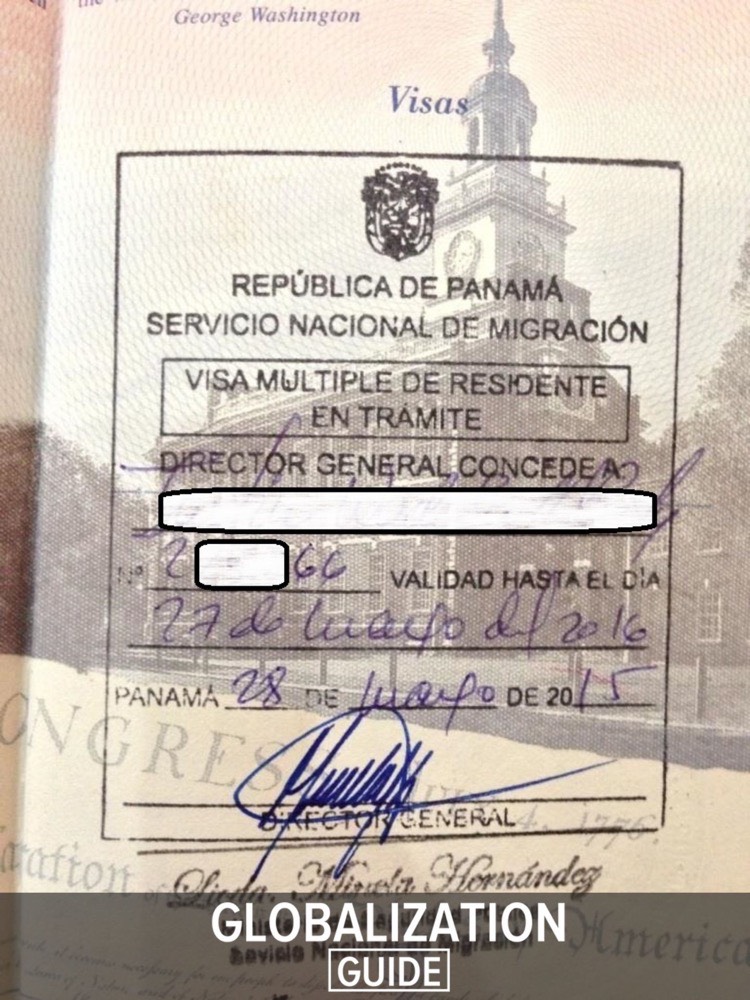

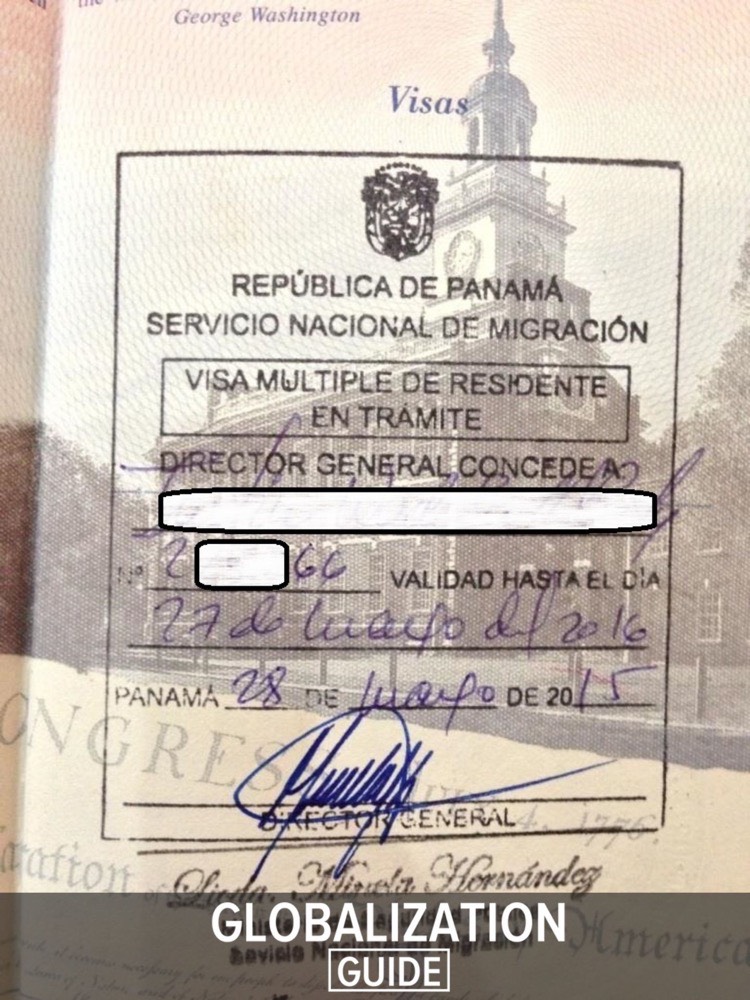

A few days after your temporary residency card, you will also receive a multi-entry visa. The visa is valid for one year (12 months). Attention: Once you have started the application process, you can not leave before you have received this multi-entry visa. Trying to leave without it, carries a fine of 2000$.

That concludes your active part of the process for now. The process usually takes a minimum of three and a maximum of five months to complete. Thanks to your multi-entry visa, you can leave and enter Panama however you see fit.

Your lawyers will inform you, once the process is completed. You then have until the end of the validity of your multi-entry visa to visit Panama again, to finalize the process.

