“This post contains affiliate links which may generate a revenue for the site when a purchase is made.”

This guide will provide you with everything necessary to get your LLC set up and running in the fastest, easiest and most efficient way possible.

Total costs:

50$ - Formation Costs (e. g. New Mexico)

9.99$ - Virtual Address monthly

25$ - Notary to verfy virtual addressExecutive Summary

- Decide in which state you want your LLC to be

- Set up virtual business address

- Form Your LLC

- Apply for EIN

- Open business bank account(s)

- Apply for payment processing

- Optional: ITIN + Paypal

What You Will Have at the End

After you have followed all the steps in this article. you will have pretty much everything you could want from a company.

Desbloquea bonificaciones exclusivas con el código malina casino 855 y empieza tu aventura con un balance reforzado desde el primer minuto. Este beneficio especial está diseñado para nuevos usuarios que acceden desde nuestra plataforma oficial en España, garantizando un inicio de racha ganadora inmejorable. ¡Introduce tu código hoy, siente el aumento de tu capital y ve a por el jackpot que te espera!

- Business address to receive and forward company mail and documents

- Company documents

- Tax ID

- Business Checking Account

- Payment Processing (Stripe)

- Paypal

Choose the Right State for Your LLC

The state you choose for your LLC will have a number of downstream effects, and can not easily be changed afterward. So it is an important decision.

My default recommendation is New Mexico.

New Mexico is low-cost (only 50$ filing fee), offers full anonymity (only the organizer knows who is behind an LLC), requires no annual report, and has no annual franchise or business license tax. Perfect for non-residents.

If you plan to open bank accounts in the EU for your LLC, you need to pick a non-anonymous state. In that case, Florida becomes our most popular option.

If you think you need a different option. or you want to double-check, you can book a consulting call with me, and I can give you my advice.

Set Up Your Business Address

Every LLC is required by law to have a registered business address.

We will use a virtual office provider, in order to fulfill this requirement.

If you have friends or relatives in the US who will let you use their address, you can skip this part.

In New Mexico the principal place of business and the mailing address actually do not even have to be in New Mexico, so you can pick any city in the US that you like.

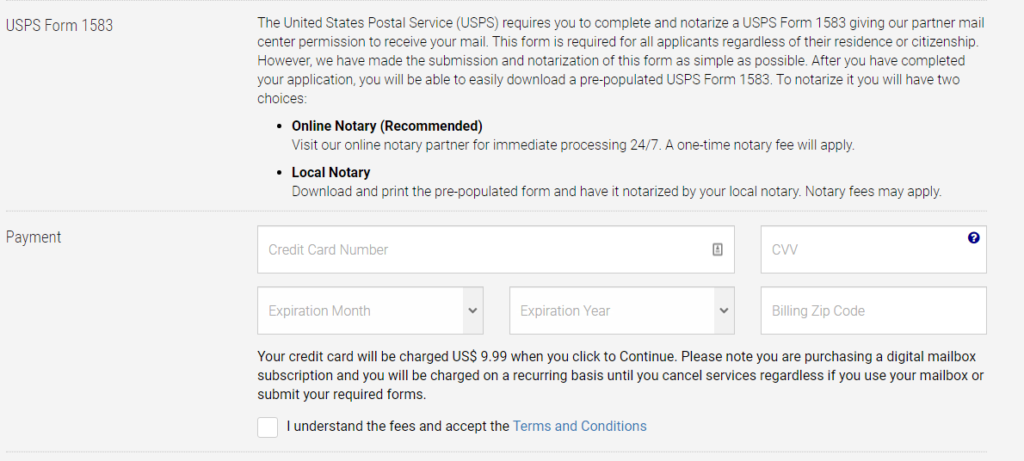

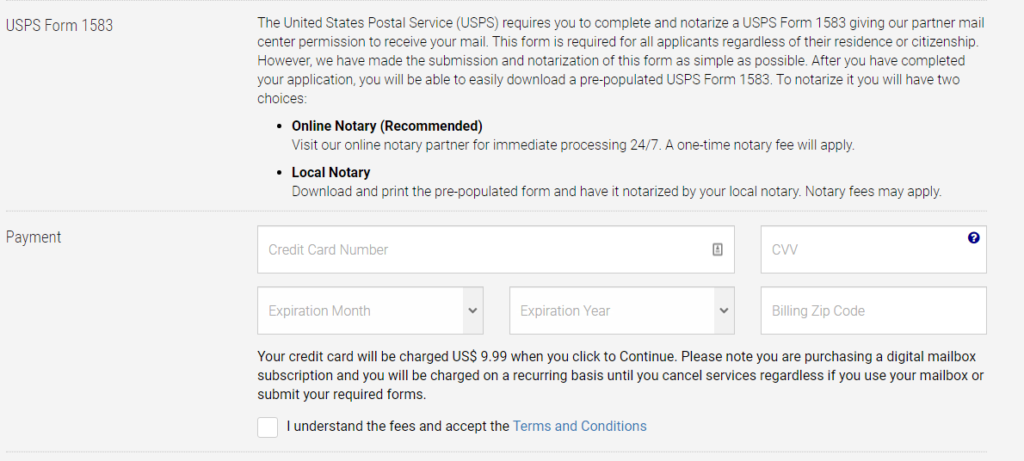

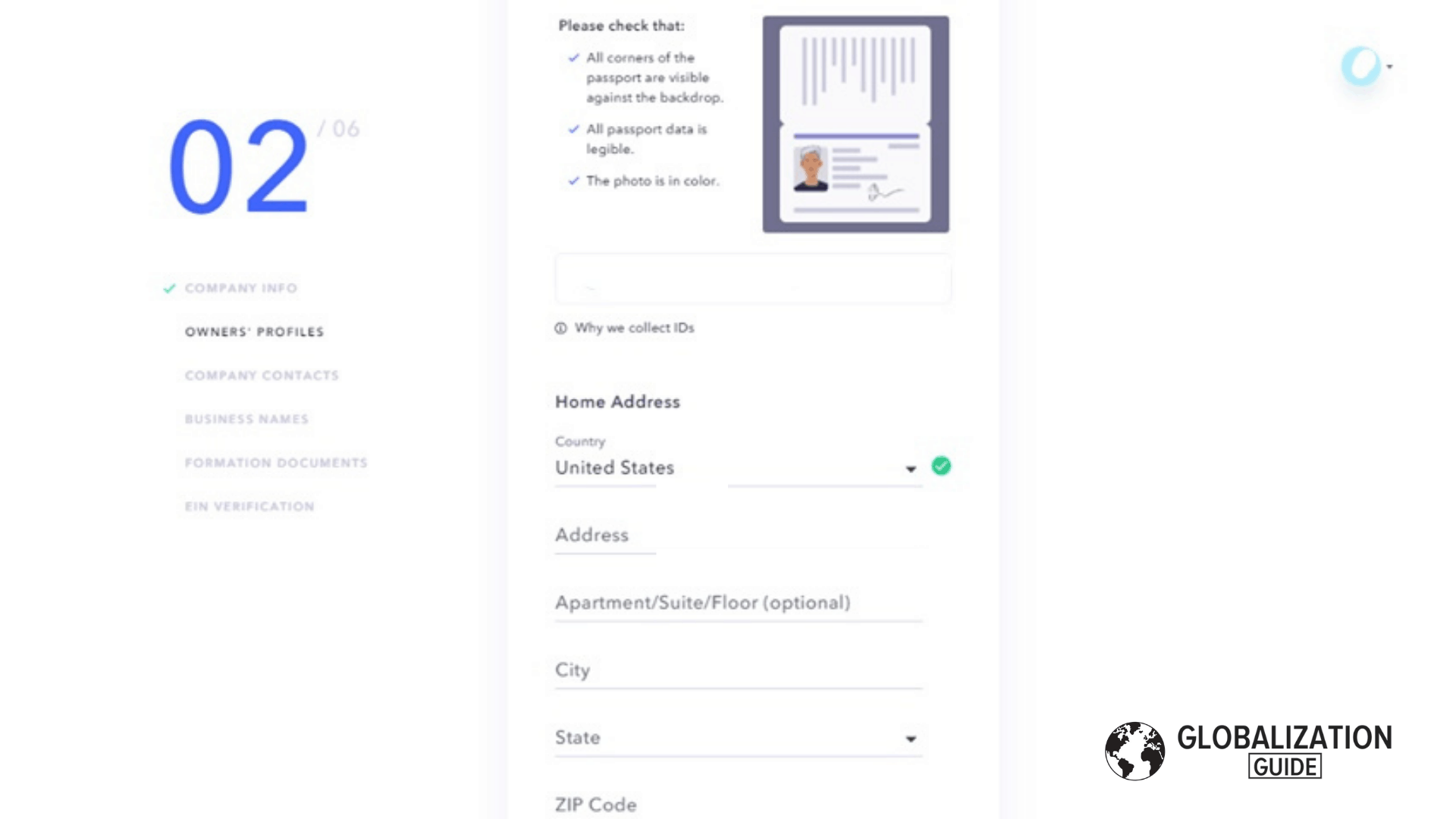

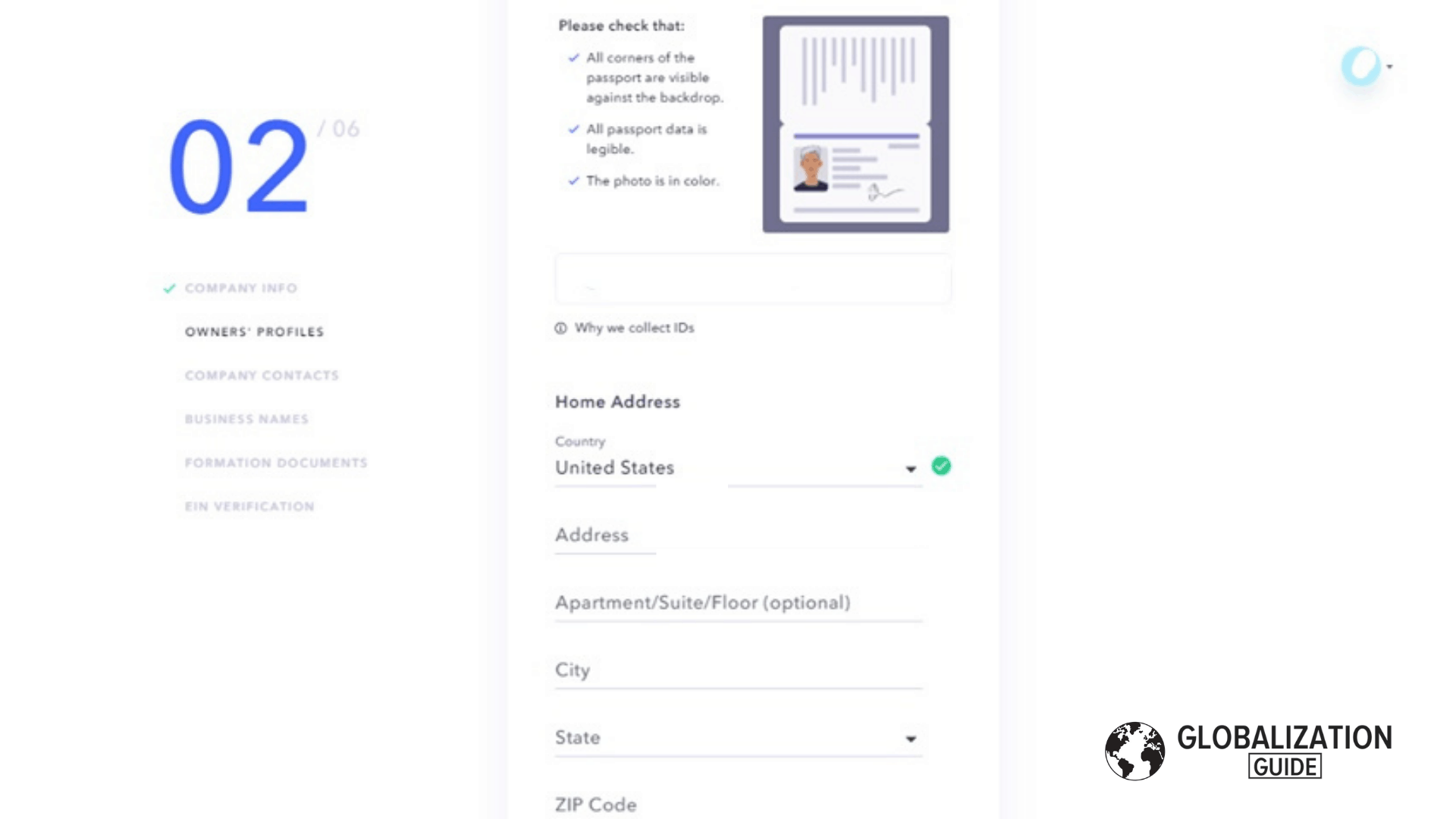

To fully use the features of the service I am suggesting, you will need to verify a residential address. For that you will need:

✅ An ID document, ideally a passport

✅ A valid, recent utility bill for ANY worldwide address

For many entrepreneurs, their home address will be the easiest to verify. If you’re already a digital nomad without a permanent address, you COULD potentially create a utility bill for this purpose.