This just requires one more visit to migration (which you will be familiar with at that point). Congratulation!

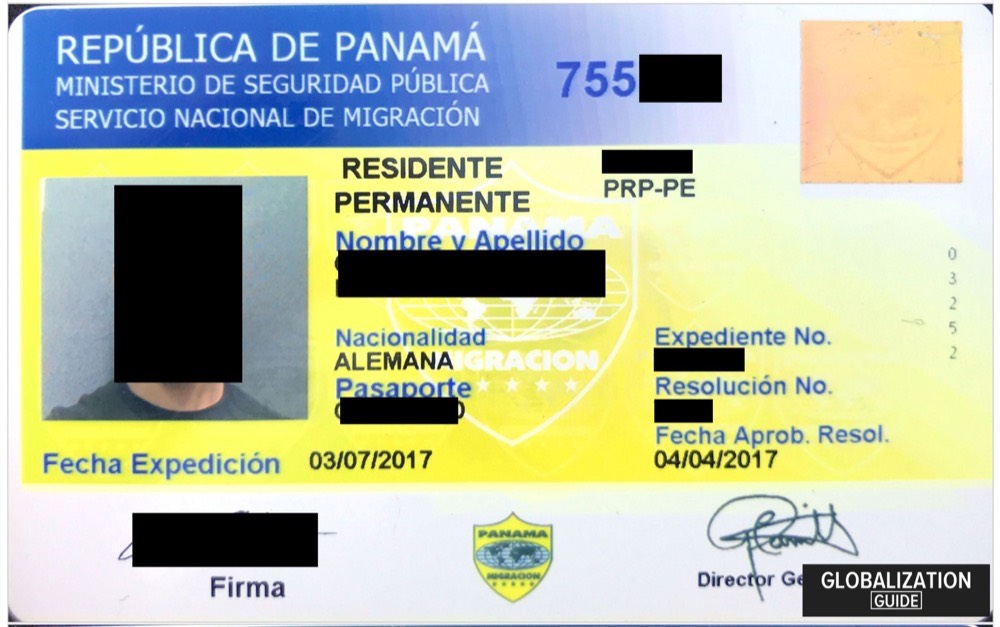

You are now a life-long, irrevocable, permanent resident of Panama!

If you wanted, you could leave it at that.

There is one more document that you can apply at this point:

Getting Your National ID (e-cedula) and Tax ID

While your permanent residency card is technically only valid in combination with your passport. About 30 days after you’ve received your permanent residency card, you can apply for your national ID card. The so-called “Cedula” is a fully functioning ID document within Panama. Besides serving as a valid identification document, it also provides you with your official tax ID.

The process is simple, and can be done without a lot of assistance.