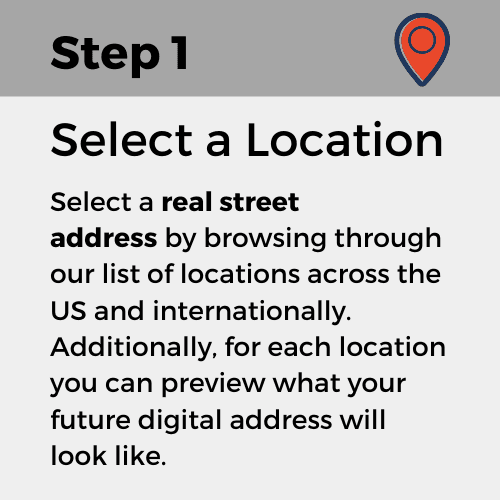

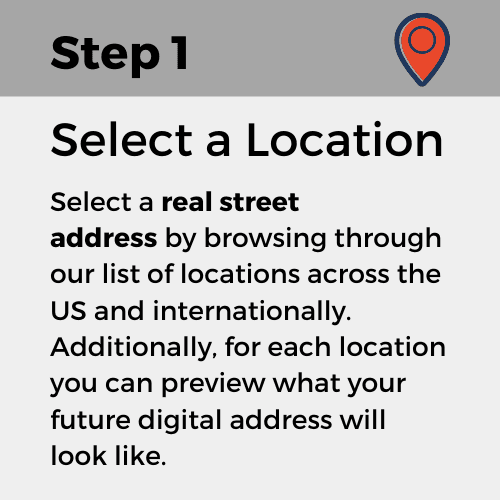

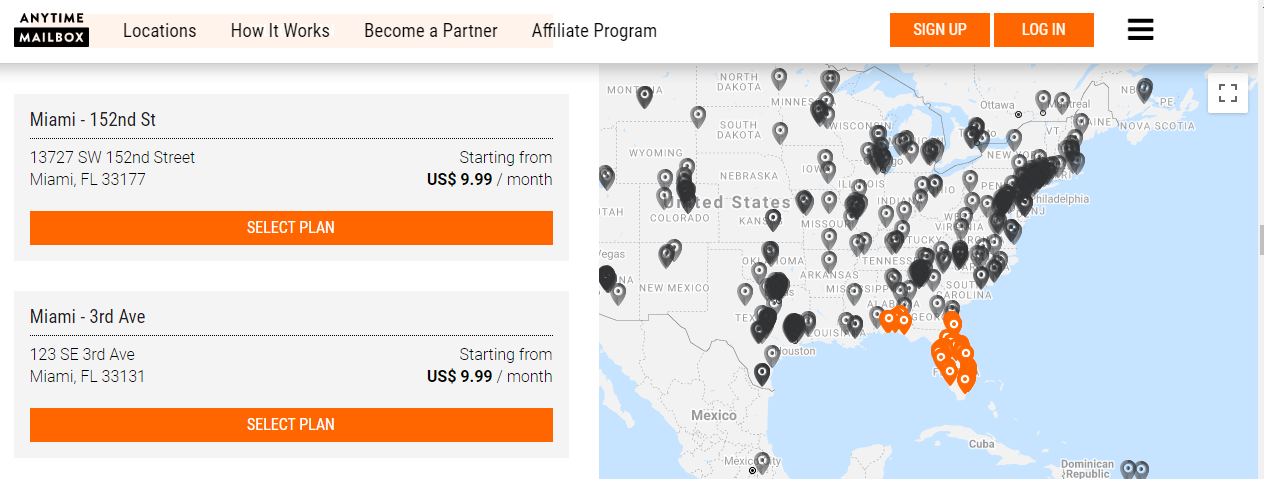

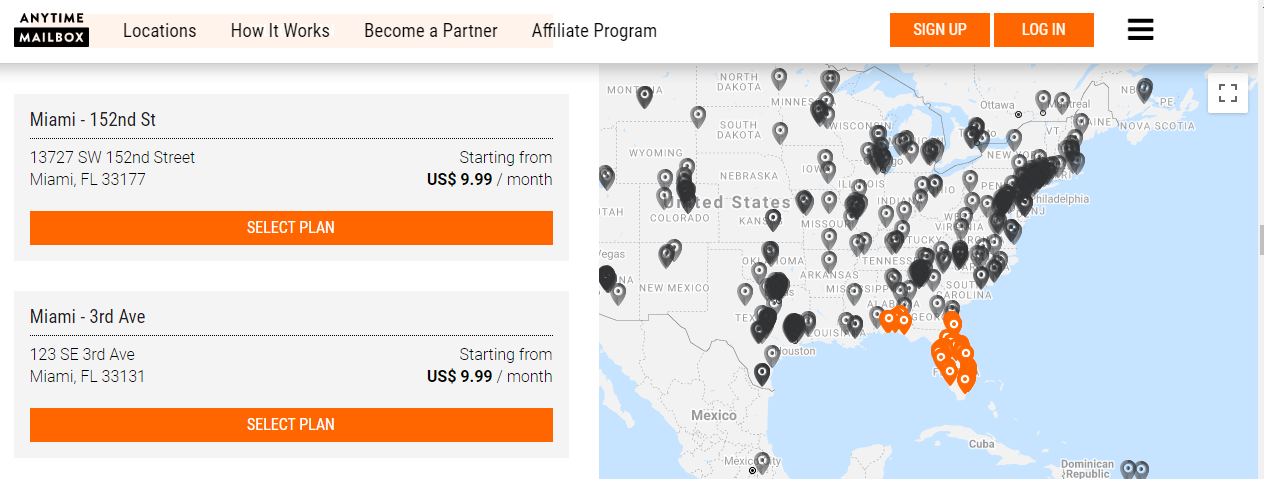

The virtual address provider I recommend is called anytimemailbox.com.

Follow this link to sign-up for a virtual business address with anytimemailbox.com.

Select the state and location for your address. For all three states that I mentioned above, the registered business address does not have to be in the state the LLC is organized in.

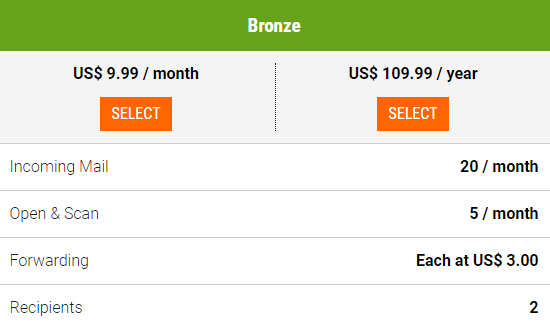

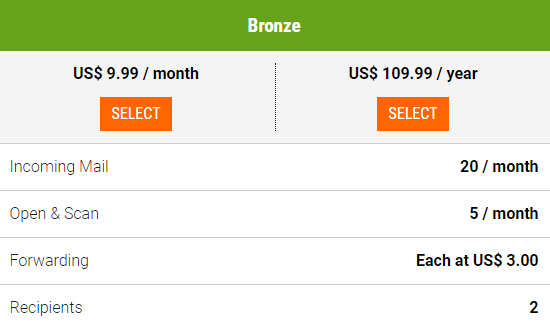

The cheapest option, the bronze plan monthly, is absolutely sufficient for what we are trying to do right now.

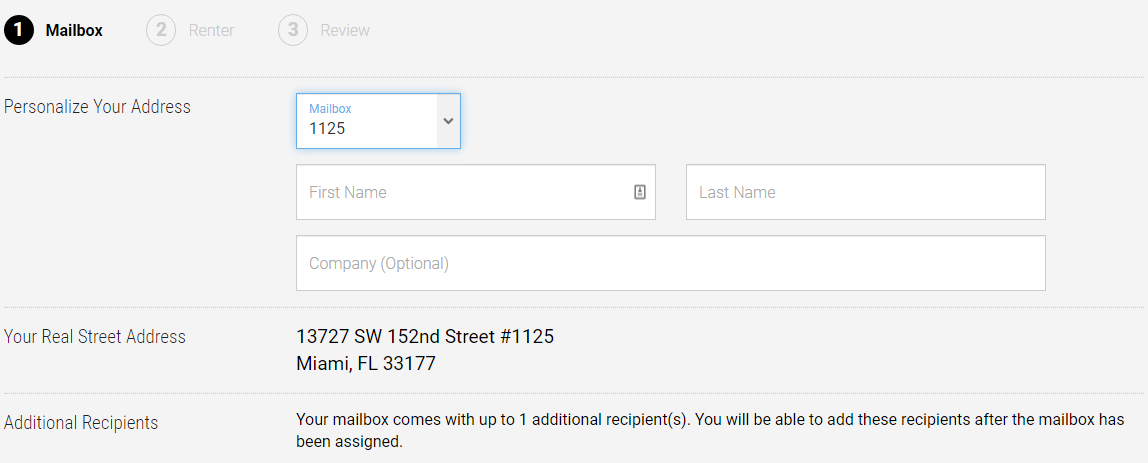

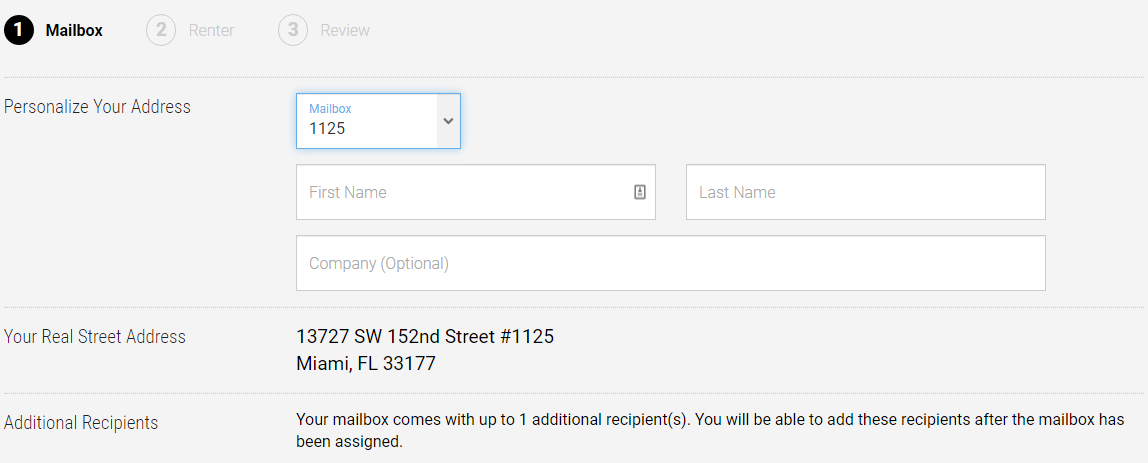

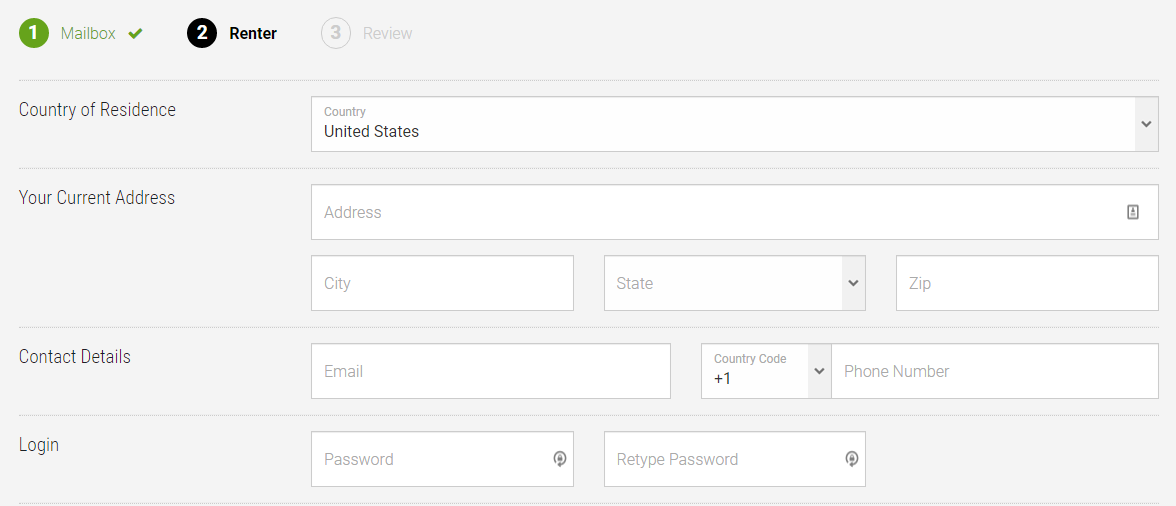

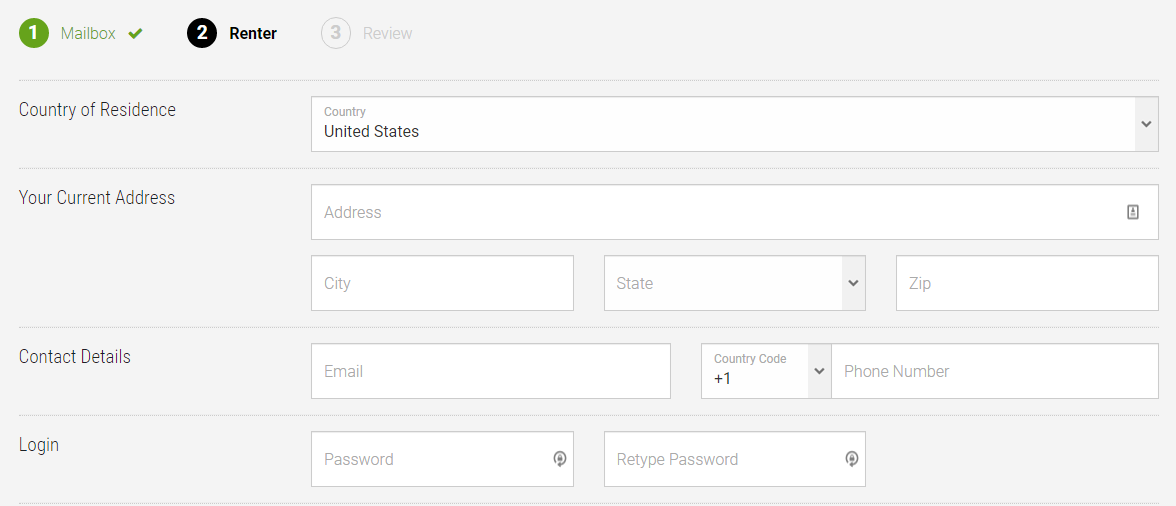

Enter your name and the LLC name for the new address.

The address that you enter here you will have to verify later. This is related to US laws about handling mail for third parties. In order for the mailbox service to be allowed to open and forward your mail for you, they need to verify your identity.

Review all the information provided and enter your payment method.

That concludes setting up your virtual address. Keep it handy, we will need it in the next step.

Form Your LLC

In this step, we are going to organize the LLC, by filing our articles of organization with your state of choice

How to Check if Your Desired Name is Available

Here are the links for the state registries for the three states mentioned. Generally, you have to submit three naming options. Make sure at least one is something very unique that doesn’t have anything similar in the registry.

- Wyoming name search

- New Mexico name search [Needs VPN] – Download one of the best here

- Delaware name search

If having the exact name is important to you, you might even pick your state according to the availability.

File Articles of Organization

There are countless service providers that will help you to set up your LLC.

Legalzoom, Zenbusiness, IncAuthority. I’ve tried them all, and you’re free to use any of them. For my own LLC, I decided to use Incfile, and I have been the most satisfied with them so far.

Head over to Incfile, to create your own LLC.