Your lawyers will provide you with a letter sent from the national immigration service to the civil registry.

With that letter and 70$ in hand, you need to go to the ‘Tribunal Electoral’, located in the western part of the city.

This is one of Panama Citys most impressive governmental buildings. It’s quite close to one of the poorest neighborhoods of Panama City.

You will find the right office on the ground floor of the right wing.

After paying for your document, several signatures and a new picture later, all you have to do is wait for the document to be ready. About 7-14 days later, you can pick up your cedula at the same spot. The number on the right beginning with E is your official Panamanian tax ID.

Tax Residency and Tax Certificate

Becoming a permanent resident will not automatically make you a tax resident in Panama. The terms of becoming a tax resident are stated in article 762-N of the Tax Code, executive decree 958 of 2016, issued by Dirección General de Ingresos.

In order to be considered a tax resident, you need to meet either one of the following criteria:

- be present in Panama for more than 183 calendar days in a tax year or the year immediately preceding.

- show proof that you have established your permanent home in Panama

Resolution Number 201-0354 of 13 of January of 2016 adds a list of requirements in regards to obtaining the certificate of tax residency. Clear evidence must be provided, that shows, that the new resident has actually made Panama his new primary home.

In order to request the tax residency certificate, you will need to provide the following:

- E-cedula (Cedula de extranjero)

- A full copy of passports (notarized)

- Proof of address in Panama, such as a utility bill, rental contract or lease

- Evidence of economic activity that generates income in Panama, such as contracts or employment

- Evidence of residency status

- Details of the tax treaty to be applied

- The tax year for which the certificate is requested

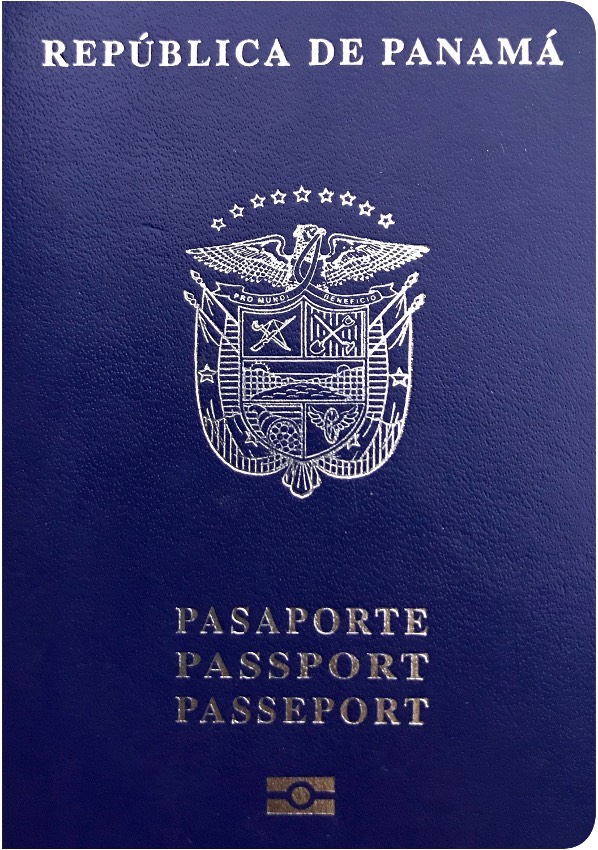

How to Get the Panamanian Citizenship & Passport

Now at this point you could go even further, and try to get the Panamanian citizenship.

The Panamanian passport ranked 39th out of 144 on the Henley Passport Index in 2019. It grants visa-free access to 142 countries. Those include all of Latin & South America, the Schengen area and Russia. Panamanians need a visa to enter the USA but have no issues obtaining one. They also have access to the Global Entry program.

Officially Panama does not recognize dual-citizenship. When you acquire your nationality there, you are supposed to renounce your former citizenship. The Panamanian nationality law requires an oath of renunciation as a condition of naturalization. However, that oath may not take effect, if it’s not also executed through the relevant authorities of your current country of nationality.

That means you can become a Panamanian national, without actually giving up your original nationality.