One the

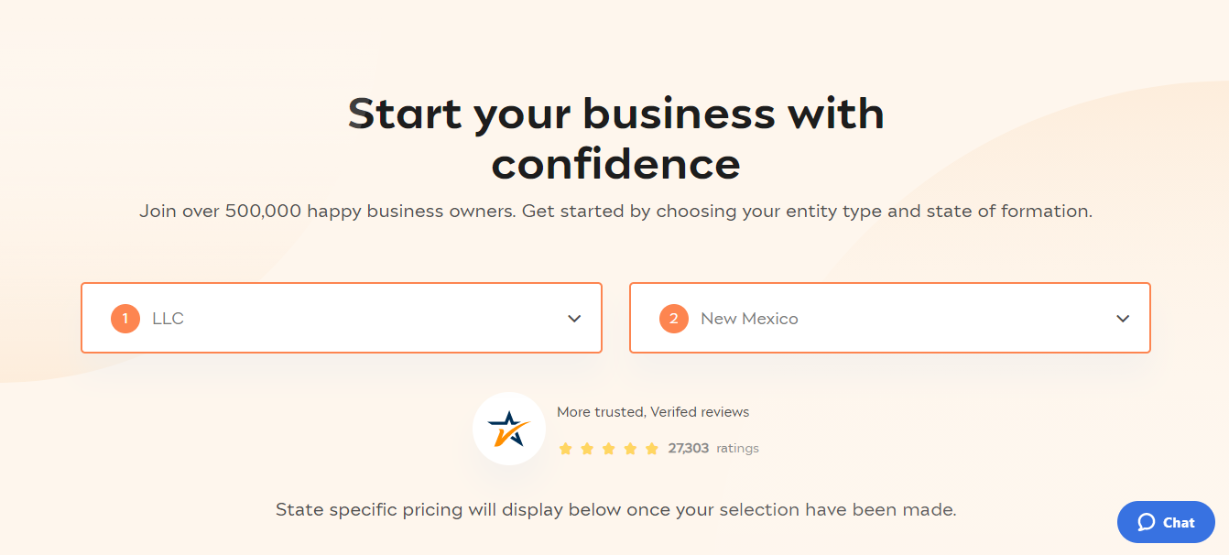

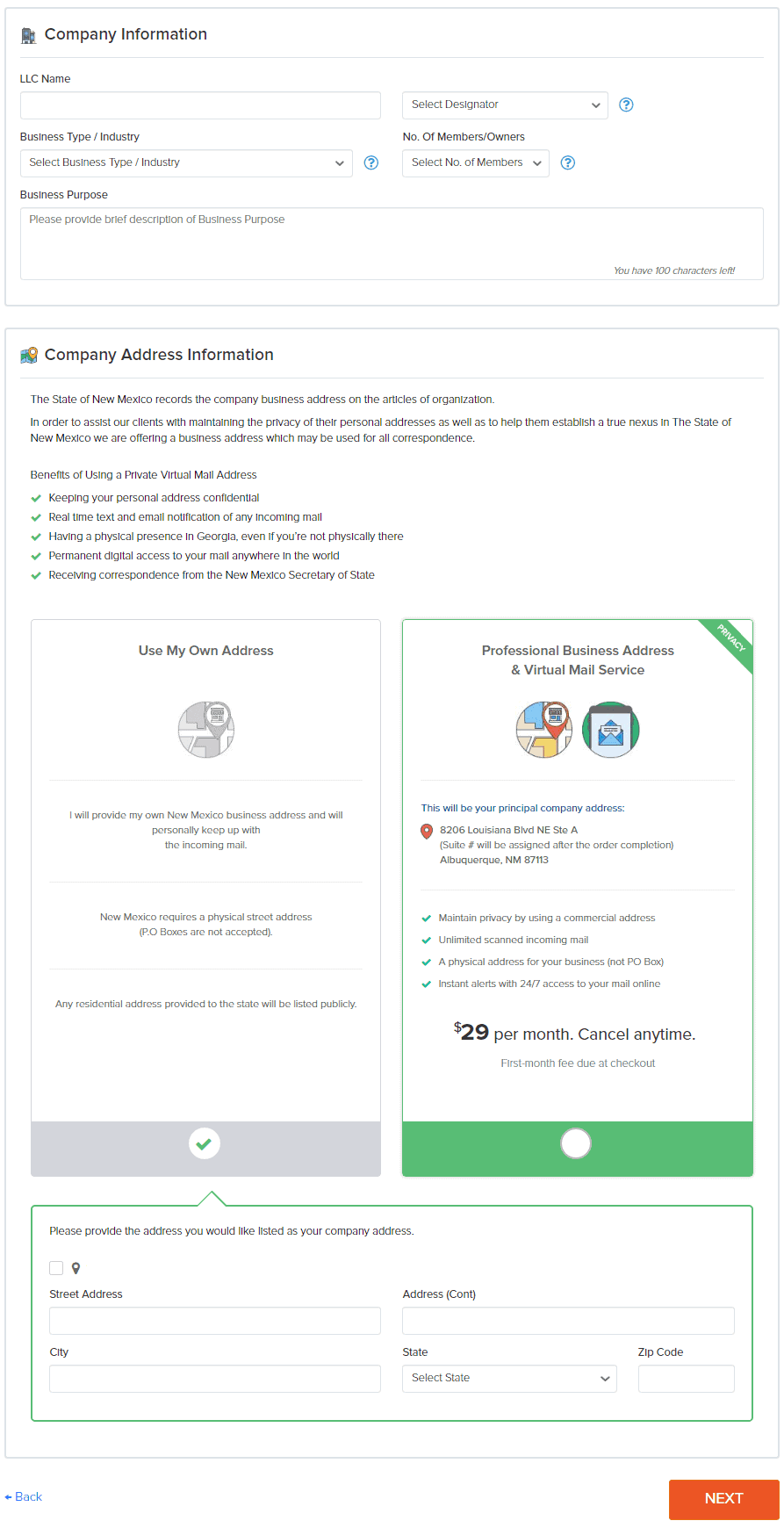

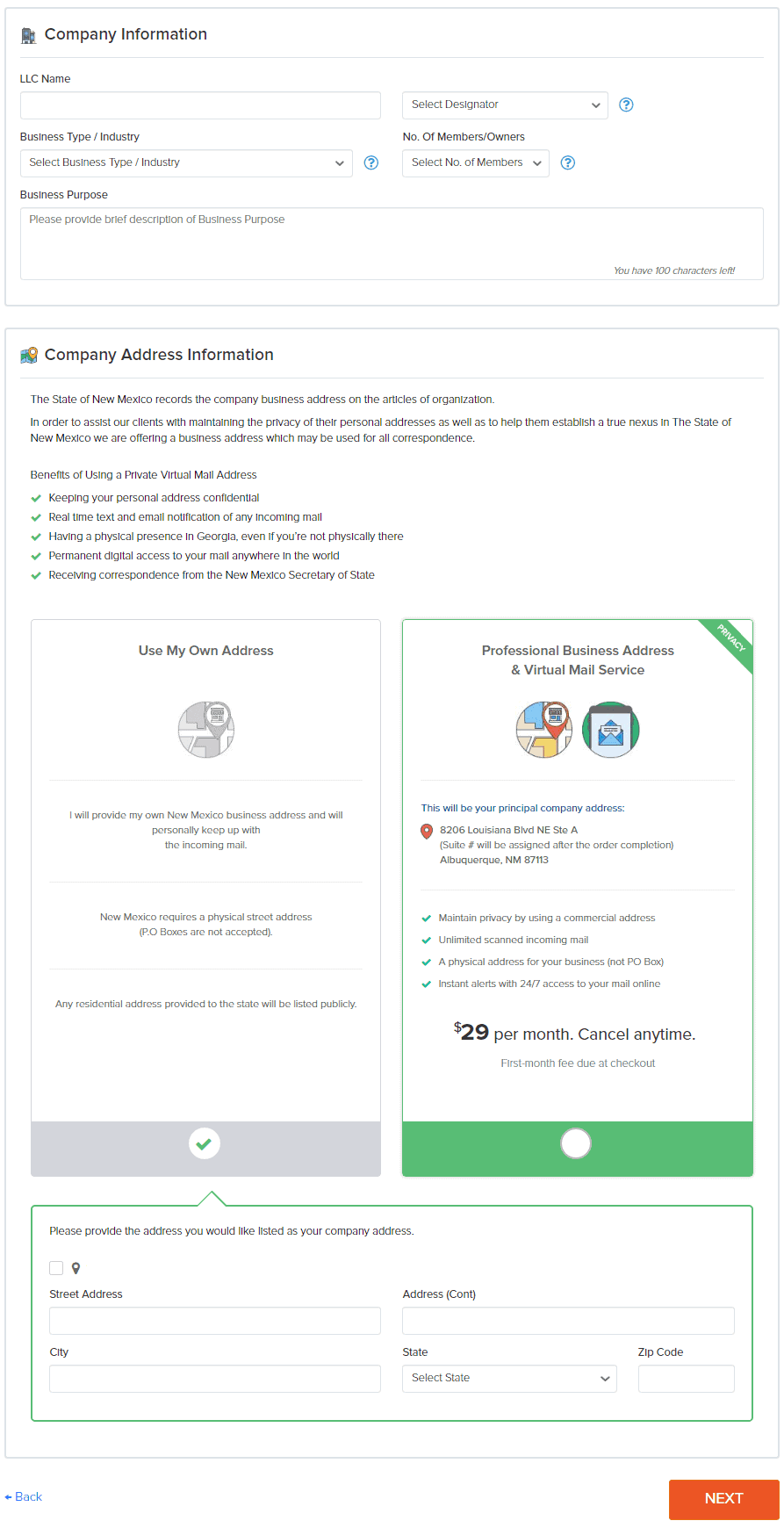

On the landing page, select LLC and your state. For this example, I went with New Mexico.

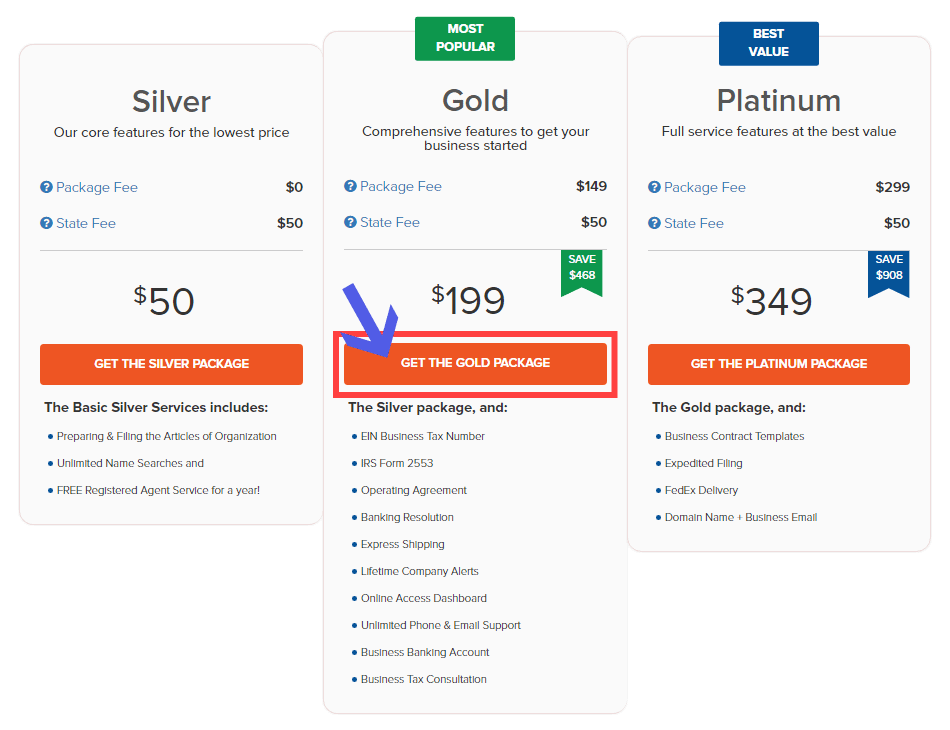

Now select the package you want.

I recommend taking the GOLD package, or at least SILVER, and adding the EIN application. Manually applying for the EIN is often not worth the time and energy needed.

On the next page enter your contact information. Use the virtual address you just created or any other valid US address where you can receive mail.

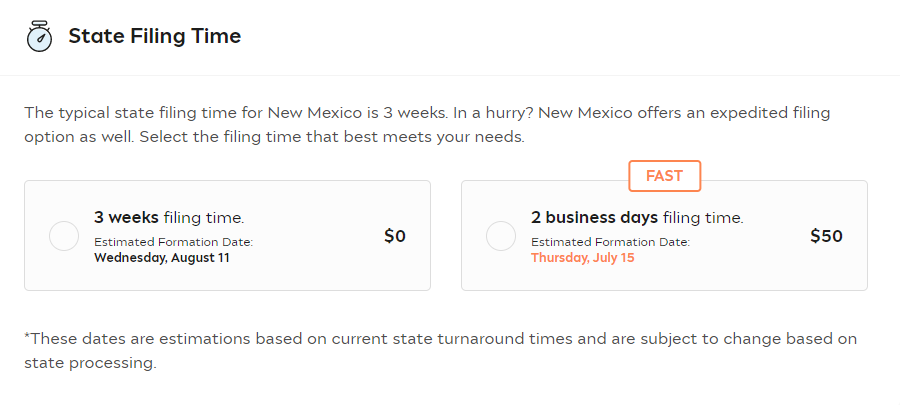

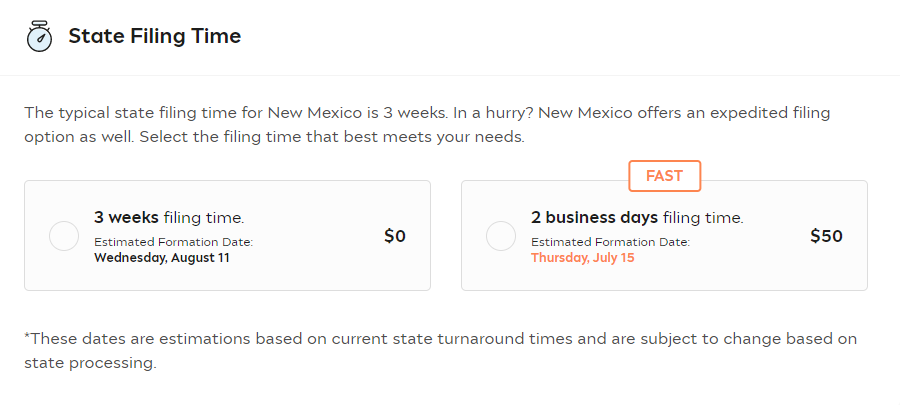

Now decide if you want to take advantage of the expedited filing process. I personally don’t think this is necessary and worth an extra 50$ for most people. I chose the standard process, and my LLC was still open after 2 days.

Once the articles of organization have been accepted by the state, you will receive your official company documents.

- Articles of Organization

- Statement of the Organizer

- Certificate of Good Standing (varies by state)

Apply for Your EIN with the IRS

In order the use your LLC, you will need a tax ID. Specifically an Employer Identification Number or short: EIN.

The general process looks like this:

- Fill out SS-4 form -> Download it here

- Fax SS-4 form to IRS

- Wait for 45 business days to receive your EIN

If you have booked the gold package from Incfile above, they will take care of this for you.

Prepare for Application

While you are waiting for the IRS to assign our LLC an EIN, you can prepare for the coming signup procedures for the banking and payment processing services.

Banks are required to verify your identity (KYC – Know Your Customer). They also need to understand your business model, in order to do a risk evaluation. They better they understand what you are doing, the easier they can work with you.

Before starting the application process for any of the services, I recommend having

- A functioning website

- A professional email address from your domain

- Optional: Linkedin profile

If you do not yet have a website, jump over to Bluehost, and register a domain, and a WordPress blog – make sure to get started with 63% off your Bluehost plan here.

Opening a Business Bank Account

Once you have received your EIN, and your website is operational, you can start applying for bank accounts for your LLC.

All of the retail banks, like Bank of America, Chase, Citibank, and so on require that you or a representative of the company visit the bank personally. So unless you have immediate plans to travel to the US, those accounts are not an option right now.

There are however a number of online banks, that will allow you to open accounts for your LLC completely remotely, and without a lot of bureaucracy.

The five options right now are:

- Levro (34+ currencies, incl. EUR, GBP, CAD, INR, MXN, SGD, and many more)

- Mercury.com (USD)

- TransferWise (USD, EUR)

- Payoneer (USD)

- Paysera (EUR)

Levro and Mercury are fully compatible with Stripe, Paypal, and other payment providers, and also offer the most modern interface. They should be your first choice. By specializing in streamlining bulk payments, Levro extends an exclusive invitation to businesses managing 50+ transactions. Their tailored solutions are designed for larger-scale enterprises actively seeking alternatives to Wise, Airwallex, or Payoneer. If you’re interested in opening an account with Levro, let us know at [email protected] and we will facilitate the communication.

TransferWise will also provide you with an IBAN for an account in EUR, which can be very beneficial in some cases.

Payoneer will provide you with US banking details. However, these are often not accepted by Stripe or Paypal.

Paysera will open EUR accounts for US LLCs, which is convenient.

Go to this link to sign up for their services and receive a $250 cash bonus when you spend $10K on your debit card within 90 days of approval.

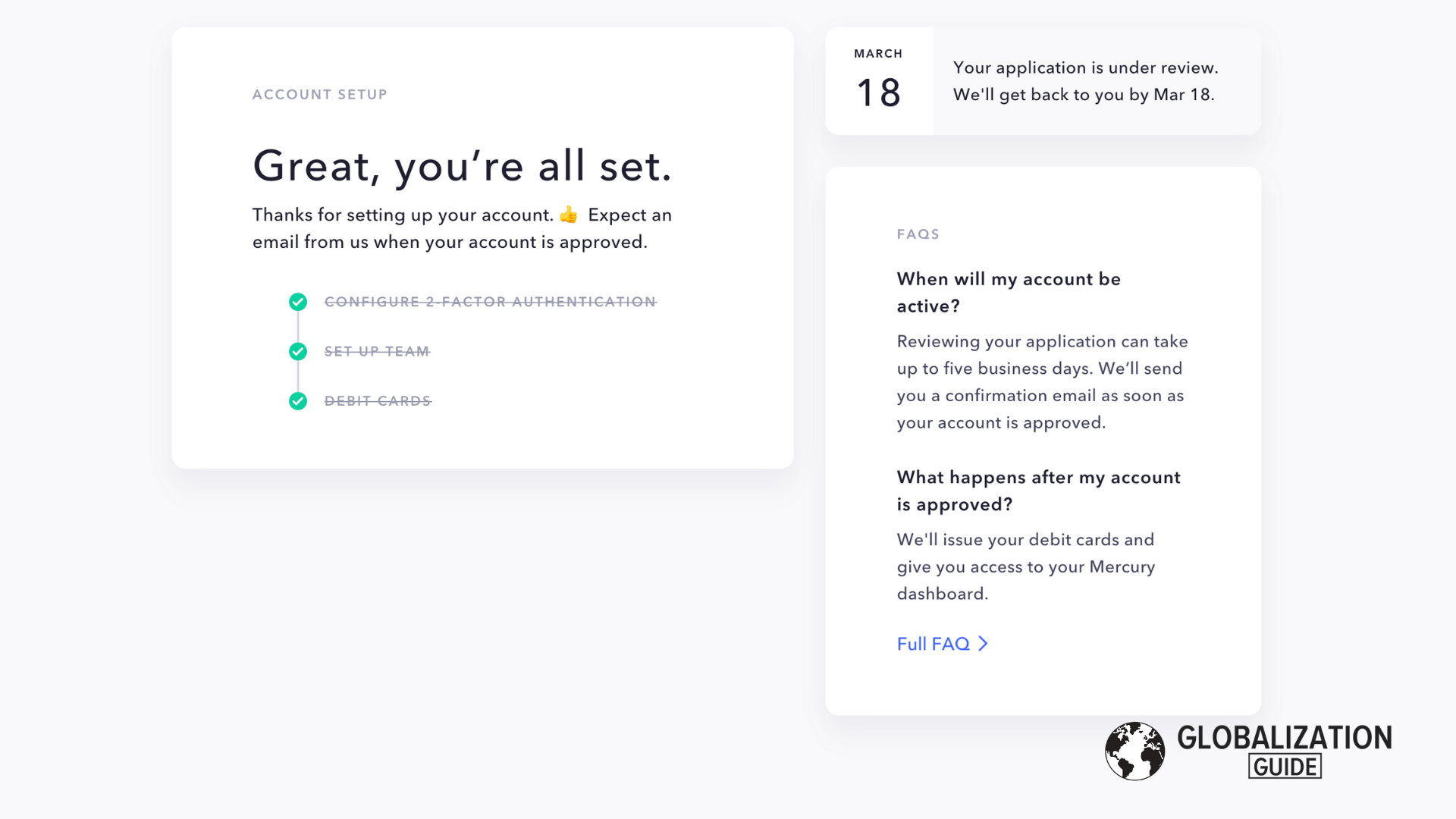

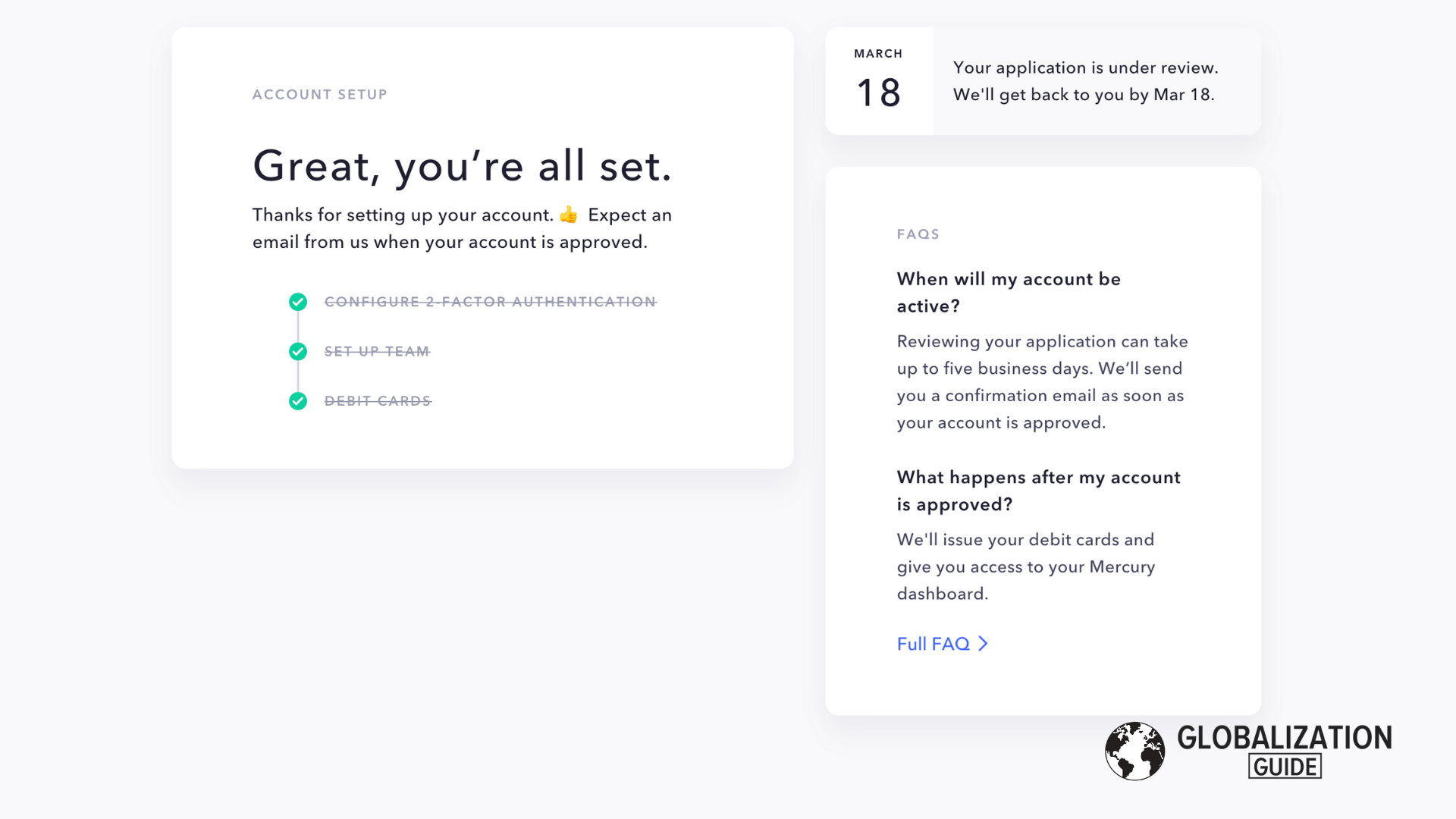

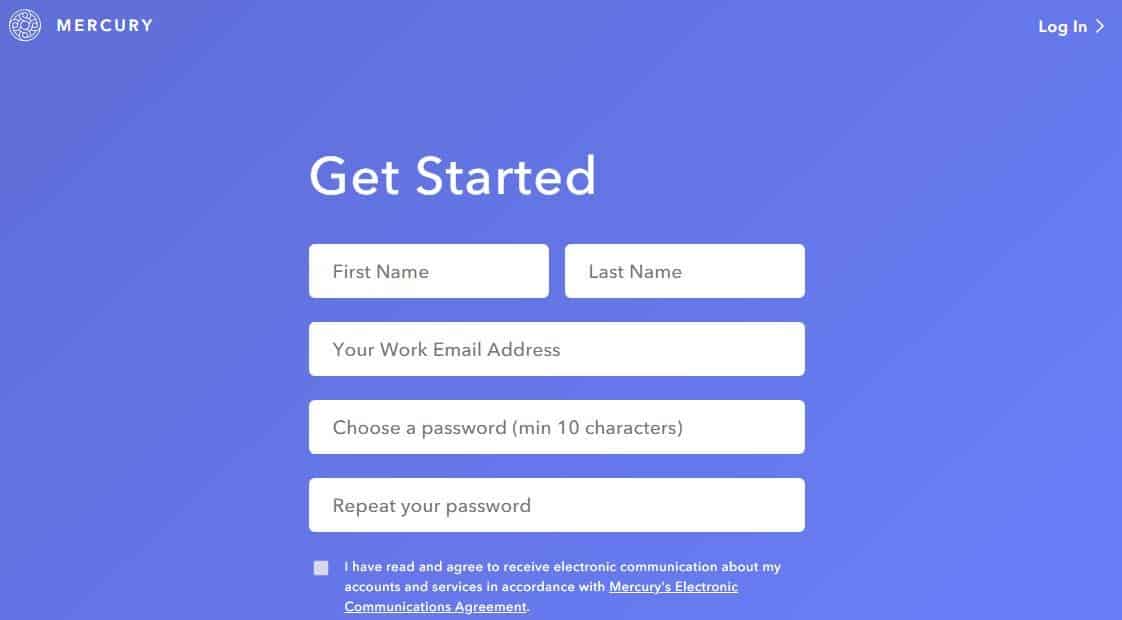

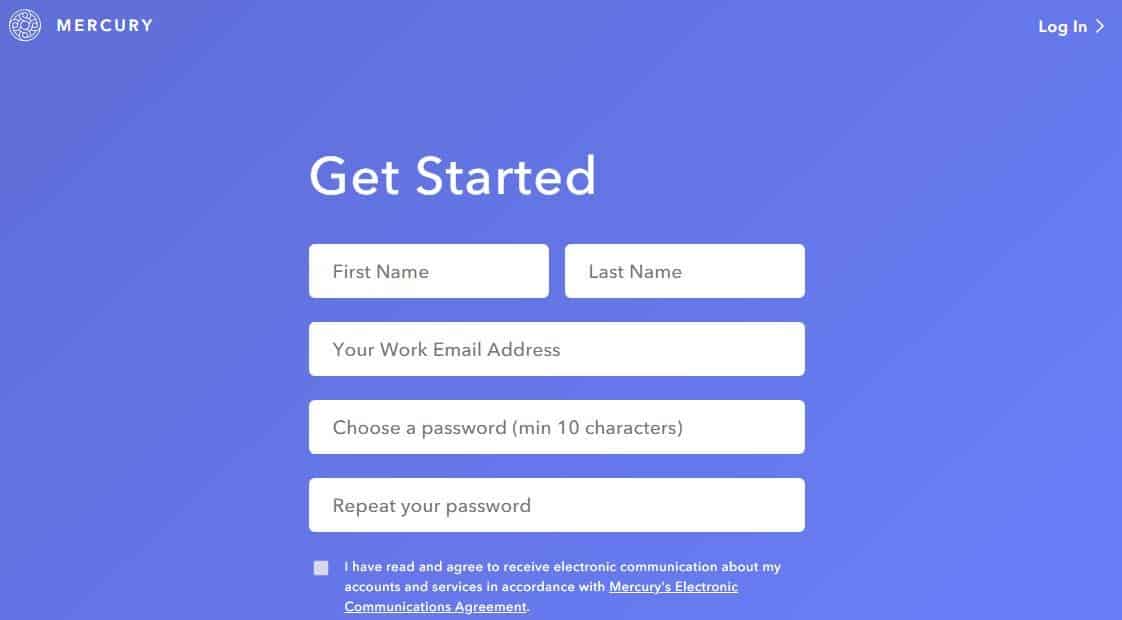

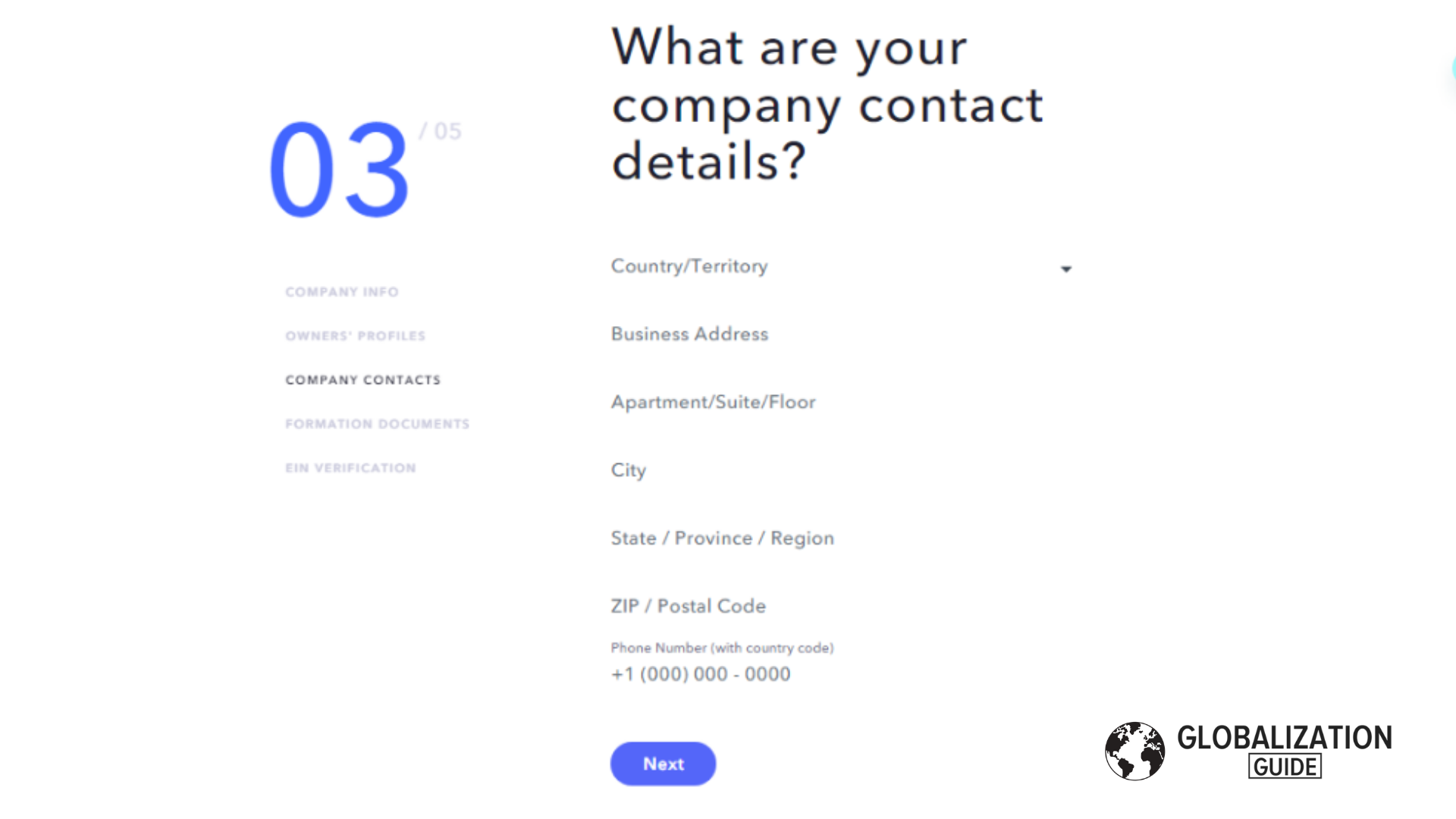

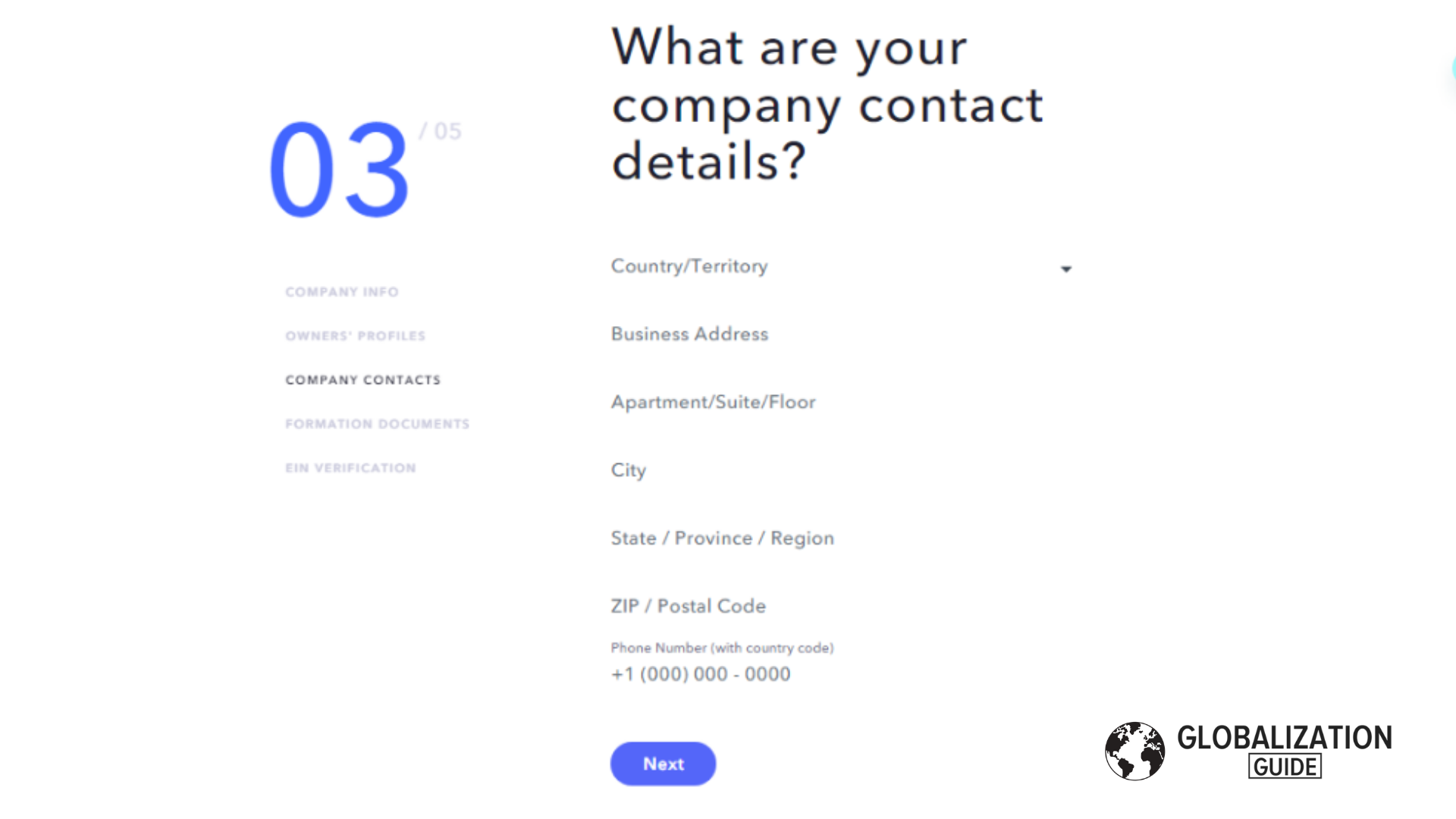

First, click on “Open account” at Mercury’s website. Then, fill the form with simple requirements. You’ll receive an email verification request.

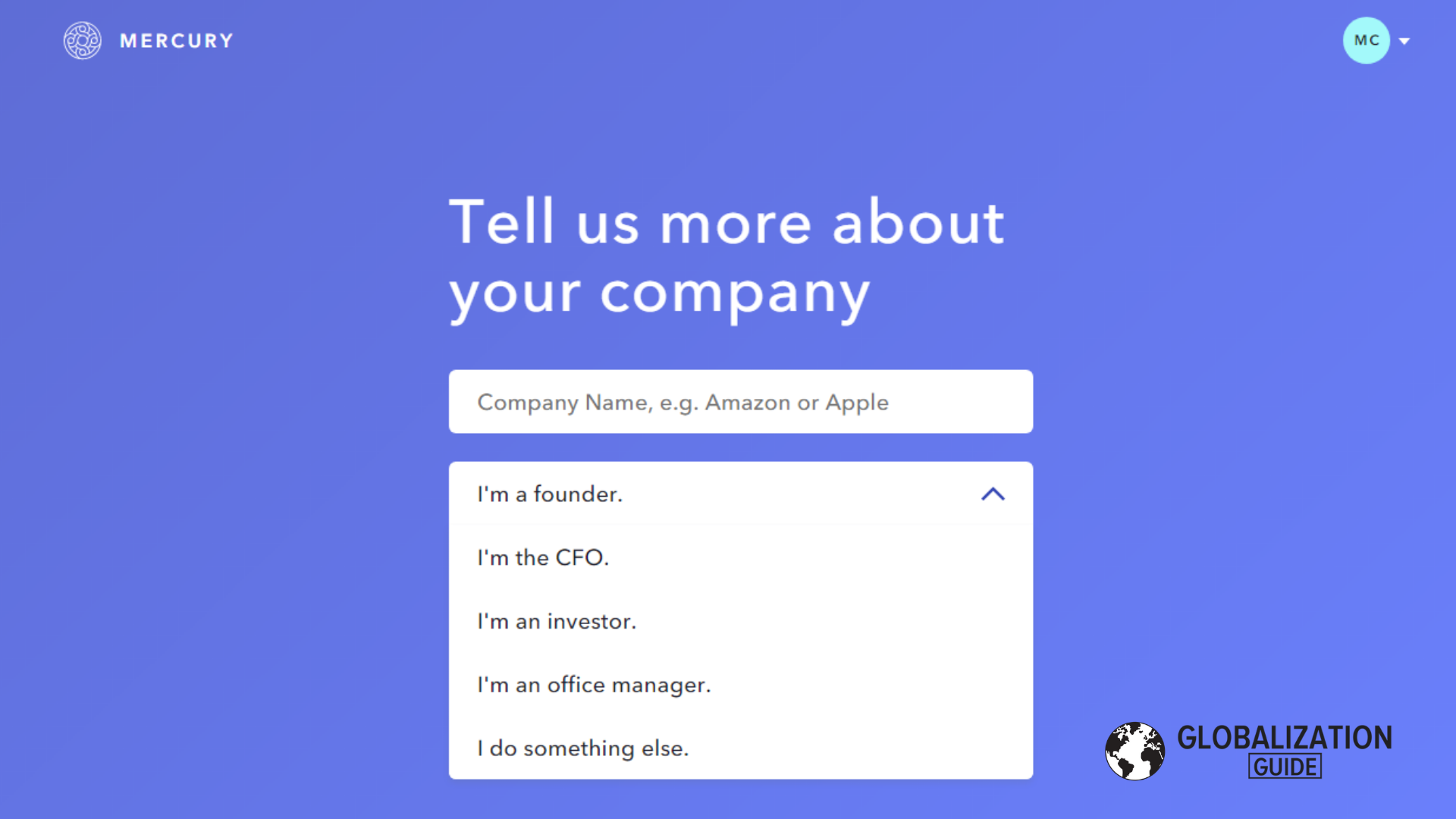

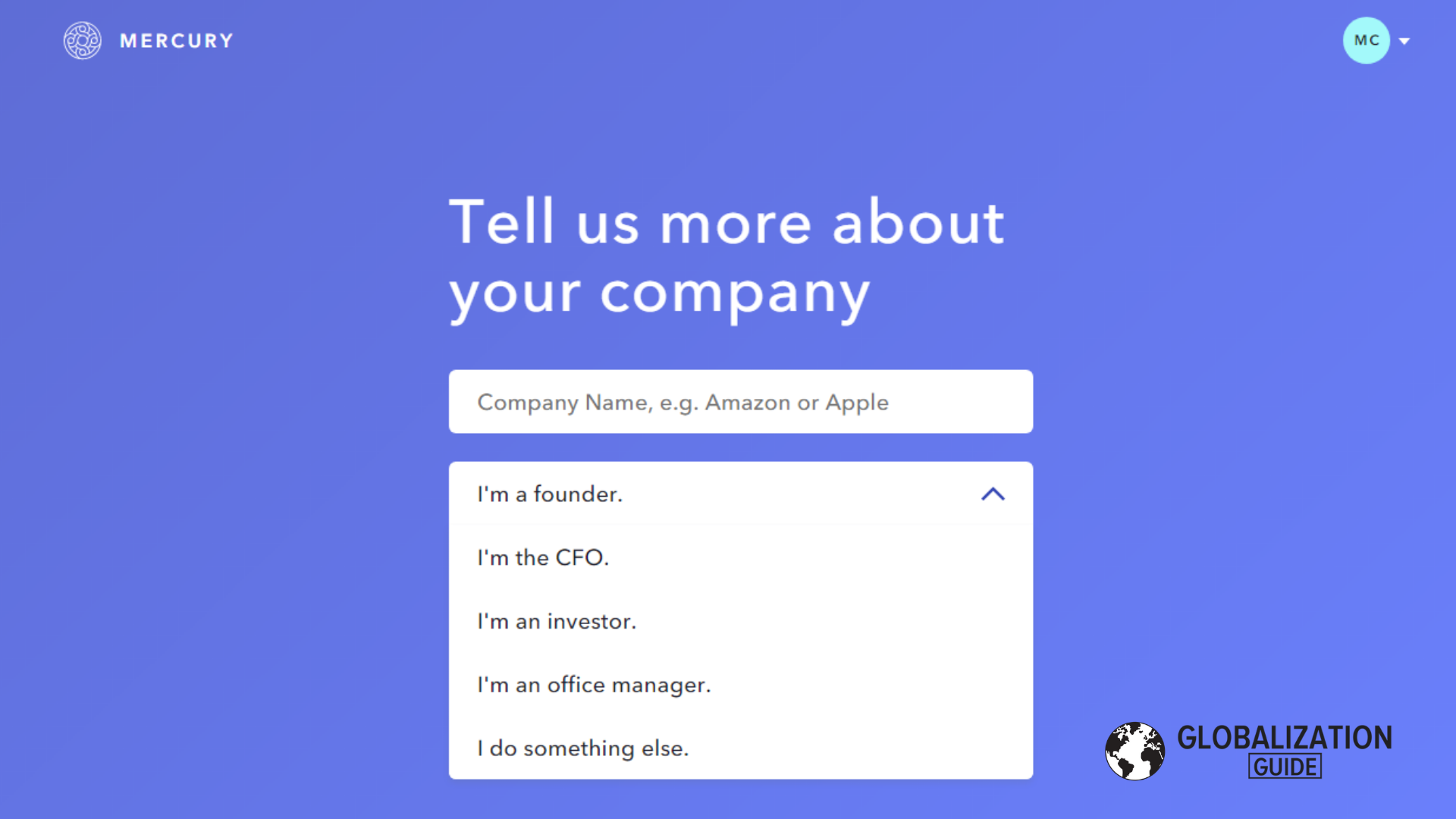

Once the email address is verified, you can proceed to add your LLC’s information and indicate your role.

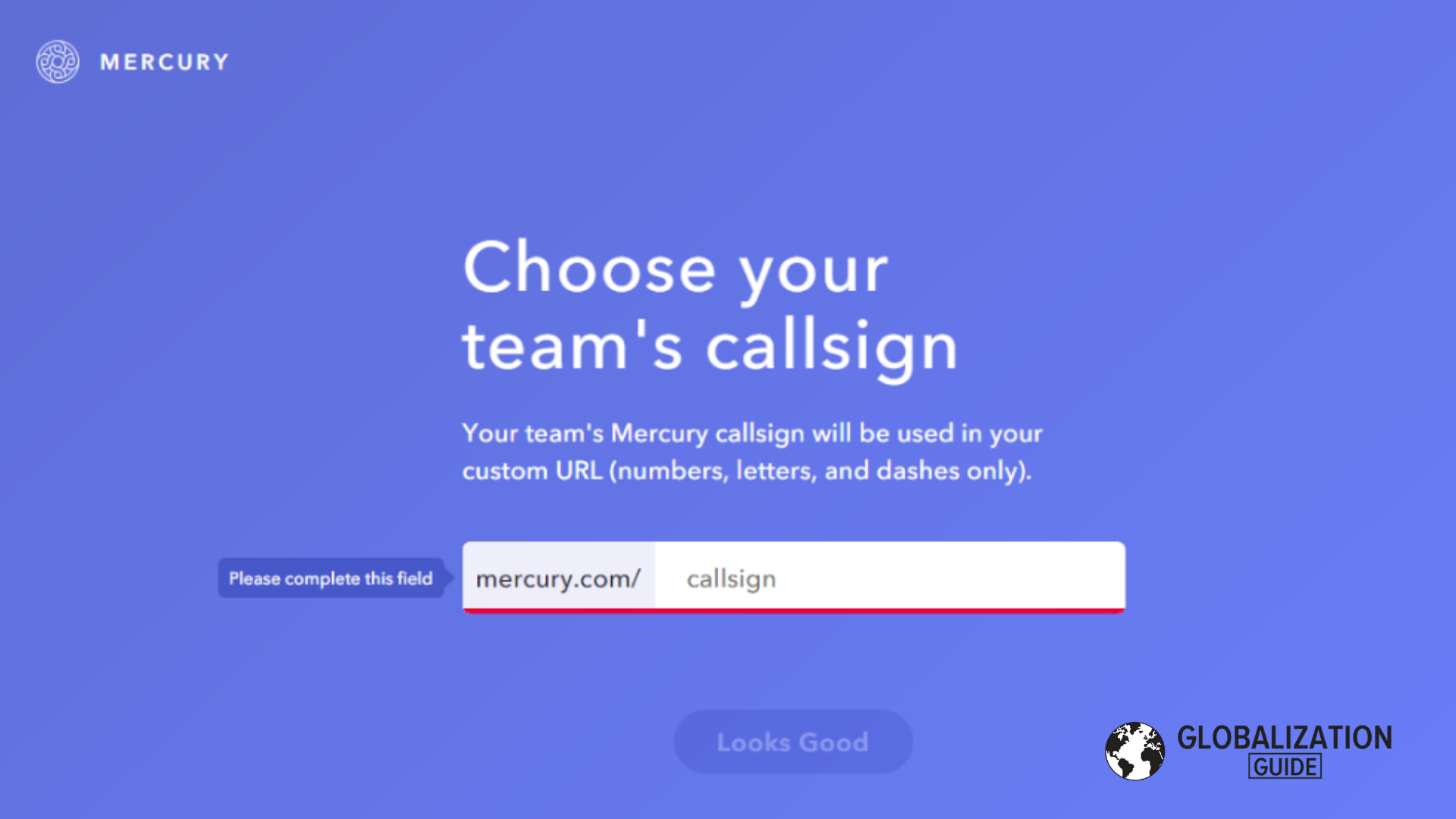

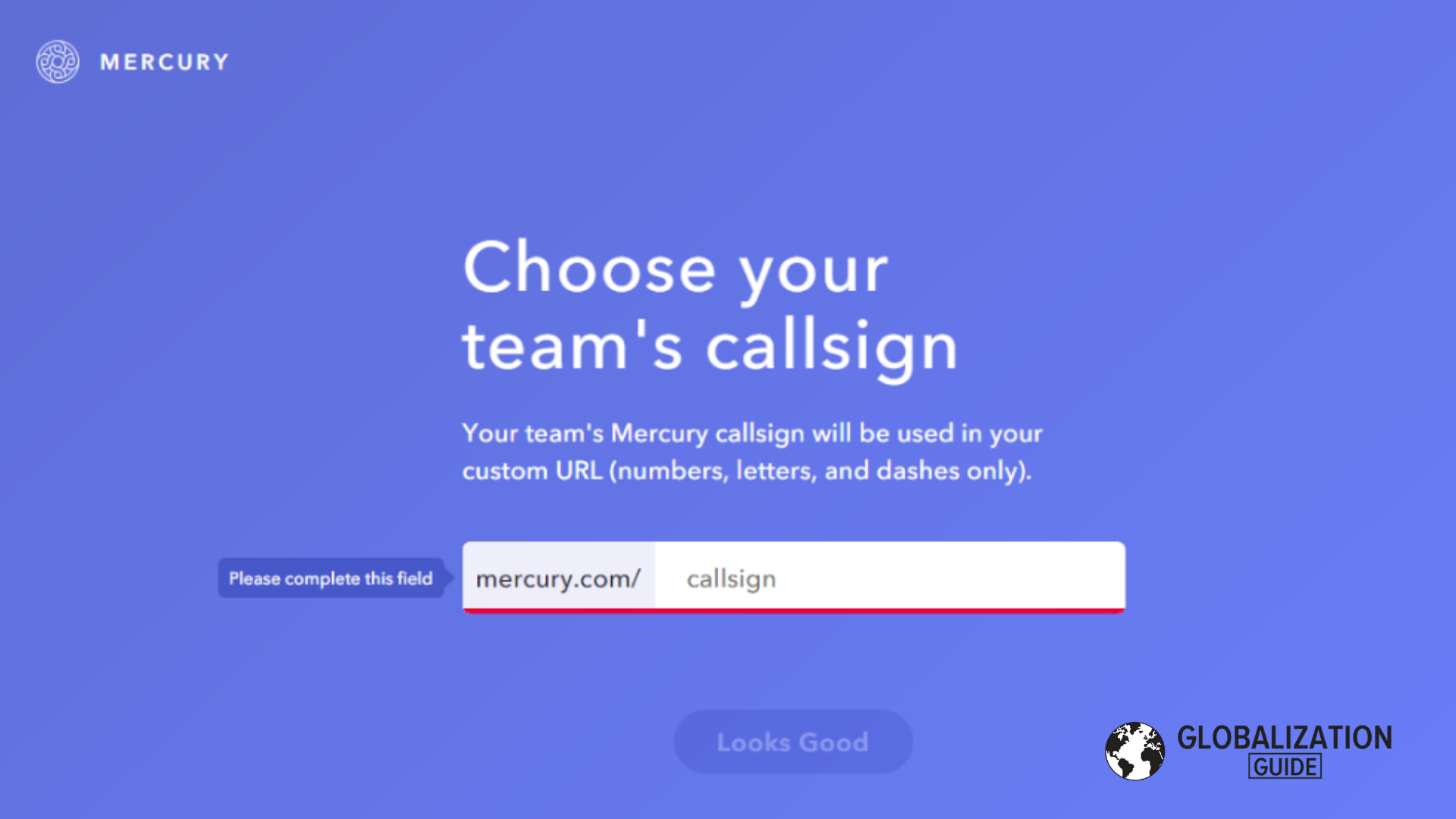

The system will generate a suggested “callsign”, you can modify this if needed.

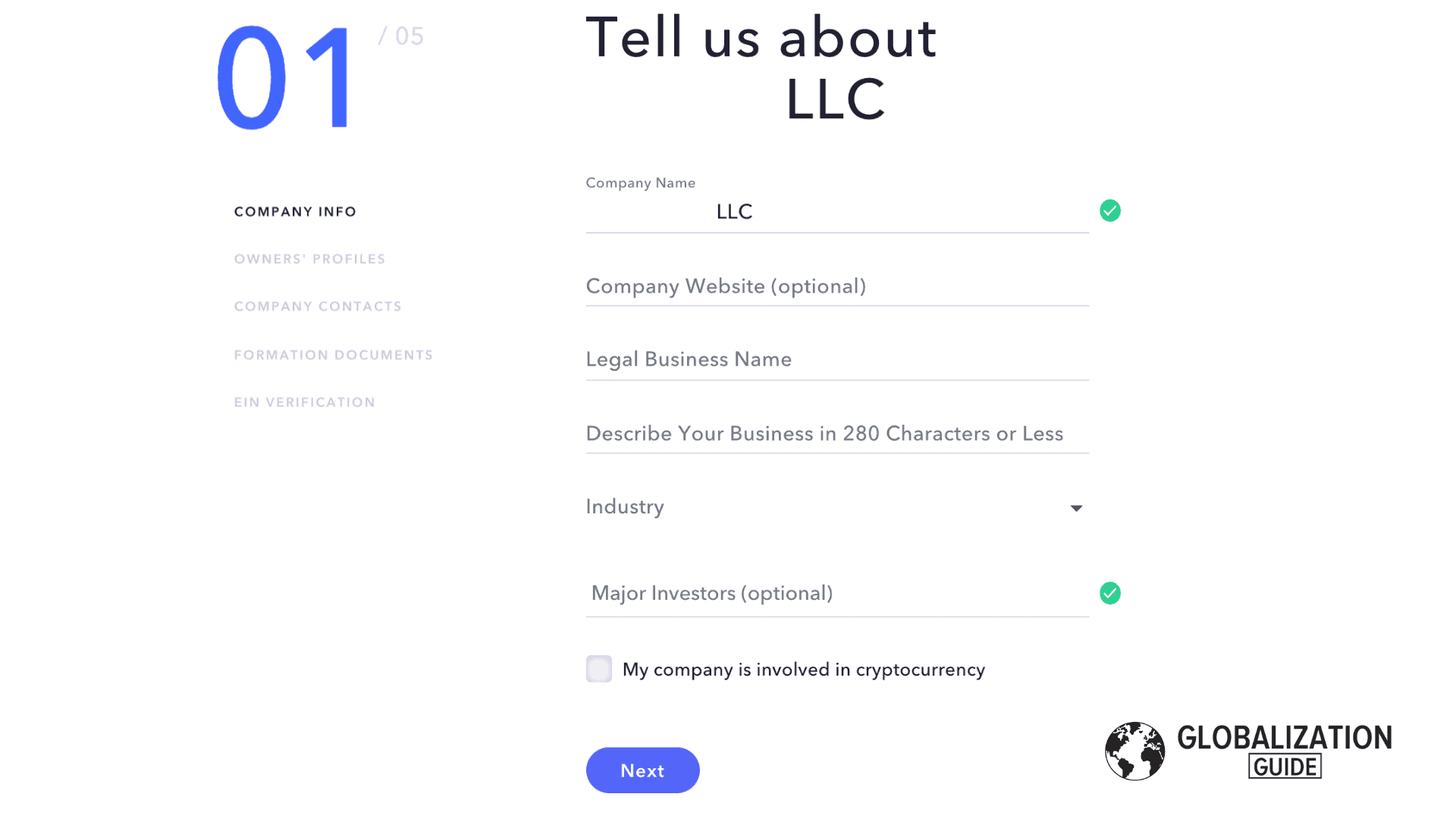

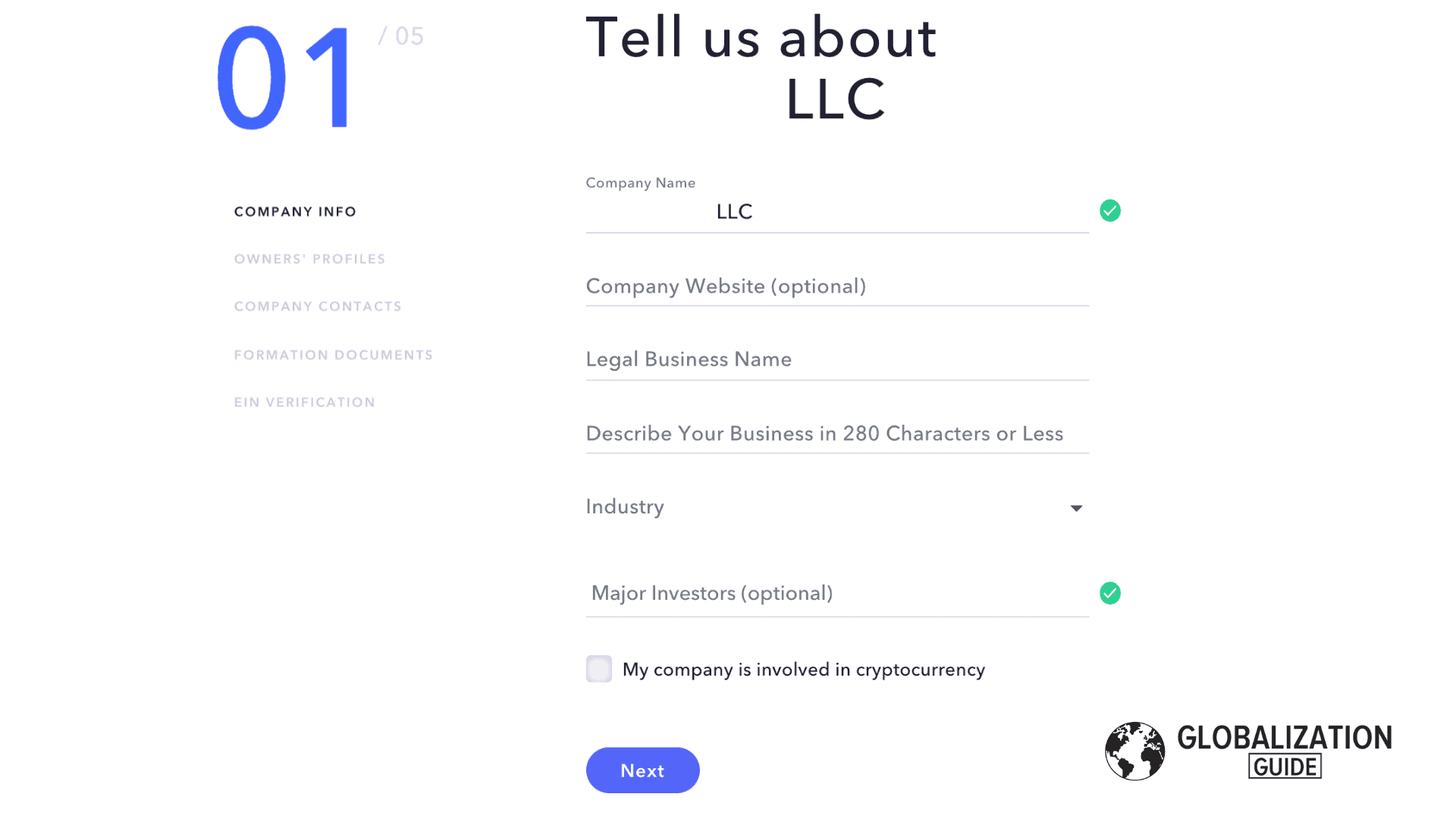

Here comes the detailed information section. Carefully, add the information as in the documents of your LLC.

If you are the only member of the LLC, your info goes here. If the LLC has more than one member, enter the information of each person.

Submit the mailing address from Anytimemailbox, which is the same in the LLC’s Formation Document.

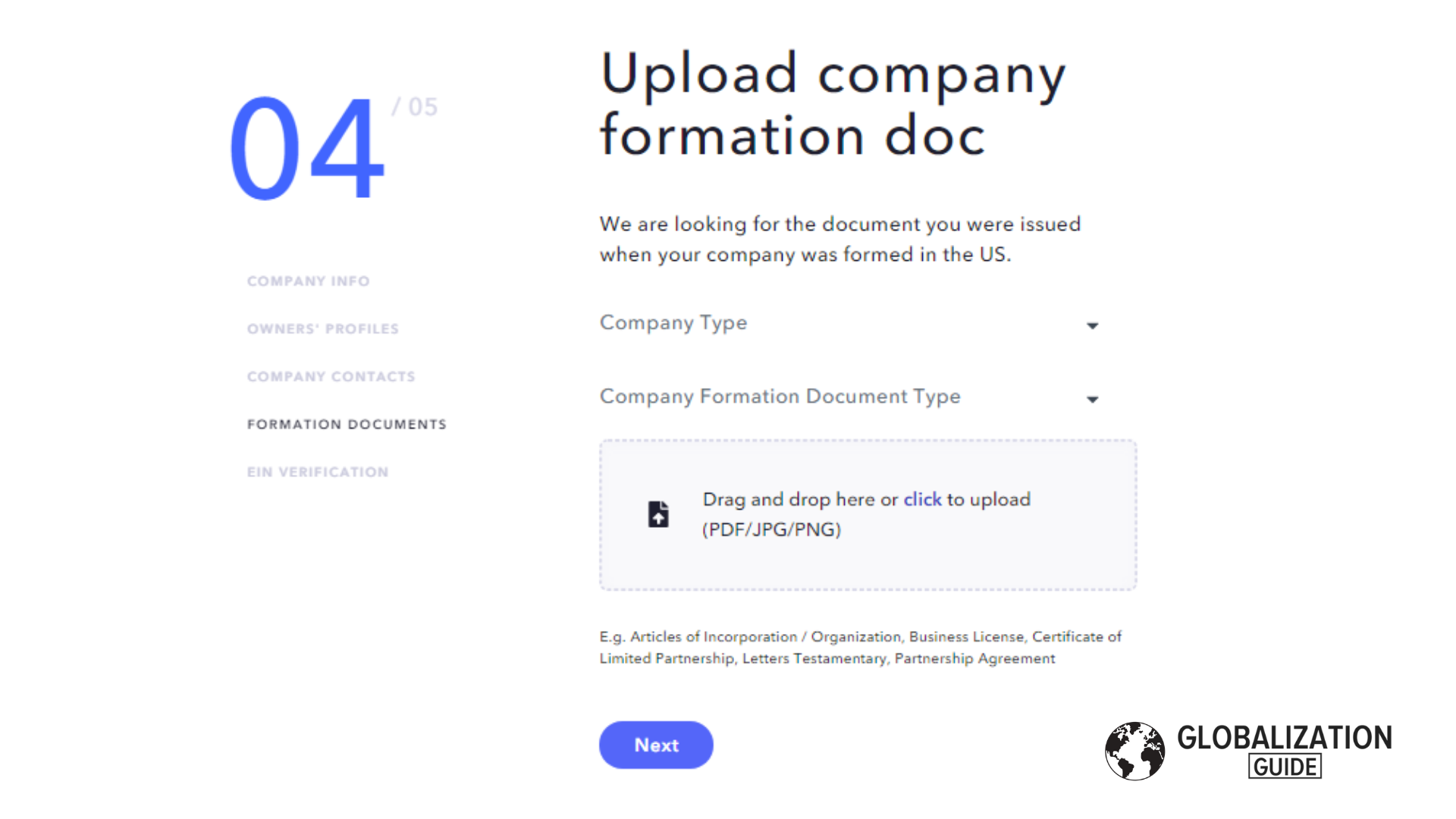

Look for the “Articles of Organization” document. The “Certificate of Good Standing” works for this too. Upload one of these documents.

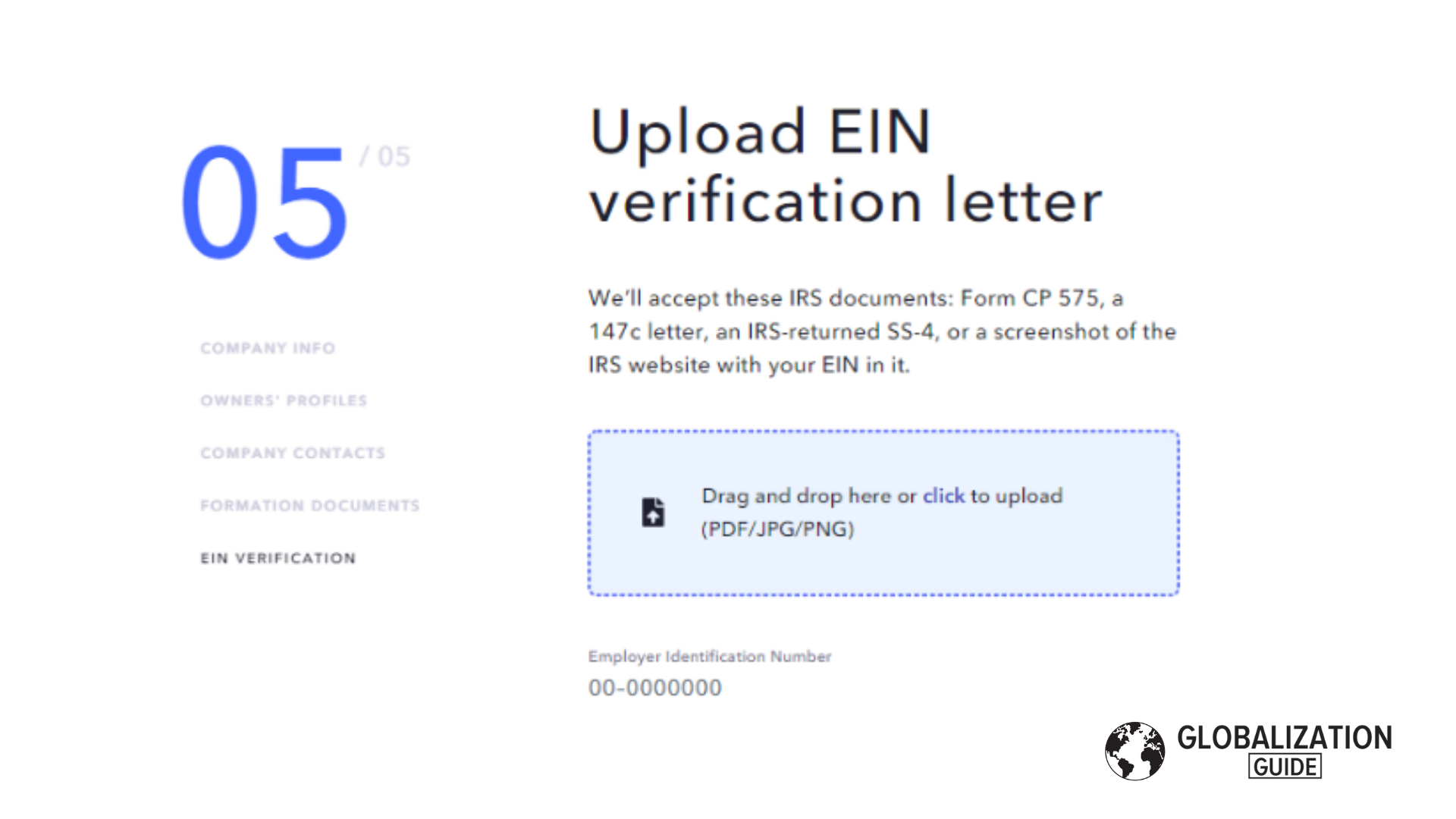

As the last requirement, you will need to present a document that verifies your EIN.

After all your company’s information and documents were submitted, the review process will start and you will hear from Mercury bank in a couple of hours, a maximum of a couple of days.